AUD/USD skids below 0.6700 amid Sino-US tensions over Taiwan, US NFP hogs limelight

- AUD/USD has surrendered the immediate support of 0.6700 as US-China tension has strengthened the risk-off mood.

- Federal Reserve to remain steady amid deepening US recession fears and cooling US labor market.

- Reserve Bank of Australia has kept doors open for more rate hikes in case Australian inflation continues to remain persistent.

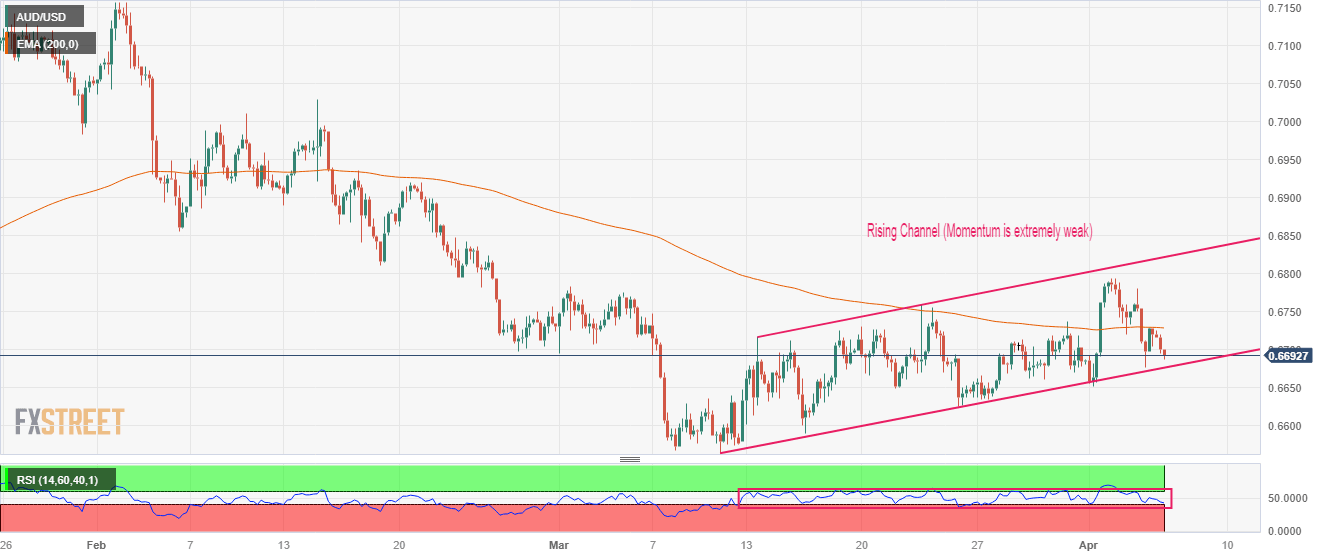

- AUD/USD is auctioning in a Rising Channel chart pattern, however, weak momentum could weaken the Australian Dollar.

AUD/USD has surrendered the round-level support of 0.6700 in the early European session. The Aussie asset is declining towards Wednesday’s low at 0.6675 as deepening United States-China tensions over Taiwan have trimmed the risk appetite of the market participants. US’s promise of delivering arms to Taiwan on a timely basis and strengthening economic cooperation on trade and technology has made China uneasy.

China’s Foreign Ministry Spokesperson made an allegation against the US after the commentary from US House of Representatives Speaker Kevin McCarthy for breaking commitment over the Taiwan issue. The event has triggered volatility for the Australian Dollar. It is worth noting that Australia is the leading trading partner of China and the deterioration of US-China relations would have a cascading effect on the Australian Dollar.

Escalating US-China tensions have trimmed the appeal for risk-perceived assets. S&P500 futures have stretched losses on expectations that US-China tensions could lead to some sanctions on the dragon economy. US equities have been registering bearish settlements for the past two trading sessions amid evidence of a slowdown in the US economy.

The US Dollar Index (DXY) looks firm above 102.00 and is expected to extend its recovery further. However, the slowing US labor market could restrict its upside. The demand for US government bonds is recovering quickly in hopes that the Federal Reserve (Fed) will consider an early pause to the policy-tightening spell. This has dragged 10-year US Treasury yields to near 3.29%.

Signs of cooling US labor strengthen amid lower job additions

On Wednesday, the US Automatic Data Processing (ADP) agency reported a decline in the number of job additions in the month of March. The US economy added 145K jobs in March, significantly lower than the estimates of 200K and the former release of 242K. Firms have slowed down their hiring process amid rising interest rates by the Federal Reserve (Fed) and a bleak economic outlook. A slowdown in the recruitment process after the release of weak Job Openings data indicates that the US labor market has started cooling off and chances are solid of an escalation in the Unemployment Rate ahead.

However, investors will get more clarity about the labor market condition after the release of the US Nonfarm Payrolls (NFP) data, which is scheduled for Good Friday. As per the consensus, the jobless rate is seen unchanged at 3.6%. An economic indicator that could prompt US consumer inflation expectations is the Average Hourly Earnings data. The street is anticipating a deceleration in the annual labor cost index to 4.3% from the former release of 4.6%. However, monthly wage data could accelerate by 0.3% against the former increment of 0.2%.

Reserve Bank of Australia opens gates for further rate hikes

Considering the current monetary policy as restrictive enough to tame stubborn inflation, the Reserve Bank of Australia (RBA) kept interest rates unchanged at 3.6% in its monetary policy meeting on Tuesday. However, Reserve Bank of Australia Governor Philip Lowe has kept doors open for more rate hikes in case Australian inflation continues to remain persistent. It is worth noting that Australia’s monthly Consumer Price Index (CPI) has softened quickly to 6.8% from the peak of 8.4% recorded in December.

AUD/USD technical outlook

AUD/USD is auctioning in a Rising Channel chart pattern on a four-hour scale in which every corrective move is capitalized as a buying opportunity by investors. However, lack of momentum in the aforementioned chart pattern is advocating a downside move in the Aussie asset ahead.

The Australian Dollar has failed in keeping the asset above the 200-period Exponential Moving Average (EMA) at 0.6730, which indicates that the long-term trend is bearish.

Meanwhile, the Relative Strength Index (RSI) (14) is oscillating in the 40.00-60.00 range, indicating a consolidation. A scenario of slipping into the bearish range of 20.00-40.00 is highly likely.

Going forward, a break below April 03 low at 0.6650 will expose the Aussie asset to the round-level support at 0.6600. A crackdown below the round-level support would further drag the asset toward March 10 low at 0.6564.

Alternatively, downside bias for the Aussie asst would vanish if it manages to climb above April 03 high around 0.6800. An occurrence of the same will drive the asset toward February 23 high at 0.6842 followed by February 13 low at 0.6890.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.