AUD/USD skidding towards 0.6300 as Aussie rolls over against Greenback

- The AUD/USD is backsliding on Wednesday, tumbling over 90 pips from the day's early peak.

- Further red is on the cards as broad-market risk appetite sours, sending the USD higher.

- Aussie inflation risks are increasing, and the RBA's holding pattern has investors worried.

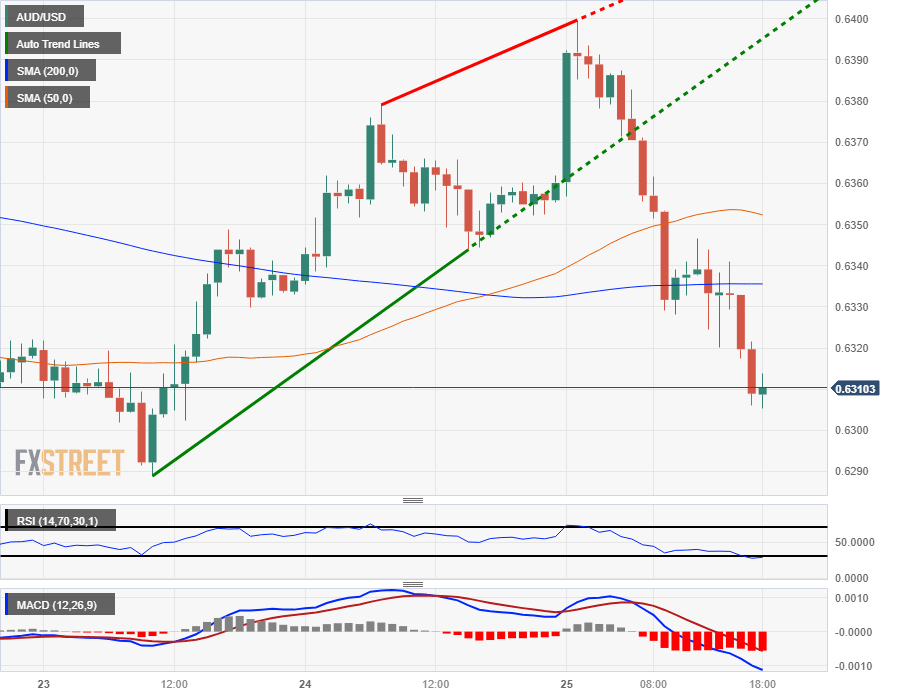

The AUD/USD hit an early high of 0.6399 on Wednesday, falling just shy of the 0.6400 handle before the Aussie (USD) went into a full reversal, sending the pair tumbling 1.4% from the day's high bids to trade back into the 0.6300 region.

Q3 CPI too high to risk holding, failing to act could harm the RBA's credibility – TDS

Australian inflation came in higher than expected early Wednesday, with the Reserve Bank of Australia (RBA) Trimmed Mean Consumer Price Index (CPI) printing at 1.2% for the 3rd quarter, compared to the previous quarter's 1% printing and overshooting market forecasts of 1.1%.

Markets are now concerned that long-term inflation is beginning to set in for the Australian economy, and the RBA's current wait-and-see pattern on interest rate hikes may not be enough to curtail price growth despite a lagging economy with cracks beginning to surface.

The RBA may be pushed to make further rate hikes in order to clamp down on inflation that is once again picking up speed, even at the risk of pushing the Aussie economy a step closer to a "hard landing" recession.

The AUD will close out Wednesday's trading action with a showing from the RBA's Governor Michelle Bullock, who will be testifying before the Australian government's Senate Economics Legislation Committee at 22:00 GMT.

US GDP, Jobless Claims data in focus for Thursday

Thursday will see US Gross Domestic Product (GDP) and Initial Jobless Claims, which should drive USD momentum heading into the latter portion of the trading week.

US GDP for the 3rd quarter is expected to rebound firmly on an annualized basis, from 2.1% to 4.2%.

Meanwhile, US Initial Jobless Claims are expected to show a slight uptick in the number of new unemployment benefits seekers, with the figure forecast to print at 208K for the week ending October 20th, compared to the previous week's 198K.

AUD/USD Technical Outlook

The Aussie is paring back the week's early gains and trading back into recent lows, testing October's familiar floor of 0.6300 as the AUD/USD continues to face firm rejections from the 50-day Simple Moving Average (SMA).

The Aussie continues to trade at its lowest bids of the year, and a downside break will see the pair quickly challenging new eleven-month lows if it manages to cross the 0.6272 level, a price the AUD/USD hasn't seen since November of last year.

AUD/USD Daily Chart

AUD/USD Technical Levels

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.