AUD/USD settles around 0.6940s on a weak US dollar

- The AUD/USD reports minimal gains of 0.03% on Monday.

- Higher global bond yields shifted Wall Street sentiment mixed, a headwind for the AUD.

- AUD/USD Price Forecast: Range-bound but skewed to the downside.

The AUD/USD seesaws in a narrow trading range, from daily highs around 0.6958 printed during the Asian session towards daily lows near 0.6910. At 0.6944, the AUD/USD trades above the middle of the aforementioned 0.6910-0.6960 region during the North American session.

The AUD/USD dropped due to falling Iron Ore prices, which declined from $131.45 to $129.71 a ton. Additionally, global bond yields ticked lower on news of fading global recession fears, pushed to the upside after one hour of the Wall Street open, which has shifted the sentiment to mixed, with US equities fluctuating between gains and losses.

In the meantime, the US Dollar Index, a gauge of the greenback’s value against a basket of its rivals, gave up some territory on Monday, down 0.32%, back under the 104.000 mark. Contrarily, the US 10-year Treasury yield grinds higher by close to four basis points and sits at 3.162%.

Analysts at Westpac expect that the AUD/USD could remain afloat at 0.6830

“The Aussie and Kiwi are softest in the G10 over the past week. Fragile risk sentiment and a startling slide in commodity prices are taking a toll. A relatively quiet global calendar suggests that equity sentiment could be pivotal in determining whether AUD/USD can remain clear of May’s lows around 0.6830,” analysts wrote.

In the week ahead, the Australian economic docket will feature Retail Sales for May on its preliminary reading, expected at 0.4%, which is less than the previous reading. On the US front, on Tuesday, CB Consumer Confidence for June is estimated at 100.4, down from May’s 106.4. Other releases include Wholesale Inventories, Trade Balance, Regional Fed Indices reports, and Fed speakers.

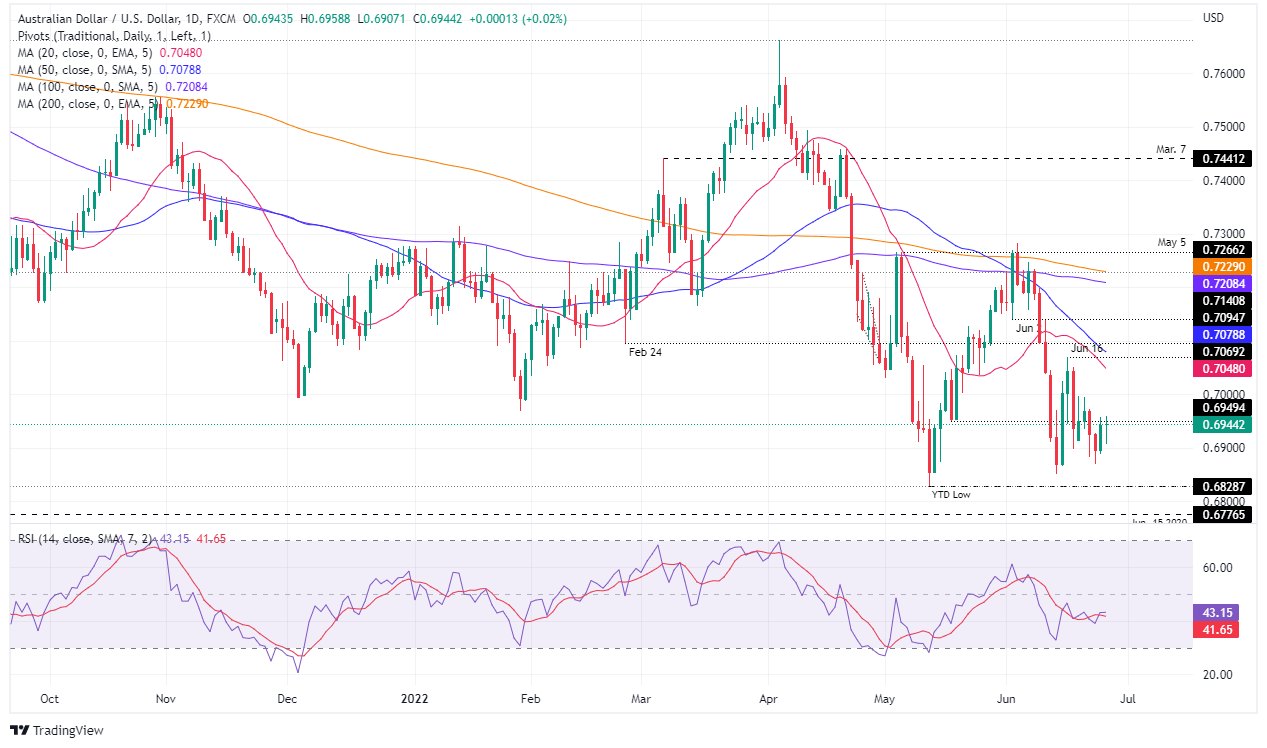

AUD/USD Price Forecast: Technical outlook

In the daily chart, the Aussie dollar is still headed to the downside as the week begins. If AUD/USD buyers would like to regain control, they need to reclaim 0.7000 to ease the ongoing selling pressure on the pair. If that is achieved, AUD buyers’ next target would be the 20 EMA at 0.7047, immediately followed by the 50 EMA at 0.7078.

On the flip side, and on the AUD/USD's path of least resistance, the first support comes in at 0.6900, a breach below which would expose the June 23 low at 0.6869, followed by the June 14 swing low at 0.6850.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.