AUD/USD rebounds as US Dollar weakens on credit downgrade

- AUD/USD trades near 0.6450 as sentiment turns against the Greenback.

- Moody's downgraded US credit rating to 'AA1' from 'AAA', citing mounting fiscal risks.

- Technical levels point to resistance around 0.6500 and support near 0.6400.

The AUD/USD pair is trading around 0.6450 on Monday, extending its recovery from recent lows as the US Dollar (USD) faces renewed selling pressure following Moody's decision to downgrade the United States' long-term sovereign rating from AAA to AA1. The downgrade, which cited mounting fiscal challenges and a $36 trillion debt load, has weighed heavily on the Greenback, pushing the US Dollar Index (DXY) toward the key 100.00 support zone.

The US Dollar remains under pressure after Moody's announced its downgrade late last week, highlighting concerns over the sustainability of US fiscal policy. Despite assigning a "Stable" outlook, the move has sparked renewed selling in the Greenback, with the DXY hovering near 100.30 as markets digest the implications for the broader US economy. This comes as Federal Reserve (Fed) officials continue to signal a cautious stance on interest rates, reflecting ongoing economic uncertainty.

Adding to the mix, President Donald Trump claimed a "moderate success" in managing the Russia-Ukraine conflict, suggesting progress toward a potential ceasefire. However, this has done little to offset the broader risk aversion triggered by the US credit rating cut. Fed Vice Chairman Philip Jefferson and New York Fed President John Williams have both highlighted the uncertain economic outlook, suggesting that further monetary easing may be limited in the near term.

Meanwhile, the Reserve Bank of Australia (RBA) is set to announce its latest interest rate decision on Tuesday, with a consensus expectation for a 25 basis point cut from 4.10% to 3.85%. While this would typically weigh on the Australian Dollar, recent upbeat labor market data and improving trade sentiment between the US and China have tempered expectations for aggressive RBA easing.

Technical Analysis

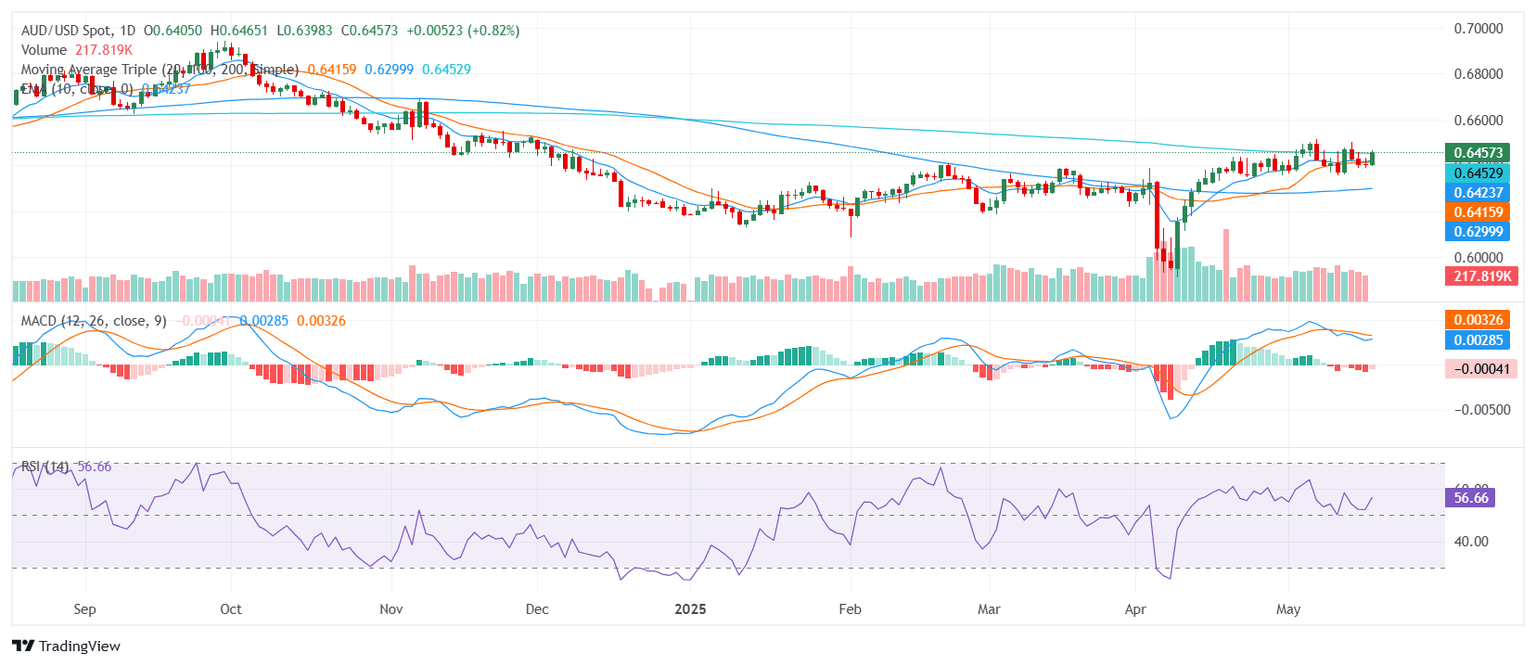

From a technical standpoint, AUD/USD is approaching a key resistance level near 0.6500, which has capped the pair's upside multiple times in May. A sustained break above this psychological barrier could open the door to further gains toward 0.6600, a level not seen since November.

The pair remains supported by the 21-day Exponential Moving Average (EMA) at 0.6402, reinforcing the bullish short-term bias. The Relative Strength Index (RSI) at 56.69 shows modest upward momentum, while the Moving Average Convergence Divergence (MACD) continues to hover in positive territory, although momentum is flattening.

On the downside, immediate support is seen at 0.6400, marked by the 21-day EMA, followed by a stronger floor at 0.6350. The near-term bias remains cautiously bullish as long as the pair holds above the 0.6400 support zone.

With the US Dollar struggling to recover from the Moody's downgrade, AUD/USD appears poised for further upside, particularly if the RBA takes a more cautious approach to rate cuts. However, traders should remain cautious as the pair approaches the critical 0.6500 resistance, with a failure to break this level potentially triggering a deeper pullback.

Daily Chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.