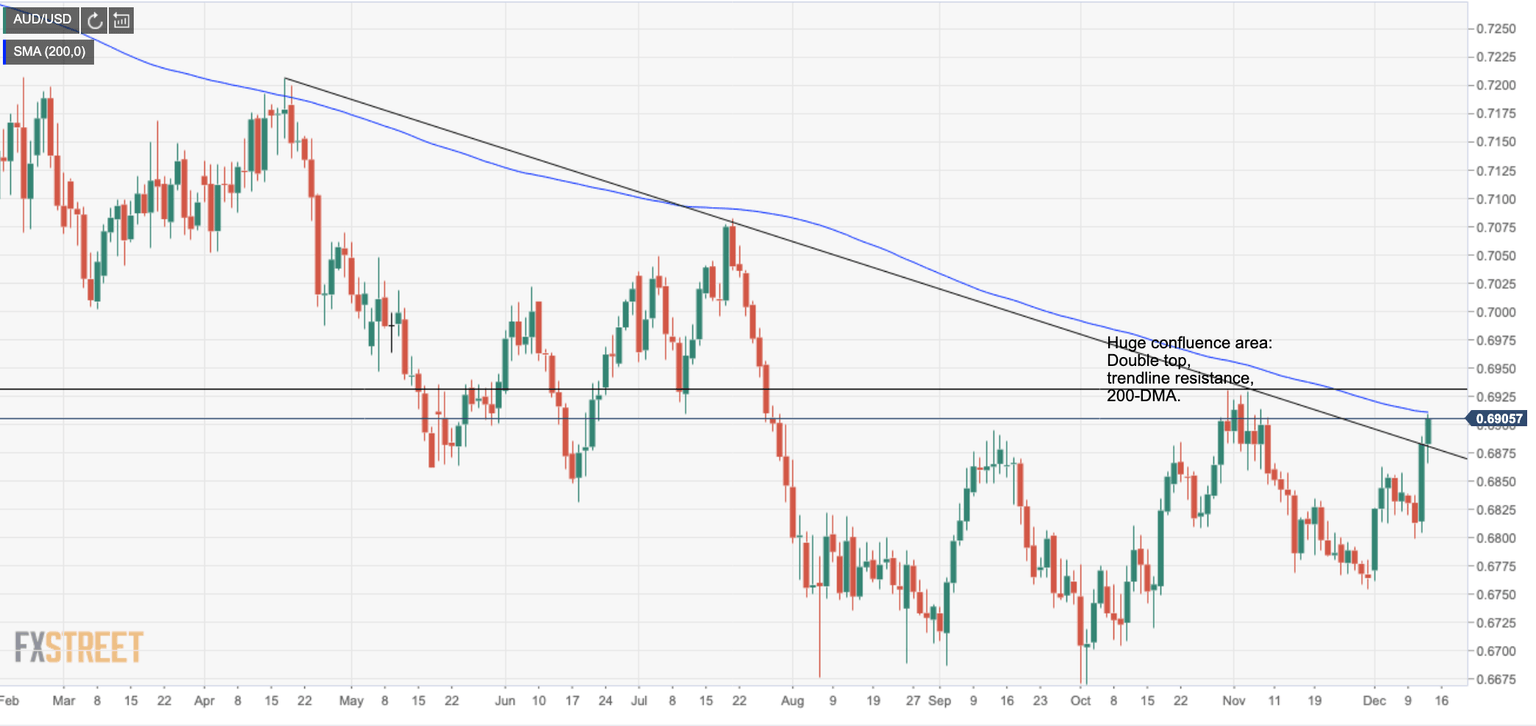

AUD/USD rallied to test critical confluence resistance area on trade-deal headlines

- AUD/USD pops on positive trade headlines and tackles key resistance area.

- US has reached a trade deal in principle with China, awaiting Trump's sign-off.

AUD/USD has rallied on trade tariff headlines where there have been consecutive and positive trade headlines throughout the day. AUD/USD is currently up 0.48% having climbed from a low of 0.6867 to a high of 0.6908.

There has been a steady build-up in news flows surrounding the Sino/US trade spat whereby anticipation has been built around an expected and so-called 'phase-one deal'. Earlier in the day, US President Trump tweeted,

"Getting VERY close to a BIG DEAL with China. They want it, and so do we!"

The news propelled the Aussie higher, trading as a proxy to the trade war saga. then, later in the day came the confirmation, first reported on Bloomberg TV from unnamed sources that the US had reached a trade deal in principle with China which was awaiting Trump's sign-off.

At this stage, there have not been any indications as to when the news becomes official with an announcement from the White House, nor when the deal will be inked. However, there has been speculation that a deal would most likely "stop China issuing its second batch of tariffs on products such as corn, wheat, and rare earth magnets, and reinstating an extra 25% tariff on US-made vehicles and 5% on auto parts which had been suspended earlier this year," analysts at ANZ Bank said.

- Treasury Secretary Mnuchin just left the West Wing, officials say the WH trade meeting has ended.

AUD/USD levels

AUD/USD is looking to the Oct and early November double top highs and July lows between 0.6910 around 0.6930 with the confluence of the 200-DMA. If there is not an additional spike on the official signing, then a phase of consolidation in AUD/USD could be expected and profit-taking which could encourage a grind back to the prior trendline resistance where the price would be expected to hold on bullish fundamentals – this comes in at 0.6890 which meets the 12th September tops. Bulls will otherwise aim for the July tops in the 0.7080s. On a breakdown of positive fundamentals, the 61.8% Fibonacci retracement of the Dec range comes in at the lows of yesterday's daily candle, around 0.6804/15.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.