AUD/USD Price Forecast: Revisits two-month high near 0.6620

- AUD/USD rises to near 0.6620 due to continued outperformance from the Australian Dollar.

- RBA’s Bullock keeps the option of further monetary policy tightening on the table.

- Investors seem confident that the Fed will reduce interest rates next week.

The AUD/USD pair extends its winning streak for the eleventh trading day on Friday, rising to near 0.6620 during the early European trading session. The Aussie pair trades firmly as the Australian Dollar (AUD) outperforms its peers amid expectations that the Reserve Bank of Australia (RBA) could adopt a hawkish monetary stance to tame de-anchoring inflation expectations.

Australian Dollar Price This week

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies this week. Australian Dollar was the strongest against the US Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.52% | -0.80% | -0.99% | -0.21% | -1.15% | -0.66% | -0.06% | |

| EUR | 0.52% | -0.28% | -0.47% | 0.32% | -0.63% | -0.14% | 0.46% | |

| GBP | 0.80% | 0.28% | 0.06% | 0.60% | -0.35% | 0.13% | 0.74% | |

| JPY | 0.99% | 0.47% | -0.06% | 0.80% | -0.18% | 0.32% | 0.92% | |

| CAD | 0.21% | -0.32% | -0.60% | -0.80% | -1.00% | -0.46% | 0.14% | |

| AUD | 1.15% | 0.63% | 0.35% | 0.18% | 1.00% | 0.49% | 1.09% | |

| NZD | 0.66% | 0.14% | -0.13% | -0.32% | 0.46% | -0.49% | 0.60% | |

| CHF | 0.06% | -0.46% | -0.74% | -0.92% | -0.14% | -1.09% | -0.60% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Australian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent AUD (base)/USD (quote).

RBA hawkish speculation intensified on Thursday after the release of the Australian monthly household spending data for October, which came in stronger at 1.3% against 0.3% in September.

Earlier this week, RBA Governor Michele Bullock also stated during his testimony before the Parliamentary Committee that monetary policy adjustments would be needed if inflation proves to be persistent.

Meanwhile, the US Dollar (USD) trades cautiously as investors are confident that the Federal Reserve (Fed) will cut interest rates in its monetary policy announcement on Wednesday. The CME FedWatch tool shows that the probability of the Fed cutting interest rates by 25 basis points (bps) to 3.50%-3.75% in the December policy meeting is 87%.

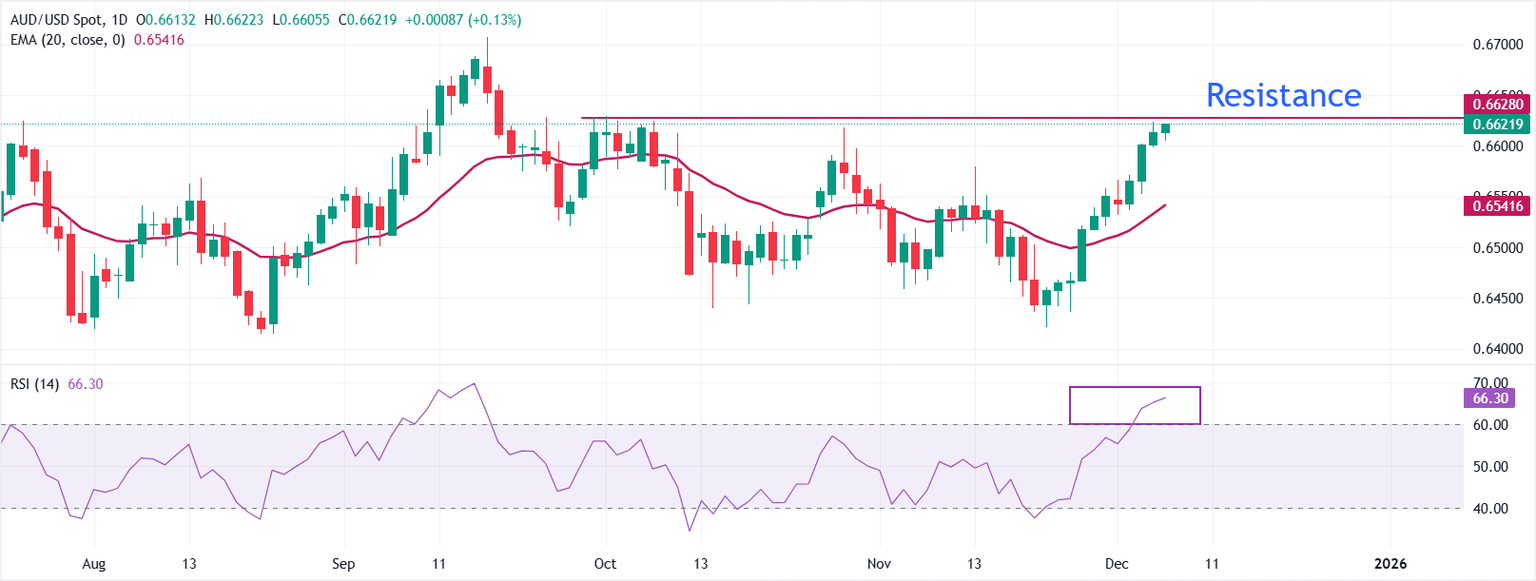

AUD/USD daily chart

AUD/USD trades higher at 0.6622 on Friday. The 20-day Exponential Moving Average (EMA) slopes higher, and the price holds above it, reinforcing a bullish tone. The distance over the 20-day EMA points to trend extension rather than mean reversion.

The 14-day Relative Strength Index (RSI) at 66.00 signals firm momentum without an overbought reading.

RSI north of 60 supports the upside and would turn cautionary only on a reversal. The 20-day EMA at 0.6542 supports; a daily close below that line could tilt the bias into a corrective pullback. On the upside, the Aussie pair could rise towards the September 18 high at 0.6660 if it breaks above the 0.6629 hurdle, which is the highest level in October.

(The technical analysis of this story was written with the help of an AI tool)

Economic Indicator

Fed Interest Rate Decision

The Federal Reserve (Fed) deliberates on monetary policy and makes a decision on interest rates at eight pre-scheduled meetings per year. It has two mandates: to keep inflation at 2%, and to maintain full employment. Its main tool for achieving this is by setting interest rates – both at which it lends to banks and banks lend to each other. If it decides to hike rates, the US Dollar (USD) tends to strengthen as it attracts more foreign capital inflows. If it cuts rates, it tends to weaken the USD as capital drains out to countries offering higher returns. If rates are left unchanged, attention turns to the tone of the Federal Open Market Committee (FOMC) statement, and whether it is hawkish (expectant of higher future interest rates), or dovish (expectant of lower future rates).

Read more.Next release: Wed Dec 10, 2025 19:00

Frequency: Irregular

Consensus: 3.75%

Previous: 4%

Source: Federal Reserve

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.