AUD/USD Price Analysis: Weekly resistance, 50-DMA in focus ahead of Australia employment

- AUD/USD struggles to extend rebound from monthly low.

- Steady RSI, downbeat forecasts for the key data probe bulls.

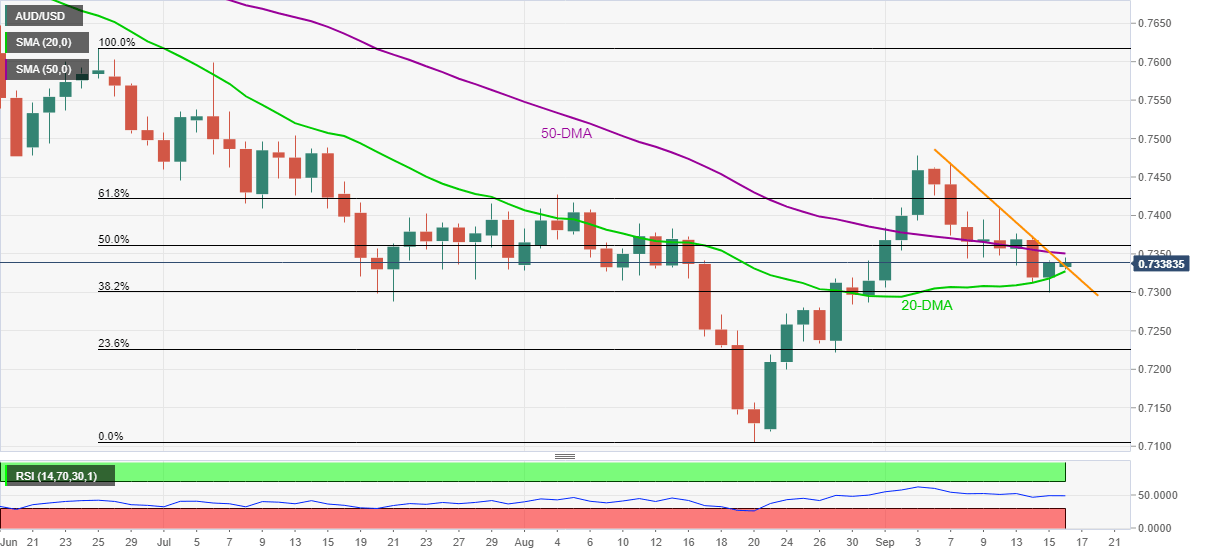

- 20-DMA, July’s low restrict immediate downside, Fibonacci retracement levels add to the upside filters.

AUD/USD fades the previous day’s recovery moves, edges higher around 0.7340 heading into the key Aussie jobs report for August during Thursday’s Asian session.

The quote bounced off August 31 lows the previous day while taking a U-turn from 20-DMA, around 0.7327 by the press time. The rebound currently battles a downward sloping trend line from September 07.

In addition to the stated trend line hurdle, steady RSI and fears of downbeat employment figures also challenge the AUD/USD bulls.

Hence, a clear upside break of the stated resistance line, near 0.7335, followed by the 50-DMA level of 0.7350, becomes necessary for the pair to extend the latest advances.

Failing to do so can tease bears to seek a daily closing below July’s low of 0.7288 for fresh entries.

Following that, 0.7270 and 23.6% Fibonacci retracement (Fibo) of June 25 to August 20 fall near 0.7225 will be the key.

It’s worth noting that the quote’s upside past 0.7350 needs validation from a 50% Fibonacci retracement level of 0.7361 to aim for 61.8% Fibo and the monthly high, 0.7421 and 0.7478 in that order.

AUD/USD: Daily chart

Trend: Pullback expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.