AUD/USD Price Analysis: Upside above 0.6700 seems likely as RBA remains hawkish on interest rate guidance

- AUD/USD is facing barricades in extending its rally above 0.6700, however, the upside bias is still solid.

- Offers for the USD Index soared dramatically as investors are anticipating a pause in the policy-tightening spell by the Fed.

- AUD/USD is auctioning in a Rising Channel in which each corrective move is considered a buying opportunity.

The AUD/USD pair is struggling in stretching its rally above the round-level resistance of 0.6700 in the early New York session. The Aussie asset is expected to climb above the aforementioned resistance confidently as the Reserve Bank of Australia (RBA) has opened room for further interest rate hikes to arrest stubborn Australian inflation.

S&P500 futures have added decent gains ahead of United States opening, portraying an upbeat market mood. The US Dollar Index (DXY) displayed a perpendicular fall after failing to recapture the previous day’s high at 104.30. Offers for the USD Index soared dramatically as investors are anticipating a pause in the policy-tightening spell by the Federal Reserve (Fed).

As per the CME Fedwatch tool, the chances of a neutral interest rate policy have jumped above 77%.

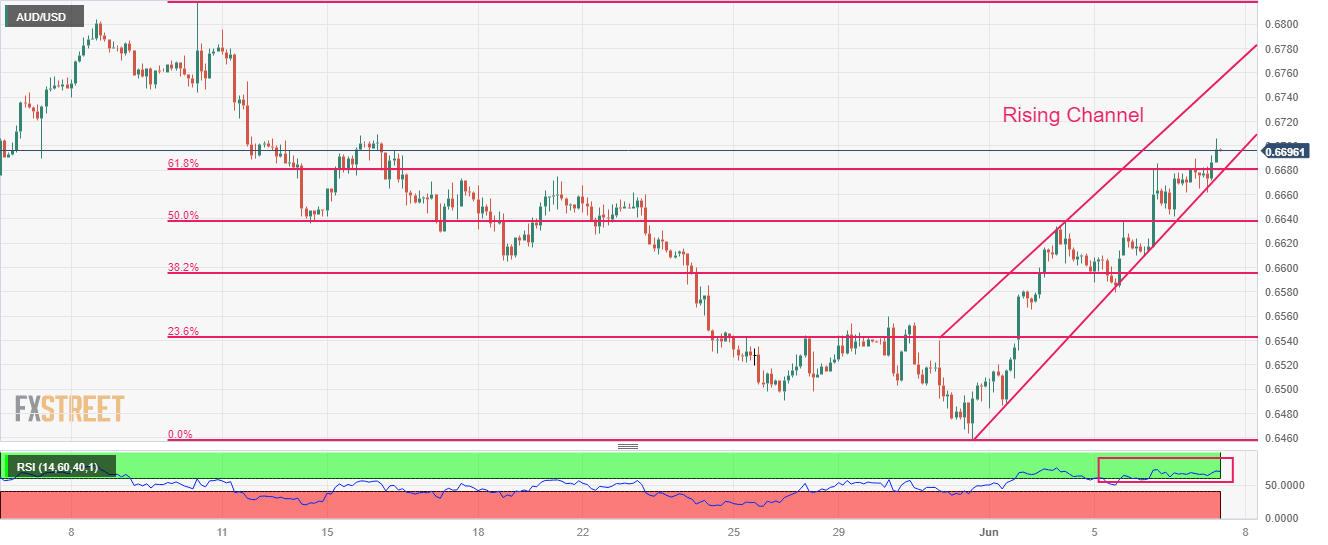

AUD/USD is auctioning in a Rising Channel on a two-hour scale in which each corrective move is considered as a buying opportunity by the market participants. The Aussie asset has comfortably shifted above the 61.8% Fibonacci retracement (plotted from May 10 high at 0.6818 to May 31 low at 0.6458) at 0.6682.

The Relative Strength Index (RSI) is oscillating in the bullish range of 60.00-80.00, indicating more upside ahead.

Should the Aussie asset confidently breaks above the round-level resistance of 0.6700, the Australian Dollar bulls will drive the asset toward April 18 high at 0.6748 followed by May 10 high at 0.6818.

On the flip side, if the Aussie asset breaks below June 01 low at 0.6484, US Dollar bulls would drag the asset to 01 November 2022 high around 0.6464 followed by the round-level support at 0.6400.

AUD/USD two-hour chart

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.