AUD/USD Price Analysis: Sellers eye 0.6800 as a bearish-engulfing candle pattern emerges

- AUD/USD is about to finish the week with losses of 1.10%.

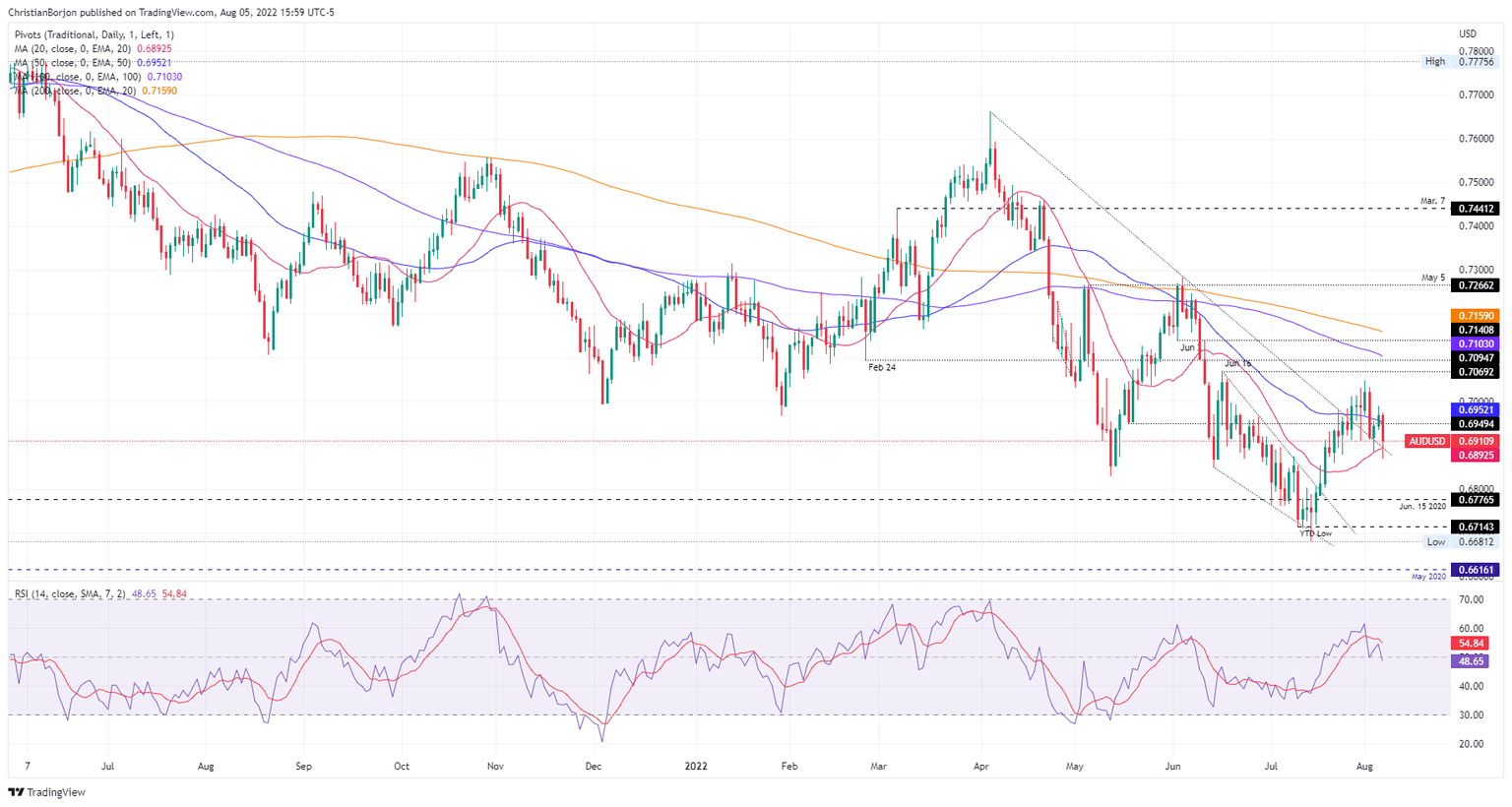

- A bearish-engulfing candle pattern and the RSI’s crossing below 50 are two reasons that could tumble the AUD/USD.

- AUD/USD sellers eye a break below 0.6900, on its way towards 0.6800.

The AUD/USD drops substantially, courtesy of upbeat US economic data, which sent the major plunging from daily highs around 0.6974 towards the day’s lows at 0.6869, though as Wall Street closed, the Aussie trimmed some of those losses. At the time of writing, the AUD/USD is trading at 0.6910, down 0.82%.

AUD/USD Price Analysis: Technical outlook

The AUD/USD daily chart portrays the pair below the confluence of the August 4 low and the 50-day EMA around 0.6952. It’s worth noting that earlier, the major dived below the intersection of a five-month-old downslope trendline and the 20-day EMA, around 0.6892, but it was short-lived and bounced toward current exchange rates.

Still, the AUD/USD is downward biased for some reasons: first, the Relative Strength Index (RSI) just crossed below the 50-midline, indicating sellers are gathering momentum. And the second reason would be that the last two-daily candles formed a bearish-engulfing candle pattern, implying that sellers outweighed buyers.

Therefore, the AUD/USD path of least resistance is downwards, and the pair’s first support would be the 0.6900 figure. Once cleared, the next stop will be the 20-day EMA at 0.6892, followed by the 0.6800 mark.

AUD/USD Key Technical Levels

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.