AUD/USD Price Analysis: Retreats from multi-month top, downside potential seem limited

- AUD/USD fails ahead of the 0.7000 mark and corrects from a multi-month top touched on Friday.

- A combination of factors helps revive the USD demand and exerts downward pressure on the pair.

- The technical setup favours bulls and supports prospects for the emergence of some dip-buying.

The AUD/USD pair retreats from the vicinity of the 0.7000 psychological mark or the highest level since August 26 and continues losing ground through the early North American session. The pair drops to a fresh daily low, around the 0.6935 region in the last hour, eroding a part of the previous day's post-US CPI gains and snapping a two-day winning streak.

A modest bounce in the US Treasury bond yields helps the US Dollar to stall its recent decline to a seven-month low. Apart from this, the risk-off impulse - as depicted by a sharp fall in the equity markets - further benefits the Greenback's relative safe-haven status and weighs on the risk-sensitive Aussie. That said, rising bets for smaller Fed rate hikes might keep a lid on any meaningful gains for the buck and limit deeper losses for the major, at least for the time being.

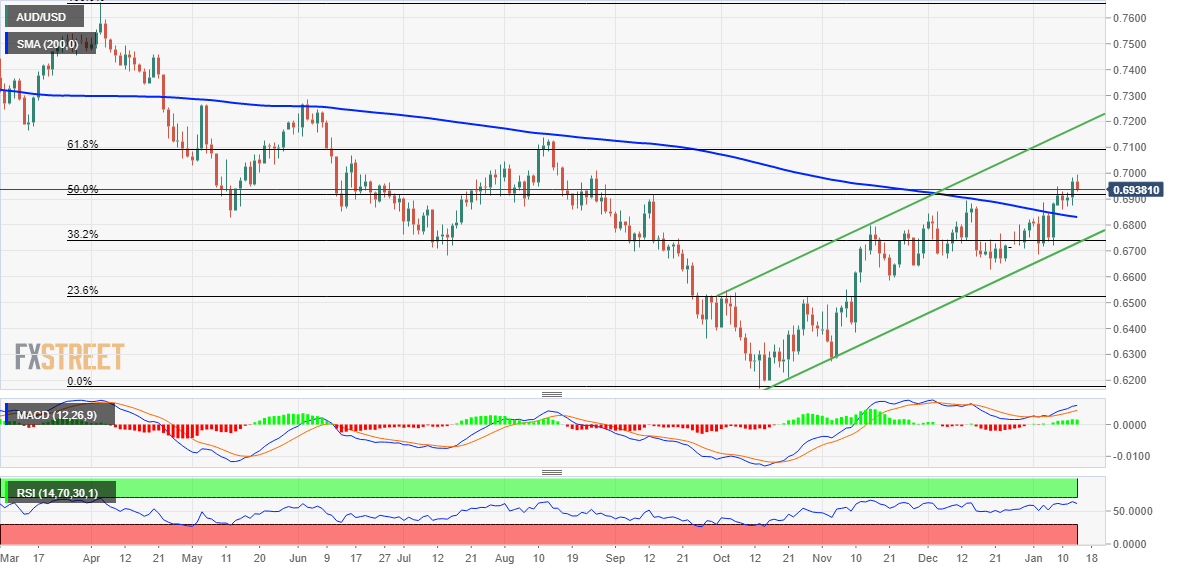

From a technical perspective, the AUD/USD pair has been scaling higher along an ascending channel over the past three months or so, which points to a well-established uptrend. Adding to this, the recent breakout through the very important 200-day SMA and the overnight strength beyond the 50% Fibonacci retracement level of the April-October 2022 downfall favours bullish traders. This, along with positive oscillators on the daily chart, supports prospects for the emergence of some dip-buying.

Hence, any subsequent slide is more likely to find decent support near the 0.6900 mark ahead of the 0.6870-0.6865 horizontal zone. This is followed by support near the 0.6830 region (200- DMA), which should now act as a pivotal point for the AUD/USD pair. A convincing break below could accelerate the fall towards the 0.6800 mark en route to the trend-channel support. The latter is pegged around the mid-0.6700s and nears the 38.2% Fibo. level, which should protect any further decline.

On the flip side, bulls might now wait for a sustained strength beyond the 0.7000 mark before placing fresh bets. The AUD/USD pair might then aim to surpass an intermediate hurdle near the 0.7030-0.7035 region and the 0.7070-0.7075 zone before eventually climbing to the 0.7100 round figure.

AUD/USD daily cahrt

Key levels to watch

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.