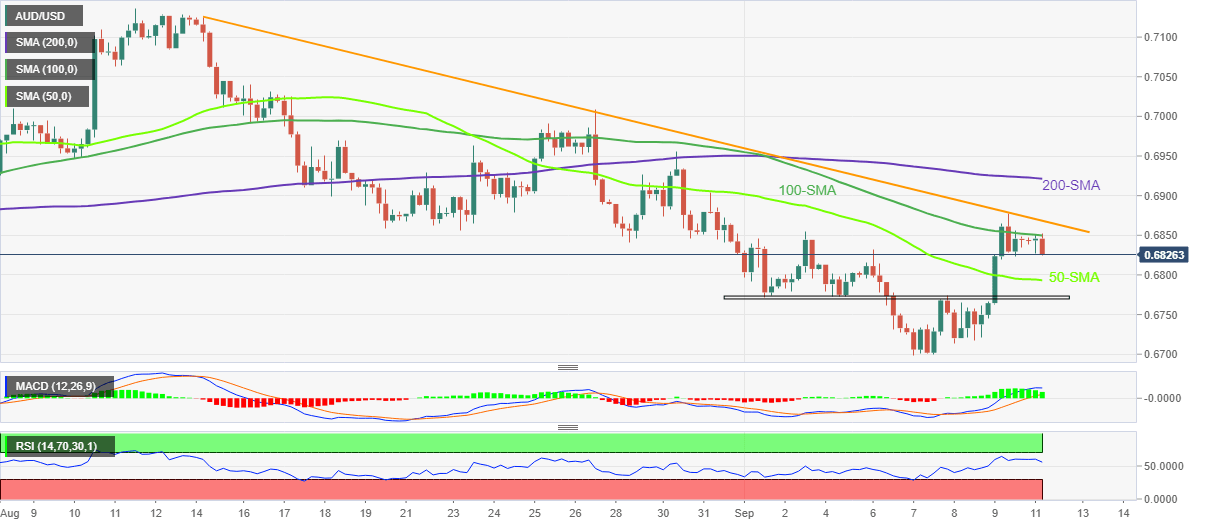

AUD/USD Price Analysis: Retreats from monthly resistance, 100-SMA towards 0.6800

- AUD/USD takes offers to renew intraday low as it pares the biggest daily gains in a month.

- Receding bullish bias of MACD, RSI pullback adds strength to the fall targeting 50-SMA.

- 200-SMA adds to the upside filters, bears have a bumpy road before retaking control.

AUD/USD consolidates the biggest daily gains in a month as it refreshes intraday low around 0.6825-30 during Monday’s Asian session. In doing so, the Aussie pair takes a U-turn from the downward sloping resistance line from August 15 as well as the 100-SMA.

Given the receding bullish bias of the MACD and the RSI retreat, the AUD/USD prices are likely to witness further downside.

However, the 0.6800 threshold and the 50-SMA, around 0.6790, could challenge the intraday sellers.

Following that, the monthly horizontal support area, around 0.6770, appears the last defense of the AUD/USD bulls before challenging the yearly low of 0.6700.

Meanwhile, the 100-SMA and the aforementioned resistance line, respectively near 0.6850 and 0.6870, challenge short-term AUD/USD upside ahead of the 200-SMA hurdle surrounding 0.6925.

It’s worth noting that the pair’s run-up beyond 0.6925 enables it to overcome the 0.7000 psychological magnet, which in turn highlights the late August swing high near 0.7010 for the bulls to watch as a probable challenge.

AUD/USD: Four-hour chart

Trend: Limited downside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.