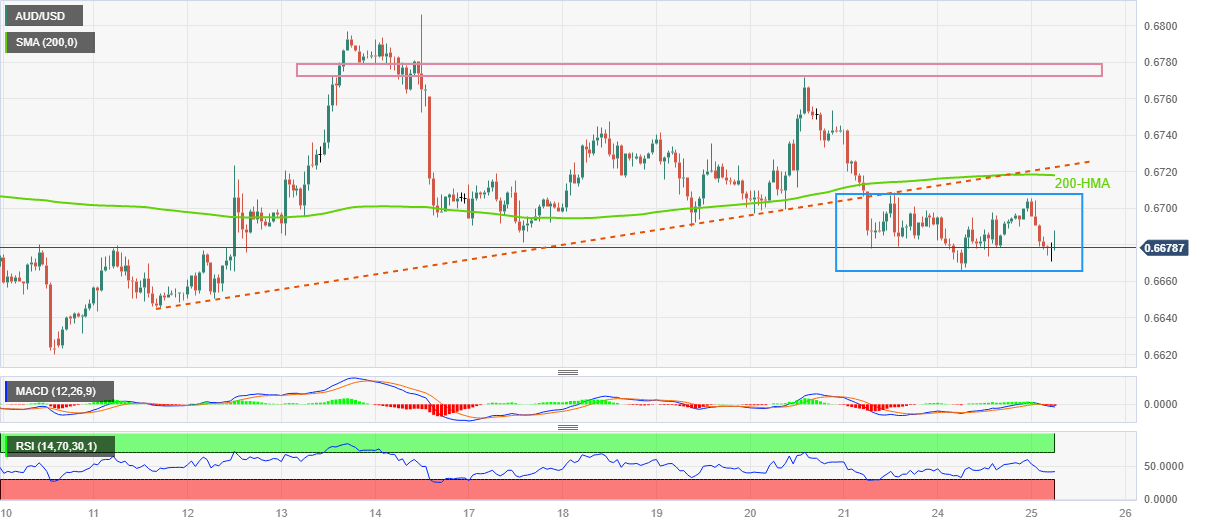

AUD/USD Price Analysis: Portrays bearish consolidation below 0.6700

- AUD/USD remains pressured within 40-pip rectangle, justifies clear break of short-term ascending trend line, 200-HMA.

- Downbeat oscillators suggest further grinding towards the south.

- Aussie pair buyers need validation from 0.6780; bears have ample room to cheer.

AUD/USD bears return to the table, following an upbeat start of the week, as the Aussie pair drops to 0.6680 amid early Tuesday morning in Europe.

In doing so, the risk barometer remains within a short-term rectangle formation comprising multiple levels marked since the last Friday amid a steady RSI (14) line, below the median line of late.

However, a clear downside break of a fortnight-old ascending trend line and the 200-Hour Moving Average (HMA) joins the bearish MACD signals to keep Aussie bears hopeful.

That said, the stated trend continuation pattern’s lower line, close to 0.6665 of late, puts a floor under the AUD/USD prices, a break of which could quickly direct the sellers towards the monthly low of 0.6620.

In a case where the AUD/USD price remains bearish past 0.6620, the 0.6600 round figure and the yearly low marked in March around 0.6560 could lure the sellers.

On the flip side, the aforementioned rectangle’s top line, around 0.6710 at the latest, precedes the 200-HMA level of 0.6720 to restrict the short-term recovery of the AUD/USD pair.

Following that, the previous support line stretched from April 11, near 0.6725 can act as the last defense of the AUD/USD bears.

Should the AUD/USD buyers keep the reins past 0.6725, a one-week-old horizontal resistance area between 0.6770 and 0.6780 can challenge the upside momentum.

AUD/USD: Hourly chart

Trend: Further downside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.