AUD/USD Price Analysis: Keeps pullback from 10/21-day SMA confluence

- AUD/USD defies Friday’s halt to five-day winning streak while refreshing the intraday high.

- Bearish MACD fails to disappoint buyers cheering a sustained move beyond short-term SMAs.

- Monthly resistance line on bulls’ radars, sellers can aim for the key Fibonacci retracements before the monthly low.

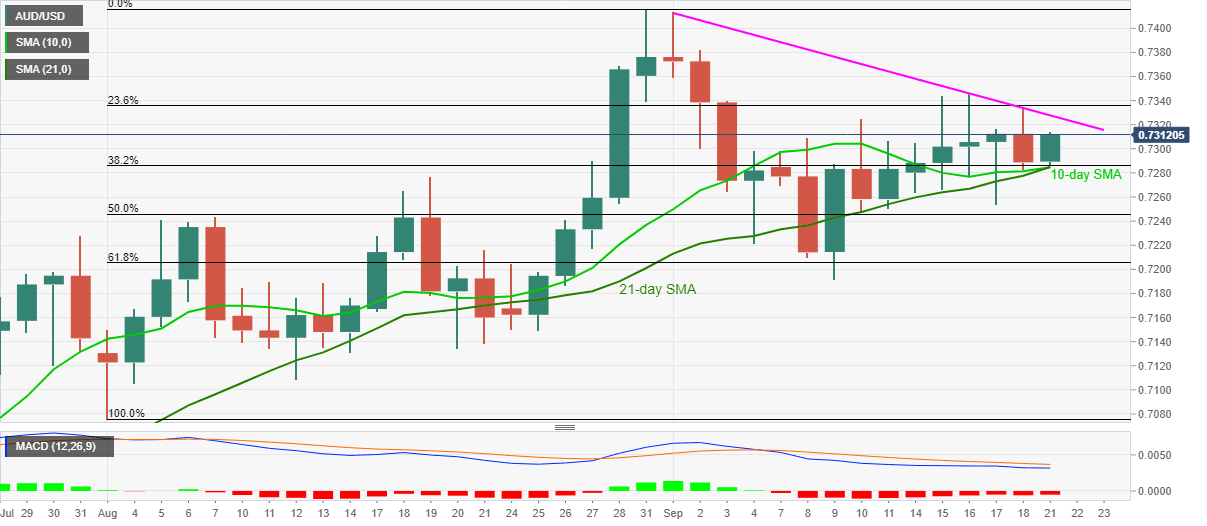

AUD/USD rises to 0.7310, up 0.28% intraday, during early Monday’s trading. The aussie pair recently refreshed the intraday high to 0.7314 while carrying its U-turn from the 10-day and 21-day SMA confluence. In doing so, the quote ignores bearish MACD while also parting ways from Friday’s downbeat performance.

Considering the pullback from the key SMA joint, AUD/USD prices may attack the falling trend line from September 01, at 0.7327 now, during the further recoveries.

However, the pair’s upside past-0.7327 becomes doubtful, which if happen needs to cross last week’s top near 0.7350 before directing the bulls towards the August 31 top close to 0.7415.

Meanwhile, a daily closing below 0.7285/80 support confluence will attack 50% and 61.8% Fibonacci retracements of AUD/USD upside marked in August, respectively around 0.7245 and 0.7205.

In a case where the bears dominate past-0.7205, the monthly bottom near 0.7190 will be the key to watch.

AUD/USD daily chart

Trend: Further recovery expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.