AUD/USD Price Analysis: Inch far from weekly-high above 0.6700 as risk-on mood strengthens

- AUD/USD has sensed a stellar buying interest amid the declining USD Index.

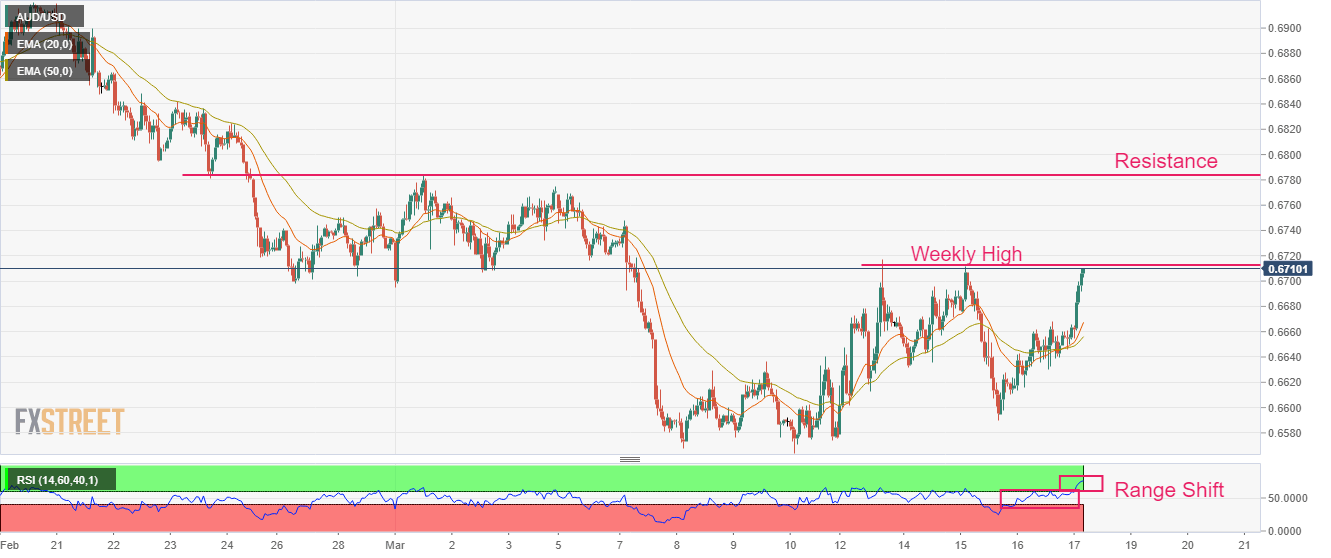

- A bull cross, delivered by the 20-and 50-period EMAs at 0.6648 indicates more upside ahead.

- The RS) (14) has shifted into the bullish range, which indicates that the upside momentum has been triggered.

The AUD/USD pair has witnessed sheer buying interest from the market participants and has reached near its weekly high plotted near 0.6720. The Aussie asset has attracted significant bids as investors have lightened their longs in the US Dollar Index (DXY) significantly. The reason behind ignoring the USD Index despite fears of global banking turmoil is the accelerating expectations of a less-hawkish stance on interest rates by the Federal Reserve (Fed) ahead.

S&P500 futures have recovered their nominal losses witnessed in Asian morning and has turned positive now. A follow-up buying in the 500-US stocks basket futures after a prominent Thursday indicates a further strengthening of the risk appetite theme. The USD Index has shifted its auction below 104.20 and is expected to deliver more losses, considering that the risk-aversion theme is fading.

After breaking above the critical resistance of 0.6668, AUD/USD has soared above 0.6700. At the press time, the Aussie asset is hovering near the weekly high. A bull cross, delivered by the 20-and 50-period Exponential Moving Averages (EMAs) at 0.6648 indicates more upside ahead.

Adding to that, the Relative Strength Index (RSI) (14) has shifted into the bullish range of 60.00-80.00, which indicates that the upside momentum has been triggered.

Should the asset breaks above March 13 high at 0.6717, Aussie bulls would drive the asset further toward March 07 high at 0.67478 followed by the horizontal resistance plotted from February 23 low at 0.6781.

On the contrary, a slippage below March 15 low at 0.6564 will drag the asset toward October 4 high at 0.6547 and the round-level support at 0.6500.

AUD/USD hourly chart

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.