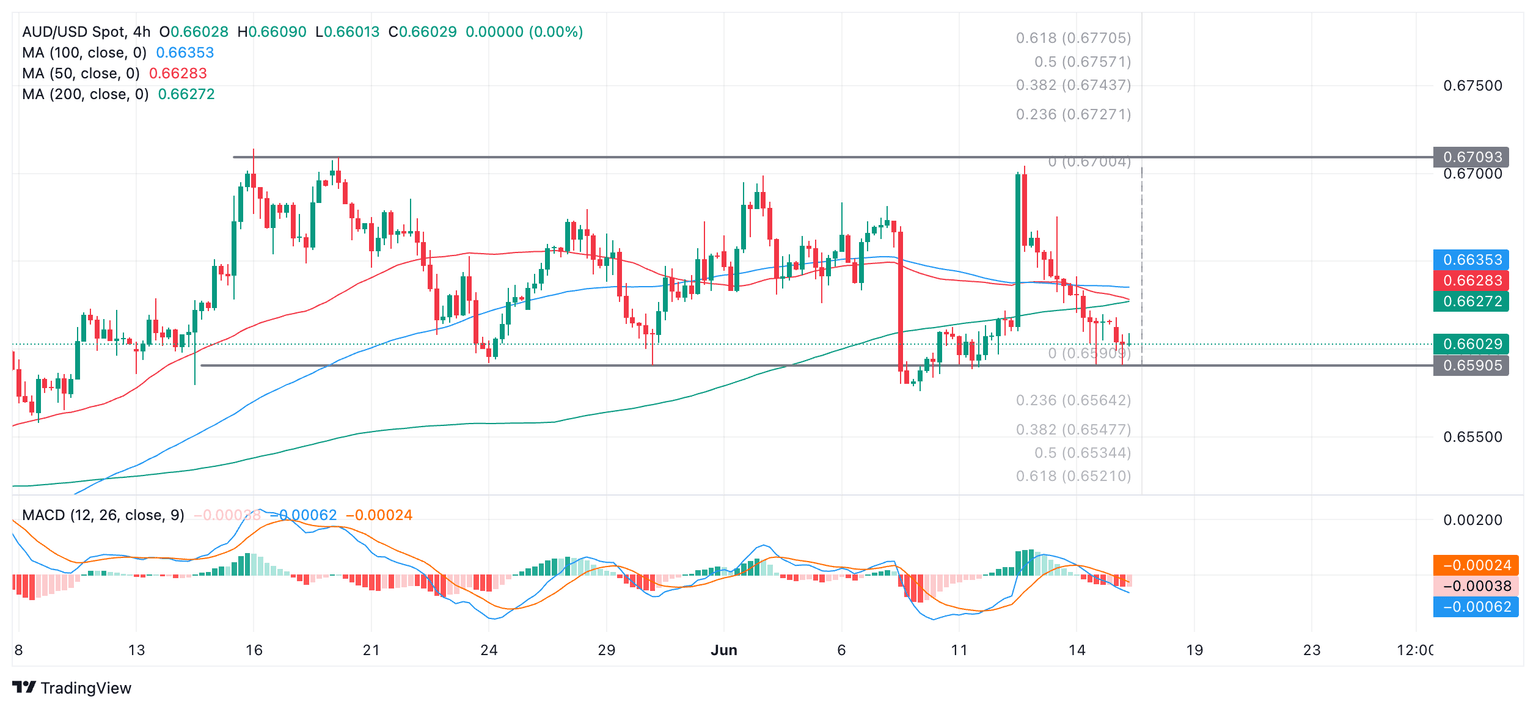

AUD/USD Price Analysis: Falls to base of the short-term range

- AUD/USD has fallen to the floor of a range it began in mid-May.

- The pair is in a sideways short-term trend which is likely to extend.

- This suggests the likely evolution of an up leg towards the range ceiling.

AUD/USD has fallen to the bottom of a range it has been trading in since the middle of May. From here it is likely to reverse and start moving back up to the top of the range at roughly 0.8609.

AUD/USD is in a short-term sideways trend which, given “the trend is your friend,” is more likely than not to continue.

AUD/USD 4-hour Chart

It would require a decisive break out of the range to signal the end of the sideways trend and a change to a more directional trend. An upside break is marginally more likely to happen because the trend prior range was bullish.

A decisive break above the ceiling of the range would likely see a follow-through to a conservative target at 0.6770; a decisive break below the range floor would indicate a follow-through to at least 0.6521.

A decisive break would be one in which a longer-than-average candle broke out of the range and closed near its high or low, or three successive candles of the same color broke cleanly through the range top or bottom.

The targets are generated using the usual technical-analysis method of extrapolating the height of the range by a Fibonacci 0.618 ratio higher (in the case of an upside break) or lower (in the case of a downside break). A more generous target would come from extrapolating the full height of the range.

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.