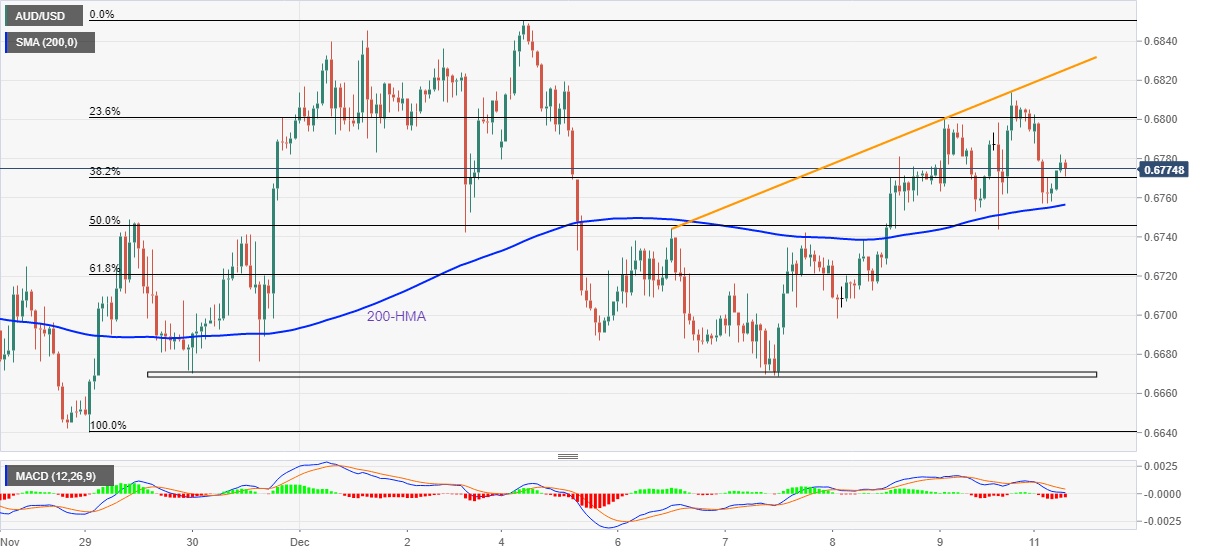

AUD/USD Price Analysis: Fades bounce off 200-HMA to snap three-day uptrend

- AUD/USD remains depressed around intraday low during the first loss-making day in four.

- Bearish MACD signals, failure to cross weekly resistance line keep sellers hopeful.

- Buyers need validation from monthly high to retake control.

AUD/USD retreats to 0.6775 as it defies the three-day winning streak heading into Monday’s European session. In doing so, the Aussie pair retreats toward the 200-Hour Moving Average (HMA) amid the bearish MACD signals.

It’s worth noting that the quote’s failure to cross a one-week-old ascending trend line also contributes to the bearish bias.

That said, the AUD/USD weakness past the 200-HMA level of 0.6755 will aim for the 50% Fibonacci retracement level of the pair’s November 29 to December 05 upside, near .6745.

However, a two-week-old horizontal support area surrounding 0.6670 appears a tough nut to crack for the AUD/USD bears.

In a case where AUD/USD remains bearish past 0.6670, a downward trajectory towards the late November swing low near 0.6585 can’t be ruled out.

Meanwhile, recovery moves may initially confront the 23.6% Fibonacci retracement level round the 0.6800 round figure before challenging an upward-sloping resistance line near 0.6825.

Even if the AUD/USD bulls manage to cross the 0.6825 hurdle, the monthly high of 0.6850 will act as an extra upside filter to challenge the pair’s further advances.

Overall, AUD/USD is likely to witness a short-term pullback but the bulls remain hopeful unless witnessing a clear downside break of 0.6670.

AUD/USD: Hourly chart

Trend: Further downside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.