AUD/USD Price Analysis: China data eyed as critical support remains pressured

- AUD/USD bears a run to the 0.7320s with hourly support under pressure.

- Longer-term. bears are seeking a daily breakout and lower swing-low.

Ahead of a busy week on the calendar for the pair, the price is craving out firm support at the start of the week so far, but on a break below, the bears will be looking to engage.

The following illustrates the medium-term prospects and the near term structure leading into today's key event in Chinese Caixin China Manufacturing PM, released by Markit Economics.

Daily chart

As per the Chart of the Week: AUD/USD bears back in play, the bearish engulfing close is highly bearish for the opening sessions this week:

However, there is stubborn support that needs to break before the bears can engage.

From a lower time frame, taking the 4-hour perspective, the price needs to break and close below 0.7330:

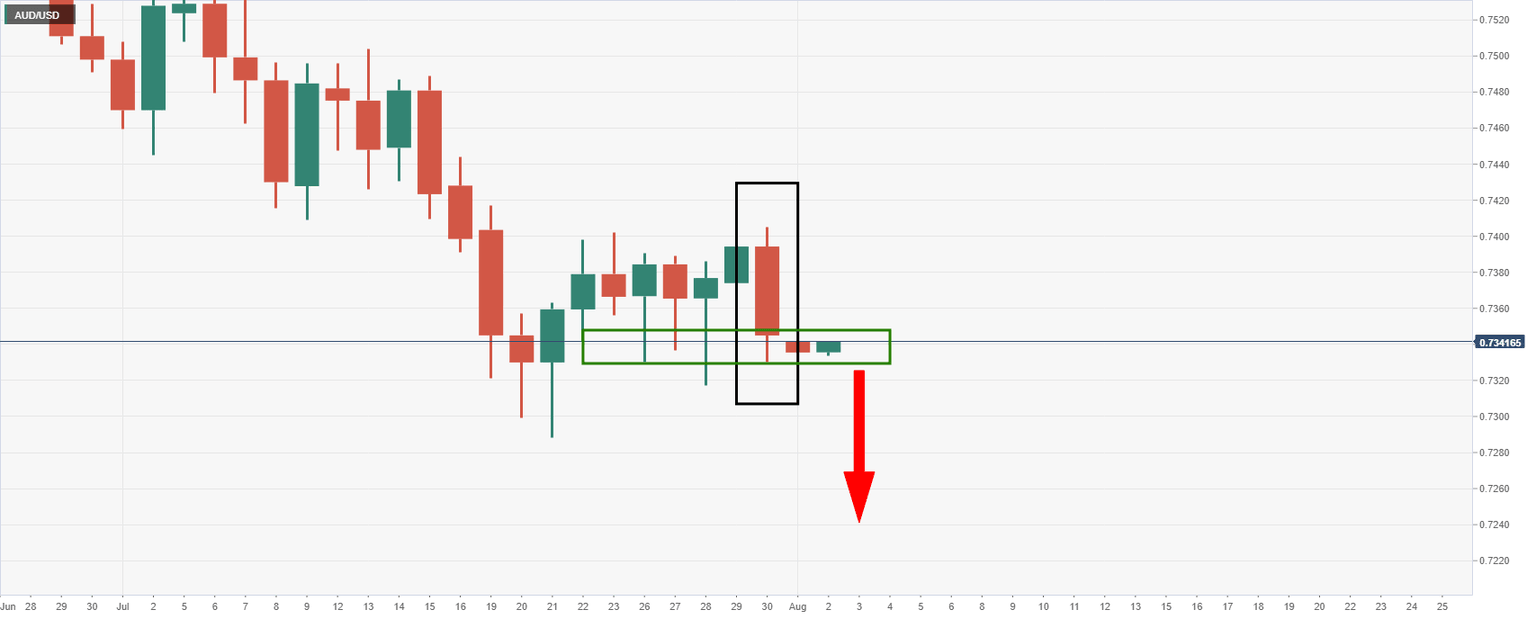

Hourly chart

With that being said, a break of hourly support could be enough to trigger the downside:

A illustrated, the price is capped by resistance and the confluence of the 38.2% Fibo, reached, and the bearish 10-EMA.

A break of the dynamic support and the latest hourly lows at 0.7341 could lead to a downside hourly continuation for a fresh low in the 0.7320s.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.