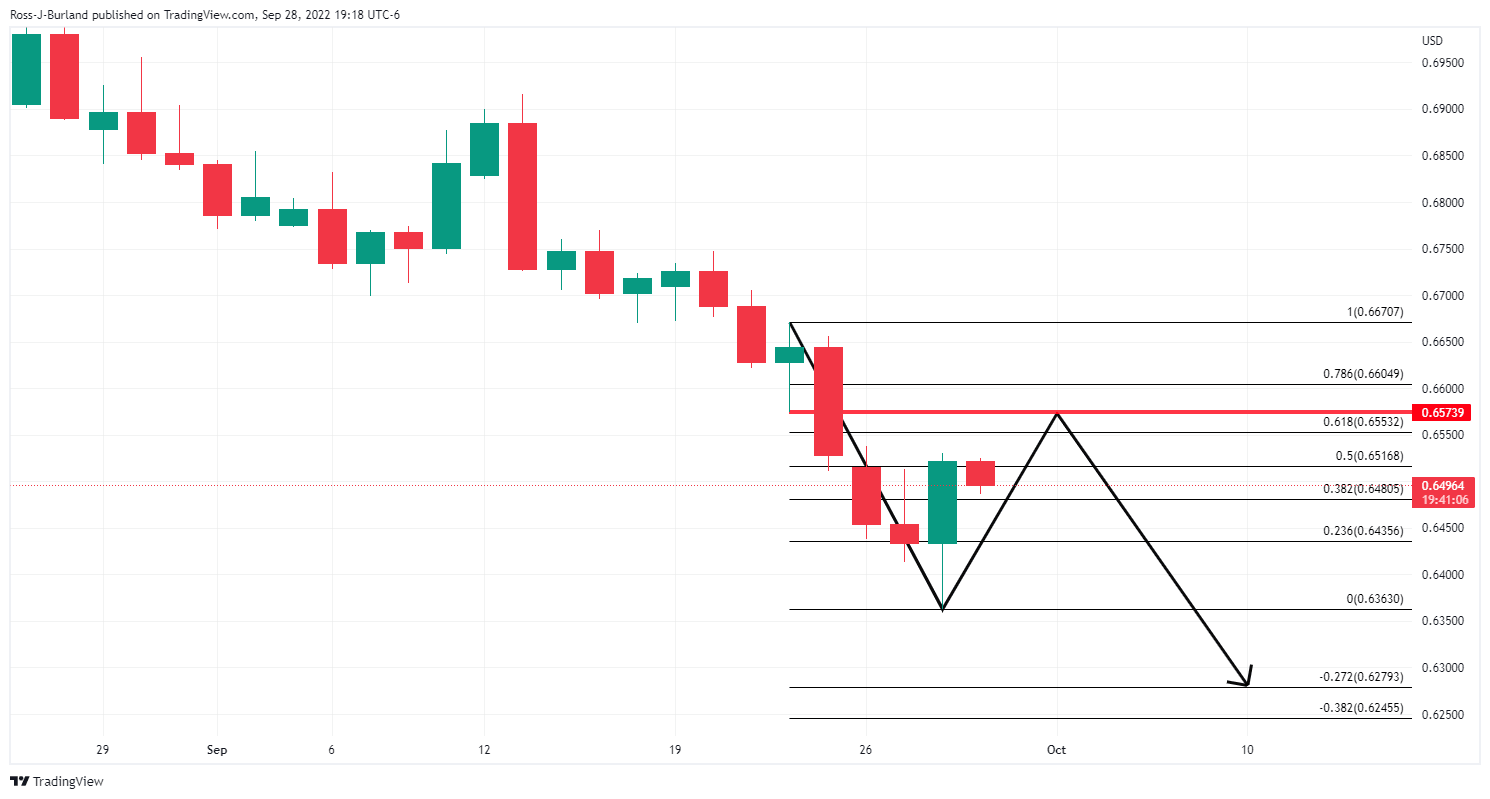

AUD/USD Price Analysis: Bulls take on the bears in key correction territory

- AUD/USD bears are lurking but bulls may not be done yet.

- The price has corrected a significant portion of the bearish impulse.

AUD/USD rallied in a correction on Wednesday and there could be more to come should the markets continue to offload long positions of the greenback into the fixes and month end this week. The following illustrates the bias on a daily time frame into the remaining days and sessions for the month.

AUD/USD daily chart

The last bearish impulse has seen a significant correction in mid-week trade and there could be more to come if the bulls can stay the course with the 0.6570s eyed. The antipodean currency might start to find support from better-than-expected data of late such as the recent Retail Sales, which showed Australian shoppers were proving resilient to red-hot inflation and rising interest rates. In recent trade, the monthly inflation data has shown a +6.8% Yoy in August and +7.0% YoY for July. However, traders are awaiting the quarterly data that will arrive in late October.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.