AUD/USD Price Analysis: Bulls in action as RBA’s surprise rate hike trims RBA-Fed policy divergence

- AUD/USD is struggling to surpass 0.6680, more gains in the pipeline as RBA raised OCR further.

- A surprise interest rate hike of 25 bps by the RBA has trimmed the RBA-Fed policy divergence.

- AUD/USD witnessed a sharp recovery despite delivering a breakdown of the consolidating formed in a range of 0.6563-0.6808.

The AUD/USD pair is struggling in extending the current rally above 0.6680 inspired by the surprise interest rate hike announcement by the Reserve Bank of Australia (RBA). RBA Governor Philip Lowe raised its Official Cash Rate (OCR) by 25 basis points (bps) to 4.10% considering the fact that current Australian inflation is extremely far from the desired level. This has trimmed the RBA-Federal Reserve (Fed) policy divergence.

S&P500 futures are displaying a subdued performance amid an absence of potential triggers. The overall market mood is cautious as investors have divided about June’s monetary policy meeting by the Fed.

The US Dollar Index (DXY) has found an intermediate cushion around 103.80 after a sell-off propelled by weaker-than-anticipated United States ISM Services PMI.

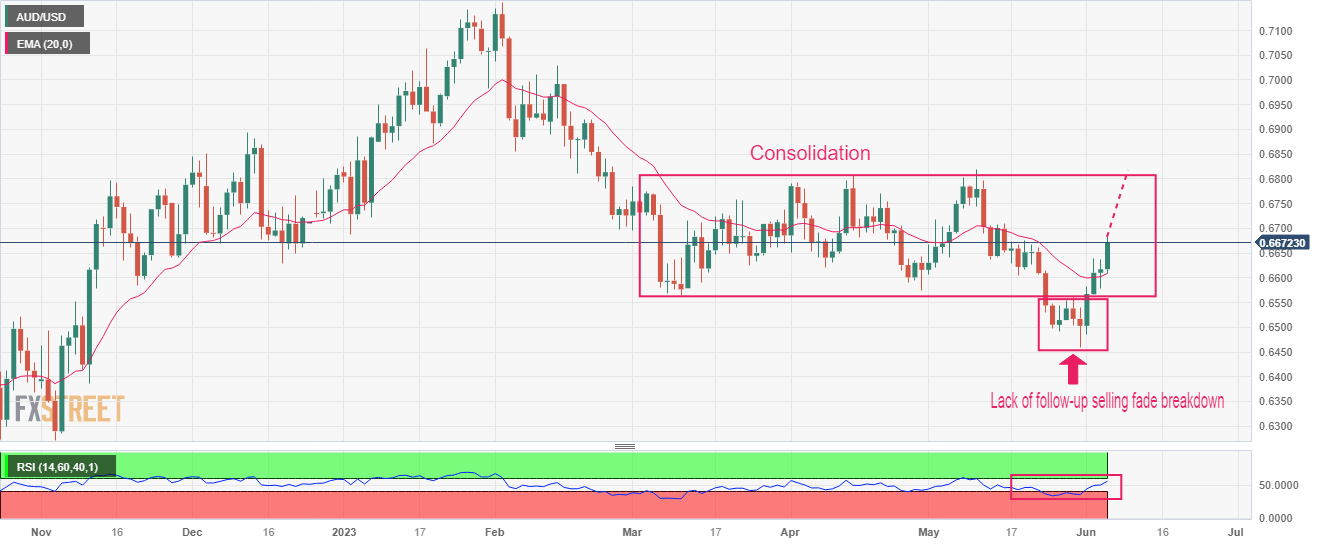

AUD/USD witnessed a sharp recovery despite delivering a breakdown of the consolidating formed in a range of 0.6563-0.6808 on a daily scale. Lack of follow-up selling in the Aussie asset after a consolidation breakdown triggered a solid recovery.

The Aussie asset has climbed above the 20-period Exponential Moving Average (EMA) at 0.6607, which indicates that the short-term trend has turned bullish.

Meanwhile, the Relative Strength Index (RSI) (14) has rebounded into the 40.00-60.00 range from the bearish range of 20.00-40.00, which indicates that the downside momentum has receded.

Should the Aussie asset breaks above the round-level resistance of 0.6700, the Australian Dollar bulls will drive the asset toward April 18 high at 0.6748 followed by May 10 high at 0.6818.

On the flip side, if the Aussie asset breaks below June 01 low at 0.6484, US Dollar bulls would drag the asset to 01 November 2022 high around 0.6464 followed by the round-level support at 0.6400.

AUD/USD daily chart

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.