AUD/USD Price Analysis: Bulls forming a phalanx at critical support

- AUD/USD is testing a critical area of daily resistance and hourly support.

- Bulls need to clear 0.7380 for a look-in beyond there towards daily highs.

AUD/USD bulls are trying to establish a base on the hourly time frame for a run towards daily resistances. The following illustrates the market structure and prospects for higher levels so long as hourly support holds.

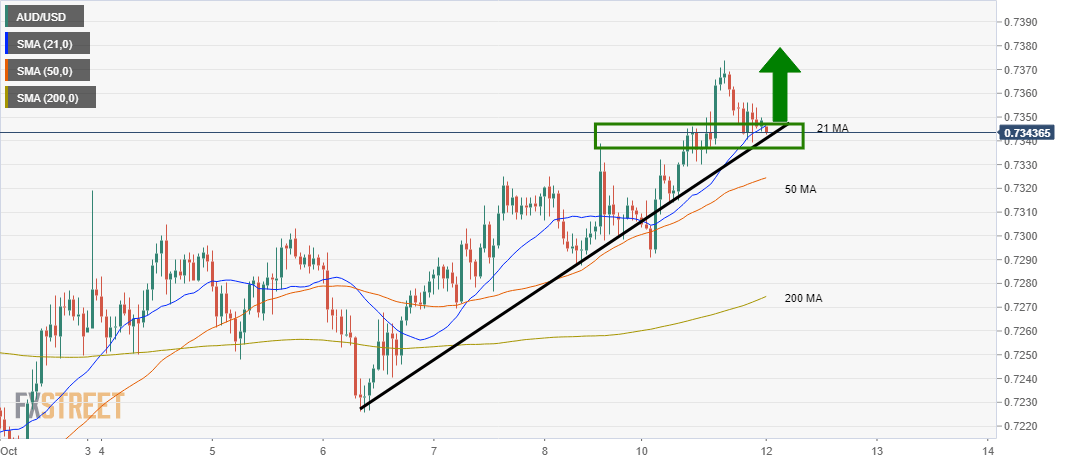

AUD/USD, 1-hour chart

The price is consolidating at a critical area of support on the hourly chart where horizontal support meets the dynamic trendline support. The price is in the bullish territory while trending above the 200 moving average and the divergence between the 21 and 50 is encouraging also.

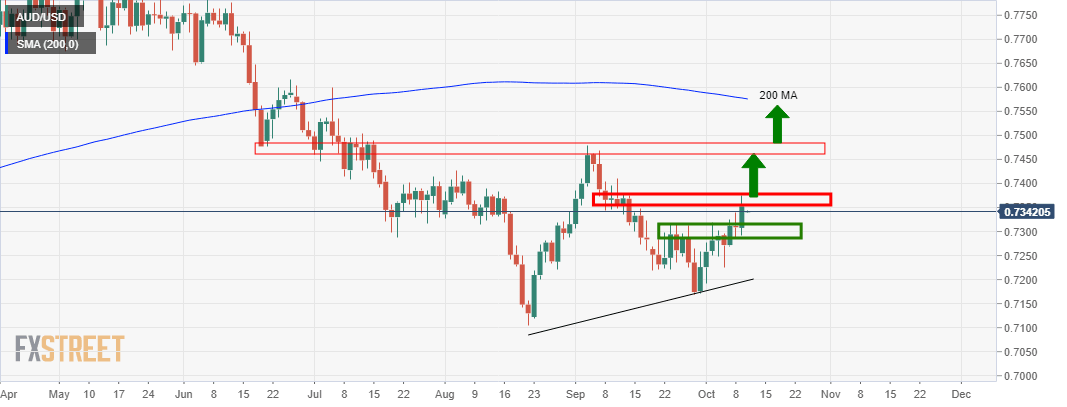

AUD/USD, daily chart

However, from a daily perspective, there is solid resistance near the 0.7380/0.7400 area. If this gives, then the bulls will likely be in the running for a test of the previous daily highs ahead of the 200-day moving average.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.