AUD/USD Price Analysis: Bulls could be lurking at the fresh cycle lows but continuation not off the table

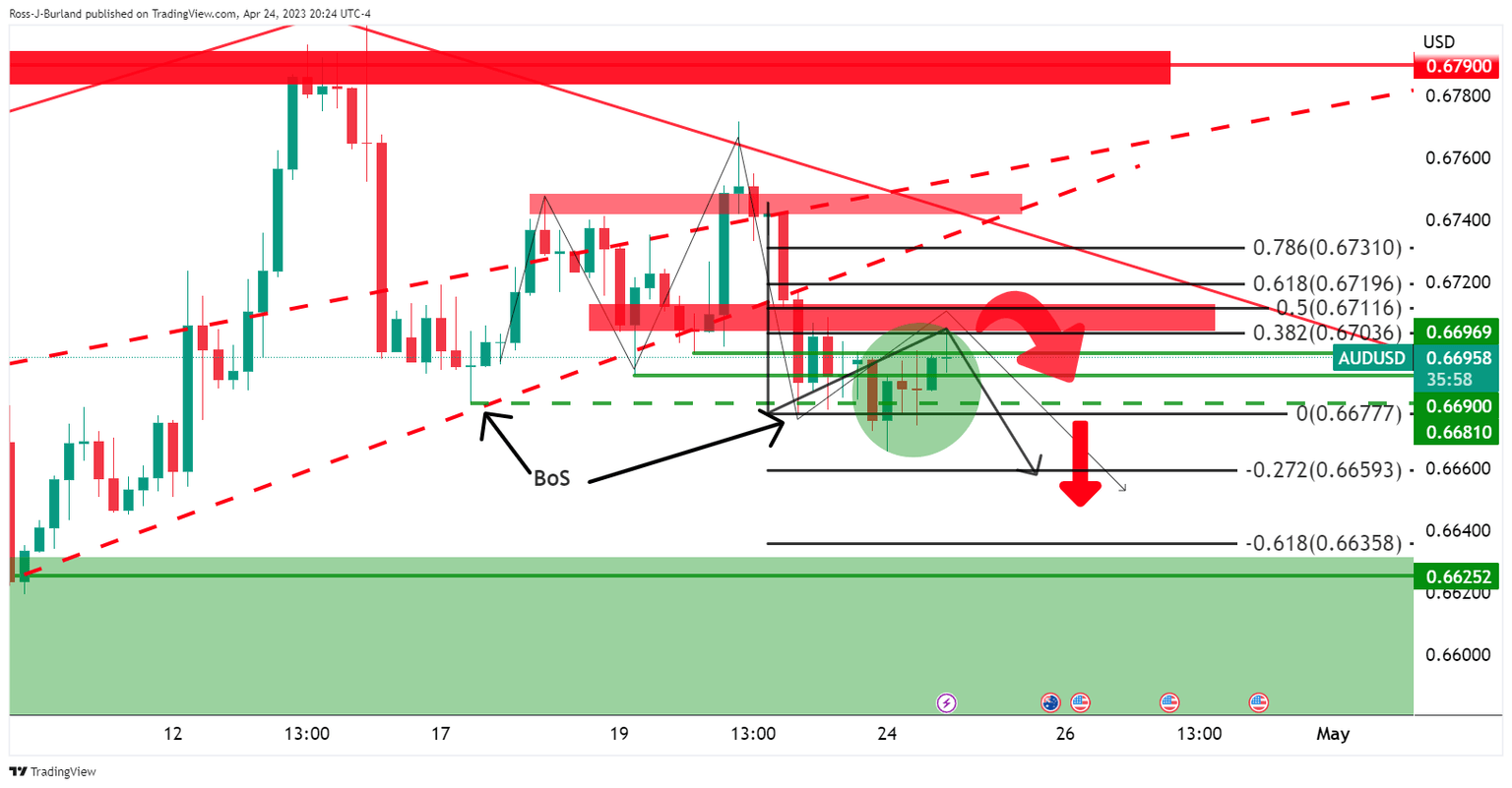

- AUD/USD bulls could start to show up.

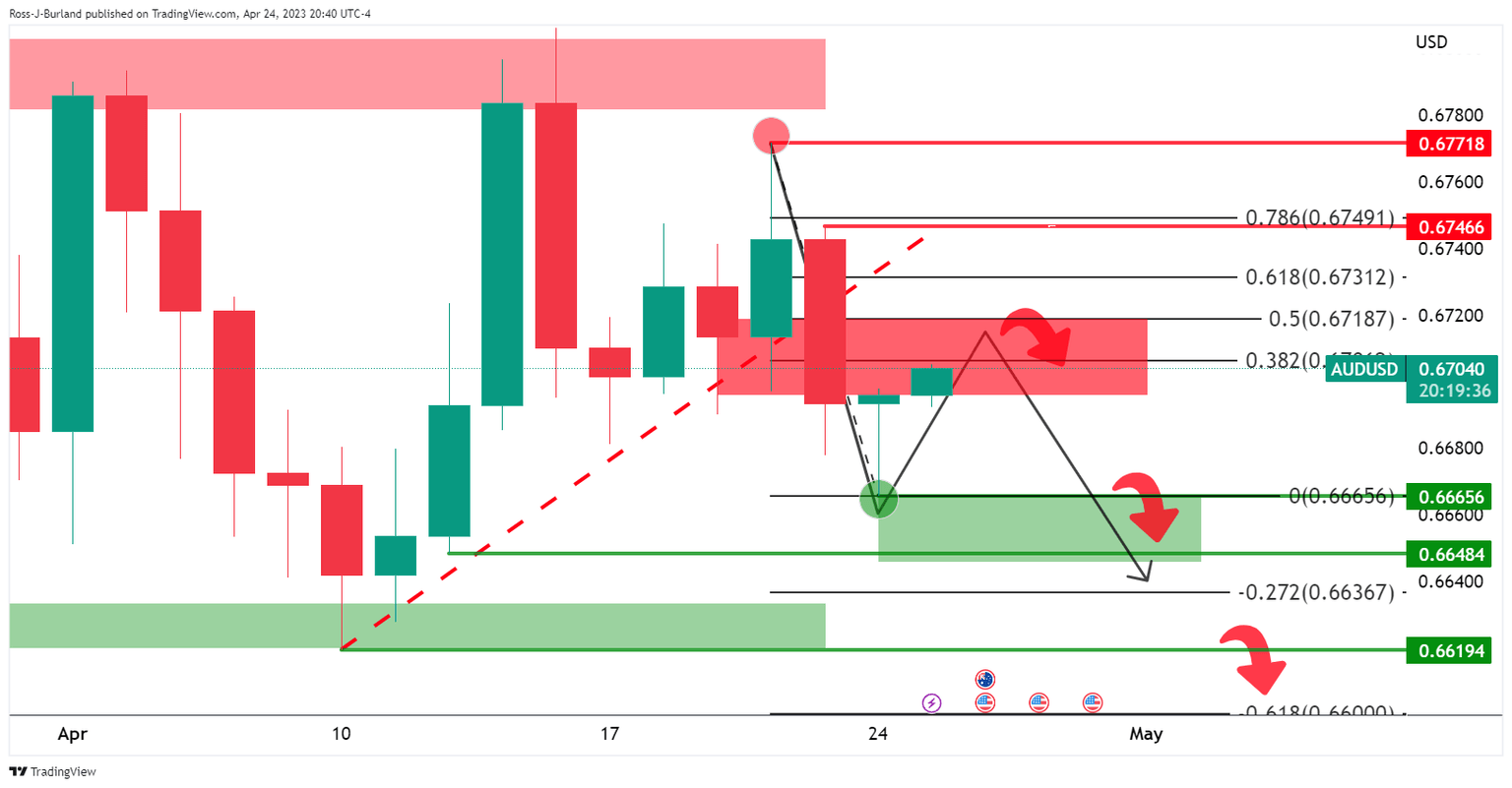

- There will be prospects of a correction into prior support near the 38.2% Fibonacci.

- The 50% mean reversion aligns with the round 0.6650 number also.

As per the prior analysis, AUD/USD Price Analysis: Bears aligned below 0.6710, and AUD/USD Price Analysis: Where are the bears hibernating? where the following illustrated the downside prospects while below 0.6710, we have seen a strong continuation move into 0.6591 today´s low.

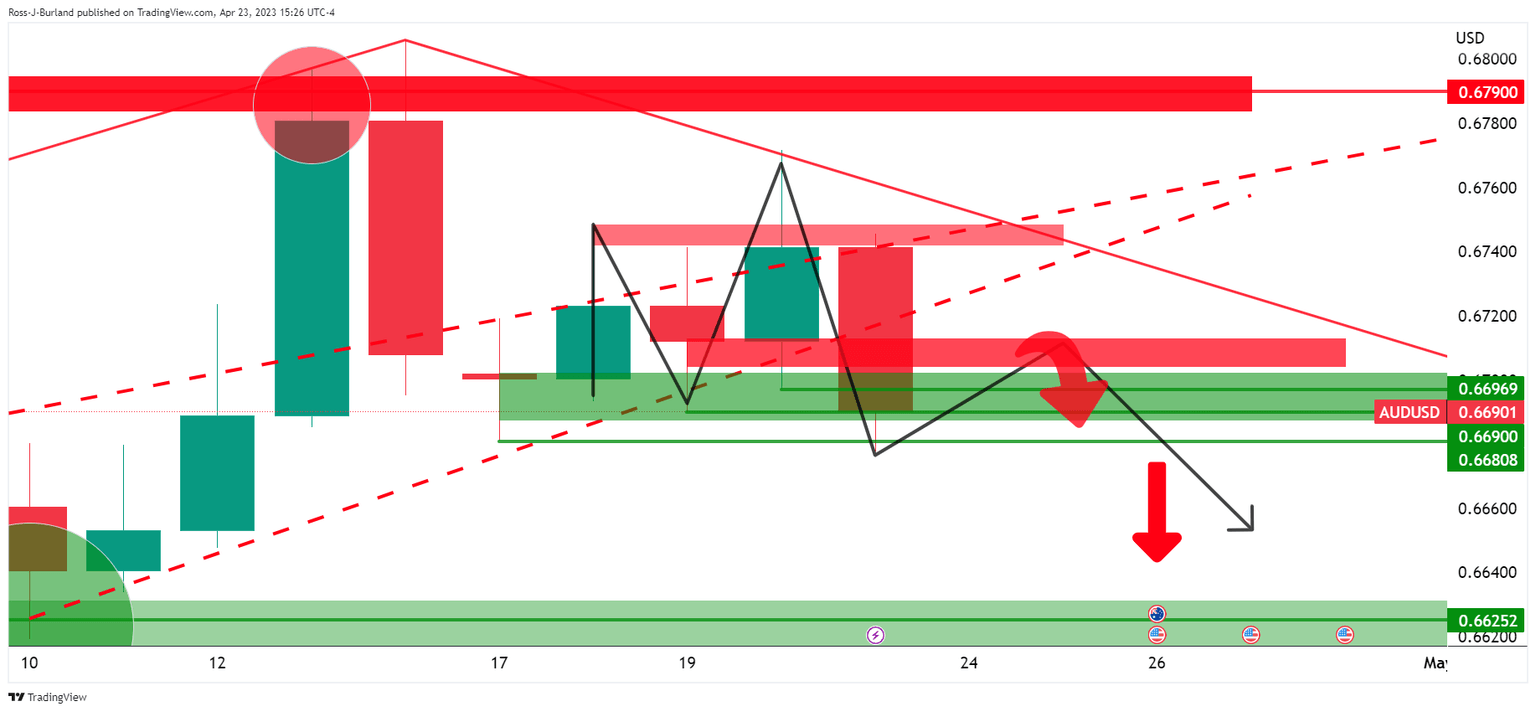

AUD/USD prior analysis

The M-formation on the daily chart was expected to act as the peak formation in a correction and lead to a move lower to break the structure on the downside.

AUD/USD H4 chart

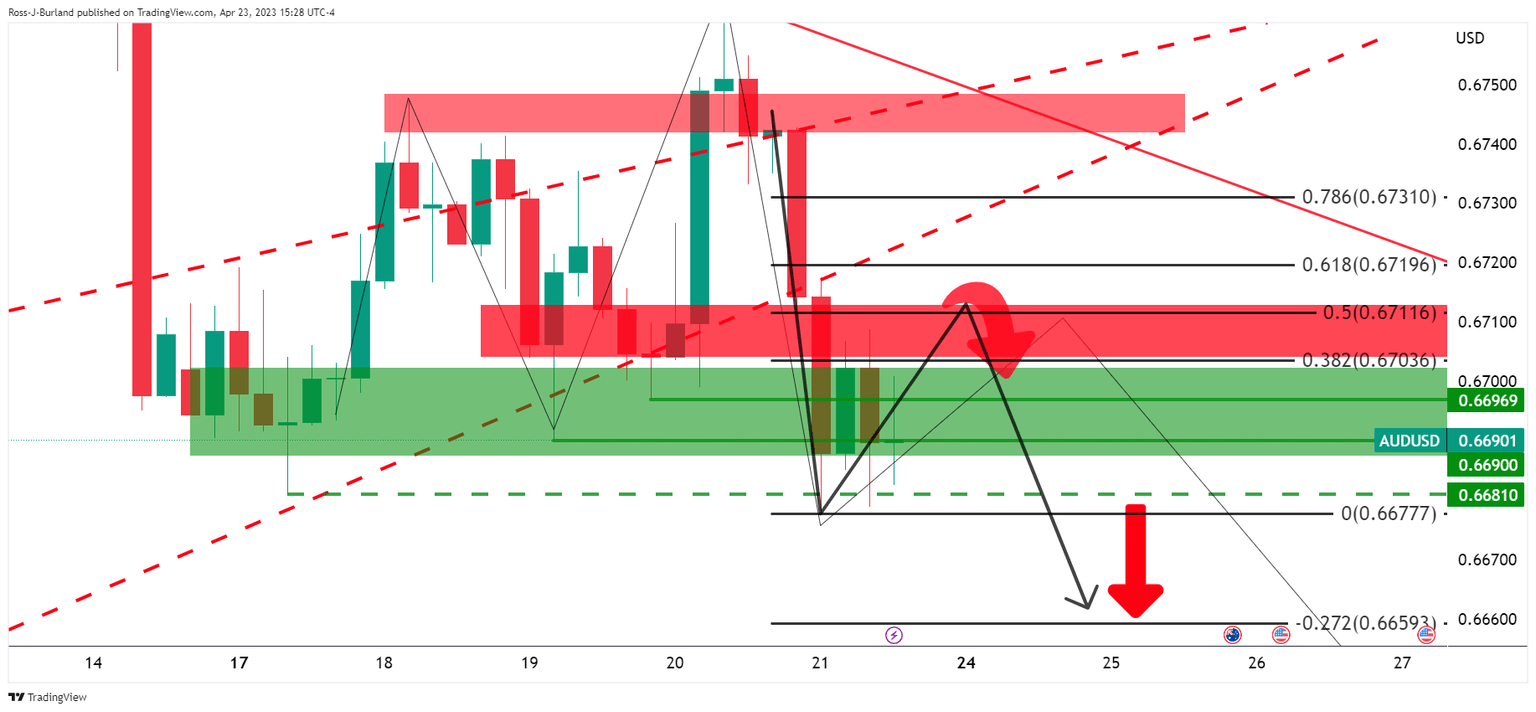

The four-hour chart´s 50% mean reversion level near 0.6710 aligned with the neckline of the pattern that could continue to act as resistance.

The price deteriorated but there had been a lack of momentum in the US Dollar and AUD/USD climbed back into the barroom brawl as follows:

In the bearish thrust, there was a break in structure which left the bias to the downside so long as the bears showed up and guarded the 0.67s.

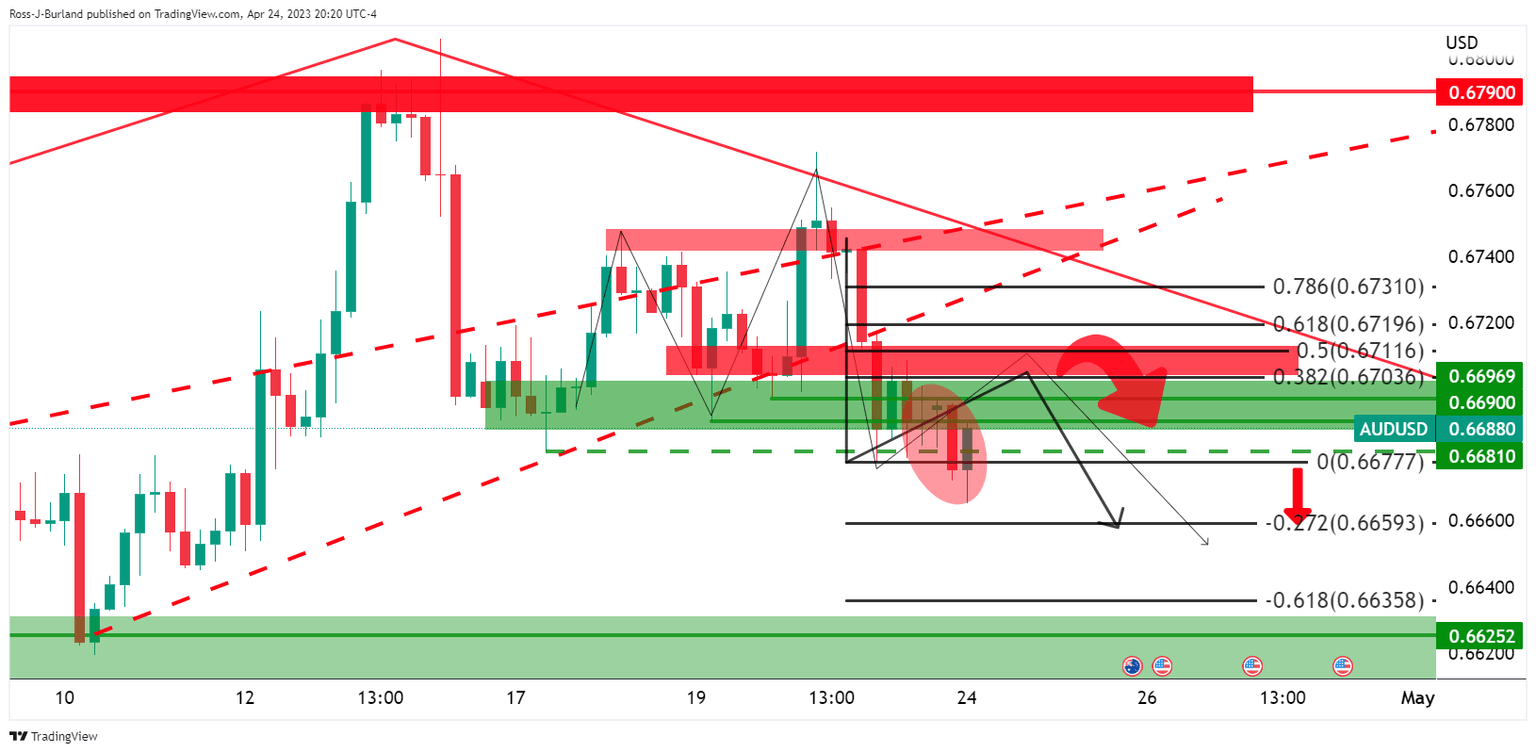

However, there was an adjustment to the daily chart´s Fibonaccis as follows:

AUD/USD update

The 38.2% Fibonacci acted as resistance and we got a strong bearish impulse from there to test 0.6600 and the -61.8% Fibo.

There are long positions from below 0.6590 and 0.6560 that could see the market move into and further out:

... there is a lot of downside potential below. However...

If the bulls step in, then there will be prospects of a correction into prior support near the 38.2% Fibonacci. The 50% mean reversion aligns with the round 0.6650 number also.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.