AUD/USD Price Analysis: Bears aligned below 0.6710

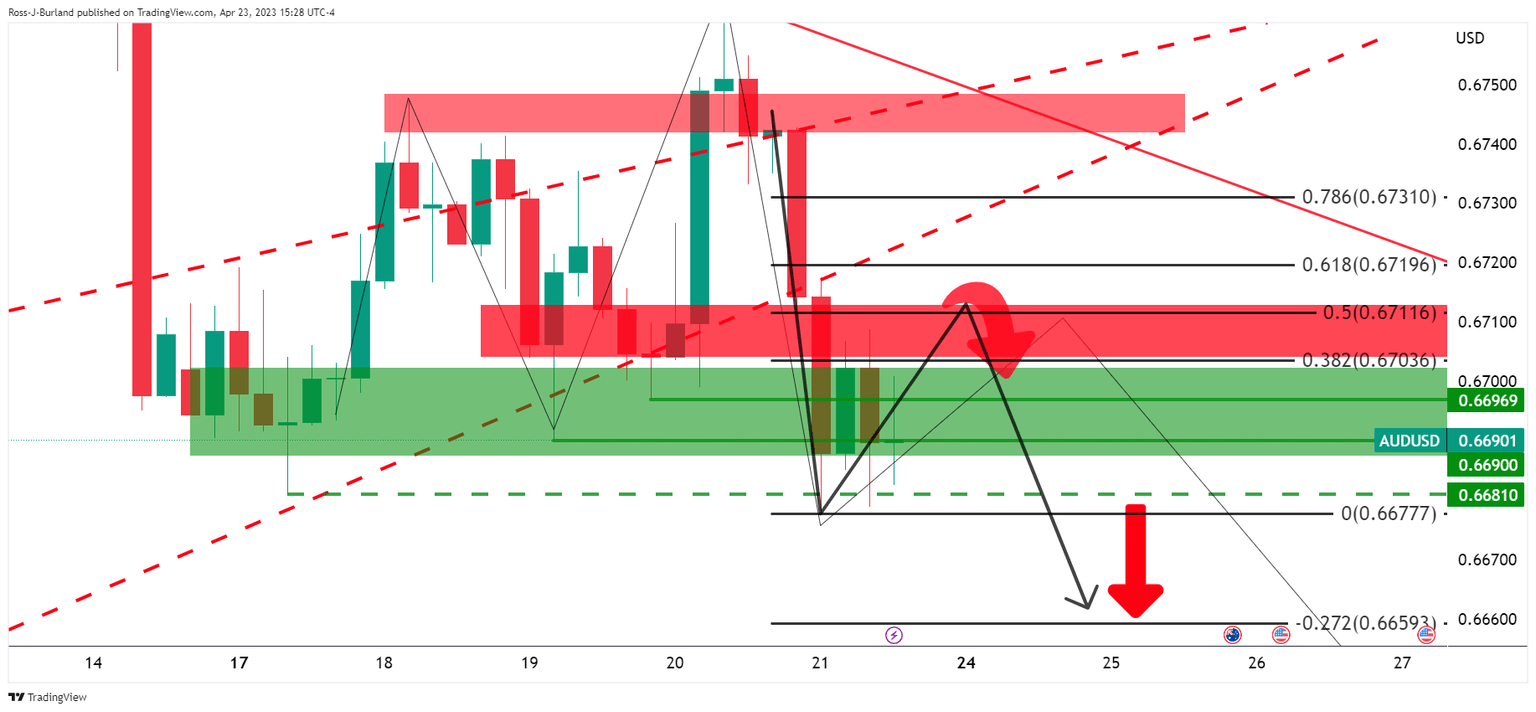

- AUD/USD bears are in the market and price is offered below 0.6710.

- Bears seeking a break in support structure.

AUD/USD has been under pressure over the course of the past few days, despite a strong Australian labour market report for March and the resultant boost in expectations that the RBA may hike rates again as soon as early May. The US Dollar has been firmer, however, as this is seeing to an offer in the pair as the following illustrates:

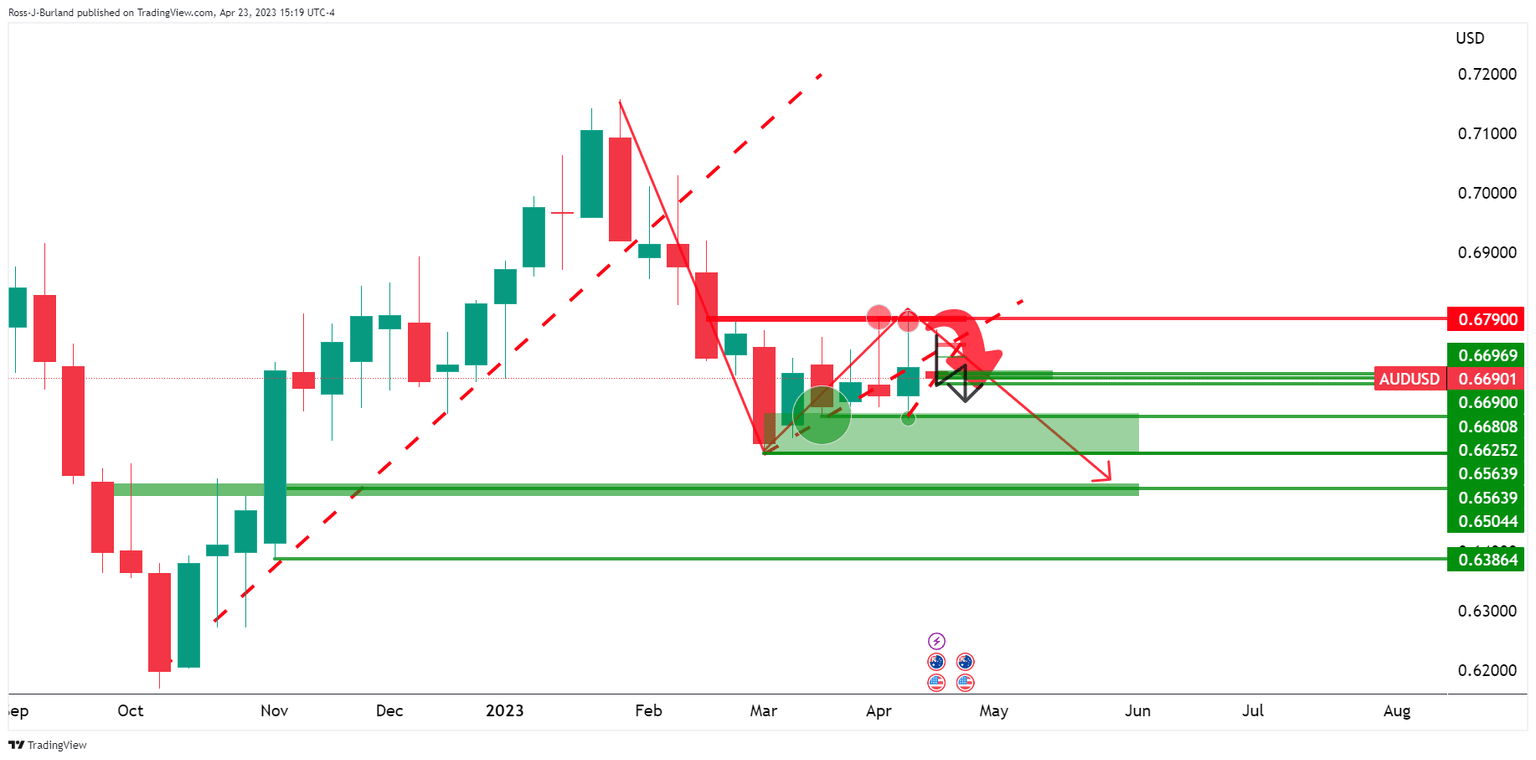

AUD/USD weekly chart

The weekly chart has the price coiling in the correction with the possibility of a downside continuation while stuck below 0.6790.

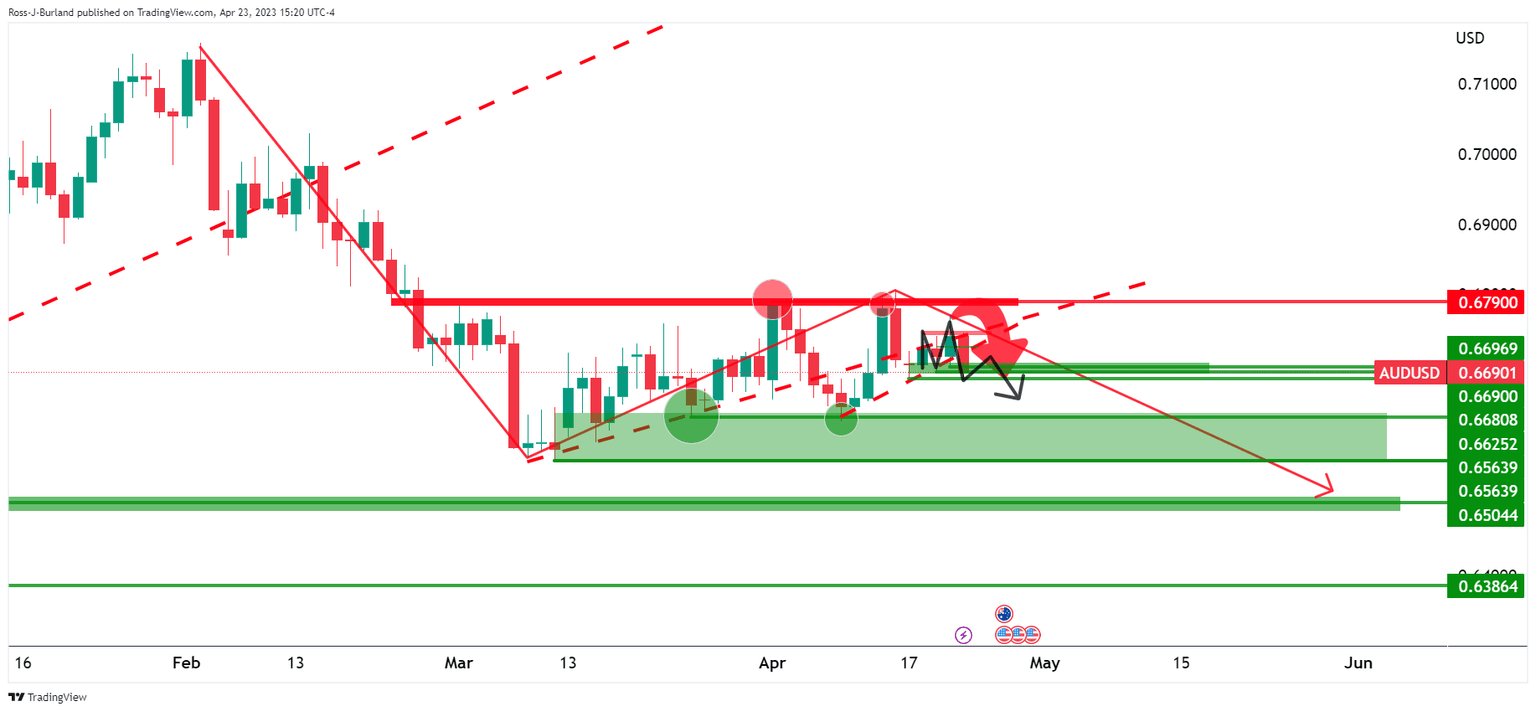

AUD/USD daily charts

The M-formation on the daily chart may act as the peak formation in the correction and lead to a move lower to break the structure on the downside.

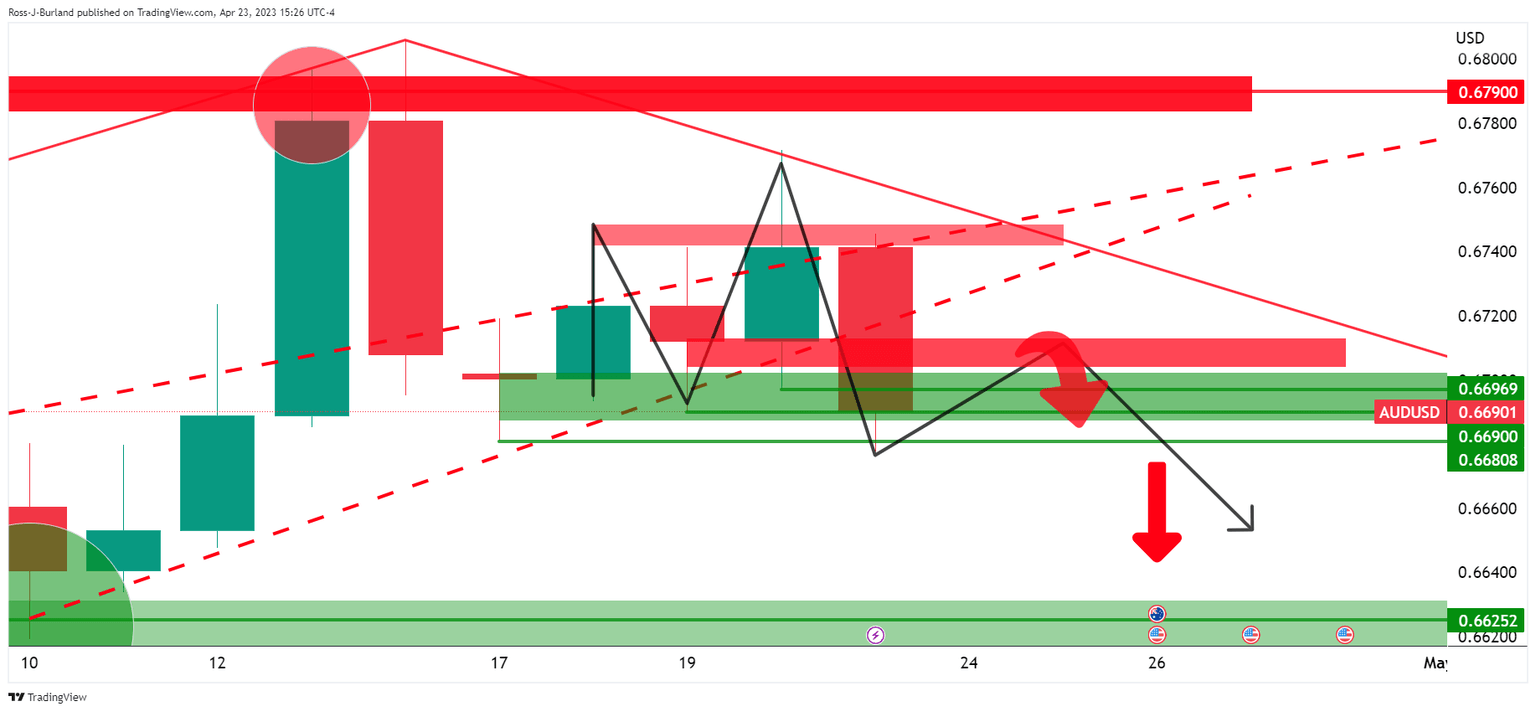

AUD/USD H4 chart

The four-hour chart´s 50% mean reversion level near 0.6710 aligns with the neckline of the pattern that could continue to act as resistance.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.