AUD/USD Price Analysis: Bounces off 61.8% golden ratio towards 0.6900

- AUD/USD picks up bids to rebound from the key Fibonacci retracement support.

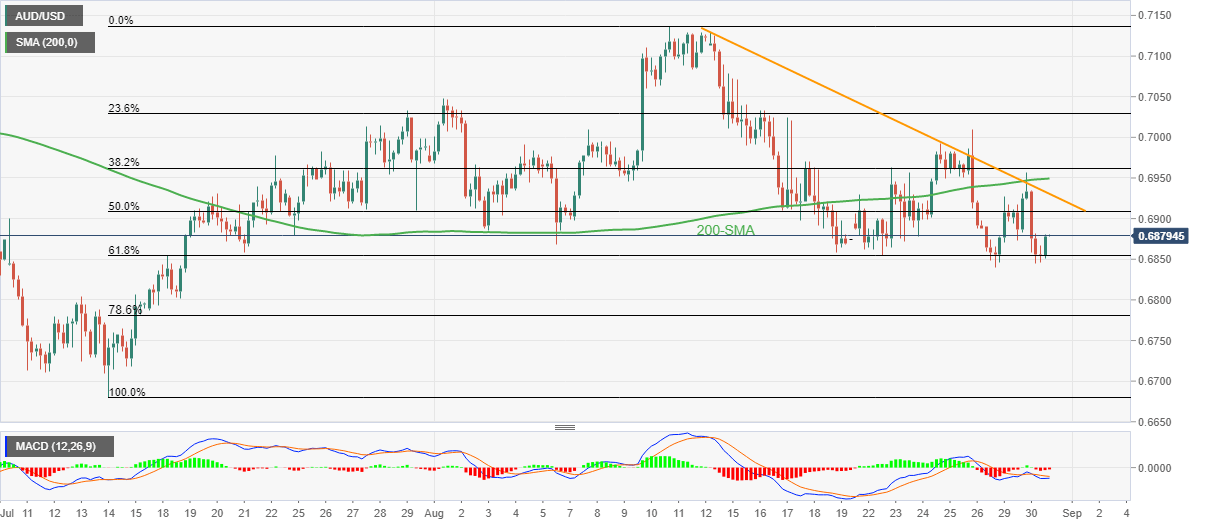

- 12-day-old resistance line, 200-SMA join bearish MACD signals to challenge recovery.

- The mid-July swing high can acts as additional support during the south-run to yearly low.

AUD/USD renews intraday high around 0.6880 during early Wednesday morning in Europe. In doing so, the Aussie pair rebounds from the 61.8% Fibonacci retracement level of the July-August upside.

Given the recovery moves from an important Fibonacci ratio, as well as the broad US dollar weakness, AUD/USD is likely to stretch the latest run-up towards the 50% Fibonacci retracement level near 0.6910.

However, a downward sloping resistance line from August 15, around 0.6930 at the latest, restricts short-term advances of the pair.

Following that, the 200-SMA level surrounding 0.6950 may act as the last defense of the AUD/USD bears.

Meanwhile, pullback moves may have to successfully break the 61.8% golden ratio around 0.6850 to convince sellers.

Even so, the mid-July swing high and the 78.6% Fibonacci retracement levels, respectively near 0.6800 and 0.6880, could test the AUD/USD sellers before directing them to the yearly low marked in July near 0.6680.

To sum up, AUD/USD is likley to remain firmer but the upside room appears limited.

AUD/USD: Four-hour chart

Trend: Limited upside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.