AUD/USD Price Analysis: Begins trading in a range-bound mode

- AUD/USD is trading in a range and may have begun a sideways trend.

- It has bounced off the floor of a prospective range and is probably rising up to the ceiling.

- It would require a decisive breakout from the range to renew directionality.

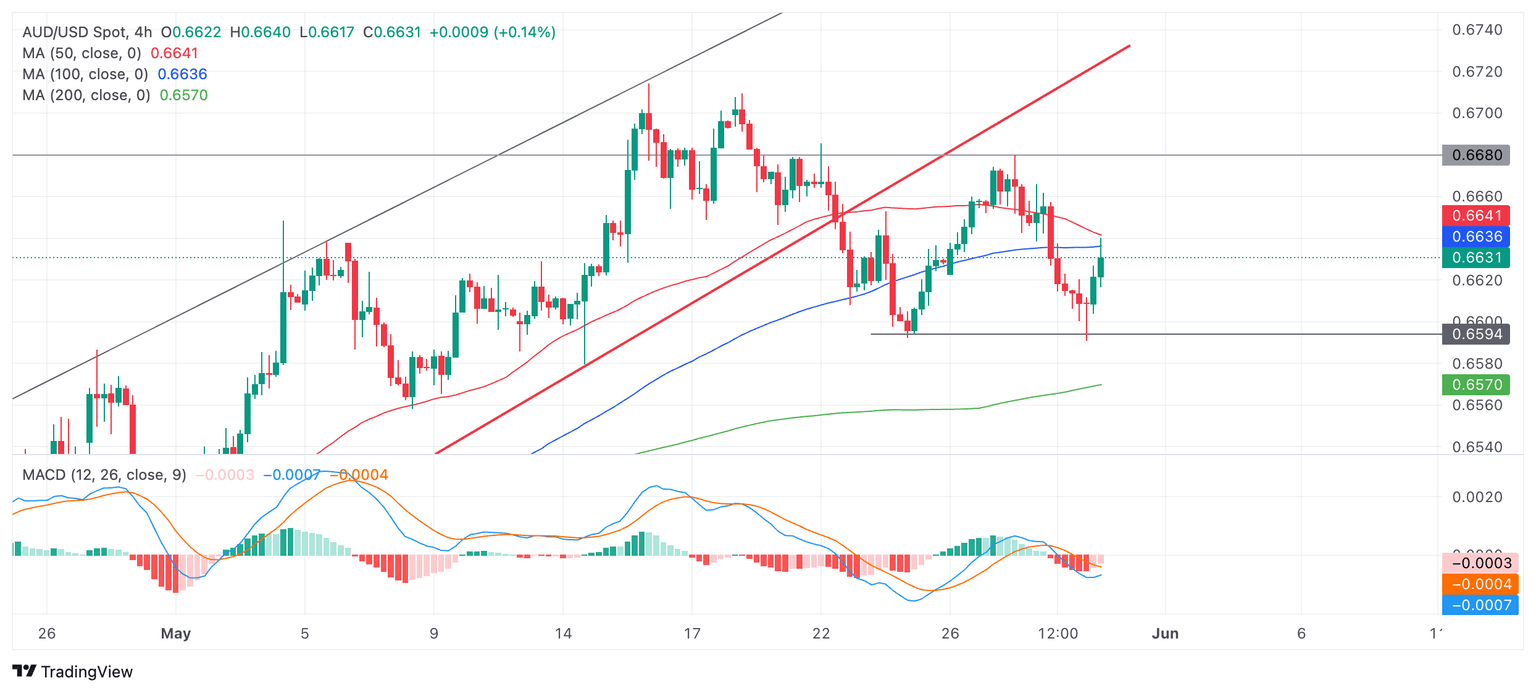

AUD/USD trades about a third of a percent higher in the 0.6630s on Thursday after finding support and bouncing from the May 24 swing lows.

It is possible the pair has entered a sideways trend with a range high at the May 26 high of 0.6680 and a floor at 0.6591 (May 30 low).

AUD/USD 4-hour Chart

If AUD/USD is in a short-term sideways trend it will probably extend its range. The next move is likely to be a continuation of the rally from the range floor up to the range ceiling at 0.6680.

AUD/USD is currently facing resistance from the 100 and 50 Simple Moving Averages, however, which will probably impede progress higher. A break above the 50 SMA at 0.6641 would be necessary to reconfirm the bullish bias and indicate odds favor a move back up to the range highs.

AUD/USD broke down from its rising channel on May 22, bringing the established uptrend into doubt. Follow-through lower was weak and the pair recovered. There is no clear short-term directional trend suggesting the trend may actually be sideways.

It would require a decisive break below 0.6591 to confirm more downside, with the next target probably at 0.6560 where the 100 and 50-day SMAs are located (not shown).

Alternatively, a decisive break above the range ceiling would reassert the bullish bias and probably lead to 0.6714 (May 14 high).

Decisive breaks are accompanied by long candles that break through the level and close near their high or low or three consecutive candles that pierce the level in question and are all of the same color (red for a bearish decisive break and green if bullish).

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.