AUD/USD Price Analysis: Bears flex muscles to revisit 0.6850 support

- AUD/USD remains pressured around intraday low, reverses the previous day’s rebound from monthly bottom.

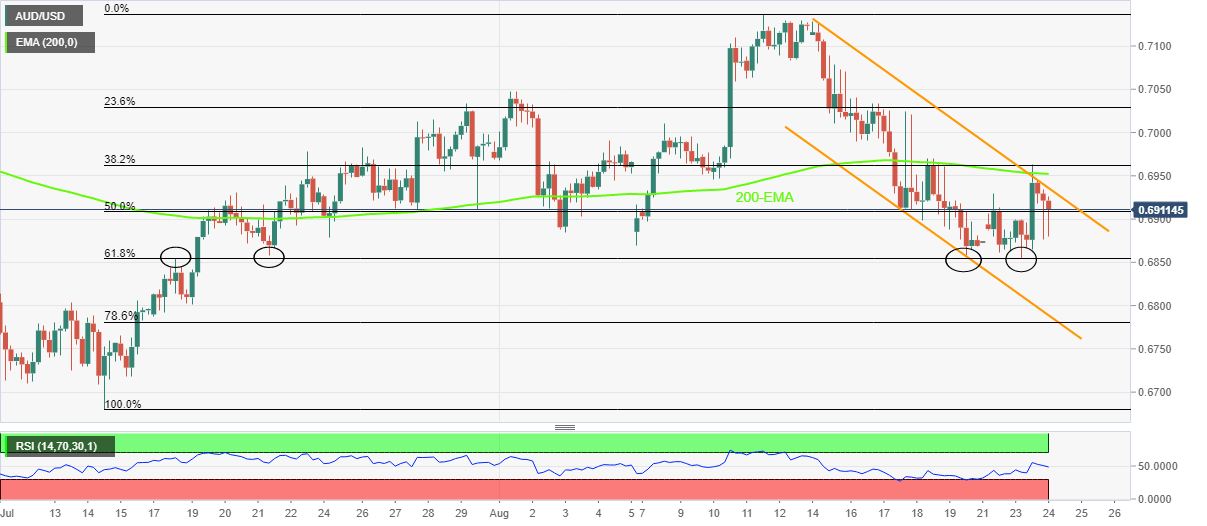

- Multiple swings around 61.8% Fibonacci retracement level highlight 0.6850 as the key support.

- Short-term bearish channel, pullback from 200-EMA also keep sellers hopeful.

AUD/USD sellers attack 0.6900 while consolidating the bounce off the monthly low during Wednesday’s Asian session.

The Aussie pair remains inside a one-week-old bearish channel, after taking a U-turn from the 200-EMA. Additionally favoring the pair sellers is the RSI (14) retreat.

With this, the AUD/USD bears again prepare to break the 0.6850 support area comprising multiple levels marked since July 18, as well as 61.8% Fibonacci retracement of July-August upside.

Following that, the aforementioned channel’s lower line, near 0.6790, could act as an intermediate halt before directing the bears towards the previous monthly low near 0.6680.

Alternatively, recovery moves need to defy the bearish channel formation with a clear upside break of 0.6940, as well as stay beyond the 200-EMA level of 0.6952, to convince AUD/USD buyers.

That said, the 0.7000 psychological magnet and the month-start peak of 0.7048 will gain the market’s attention afterward. However, the monthly peak of 0.7137 appears a tough nut to crack for the AUD/USD bulls afterward.

AUD/USD: Four-hour chart

Trend: Further weakness expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.