AUD/USD Price Analysis: Bears are targeting the 0.7280s

- AUD/USD bears stay in control with eyes on the 0.7300 figure.

- A break below 0.7300 opens risk to the 0.7280s for the sessions ahead.

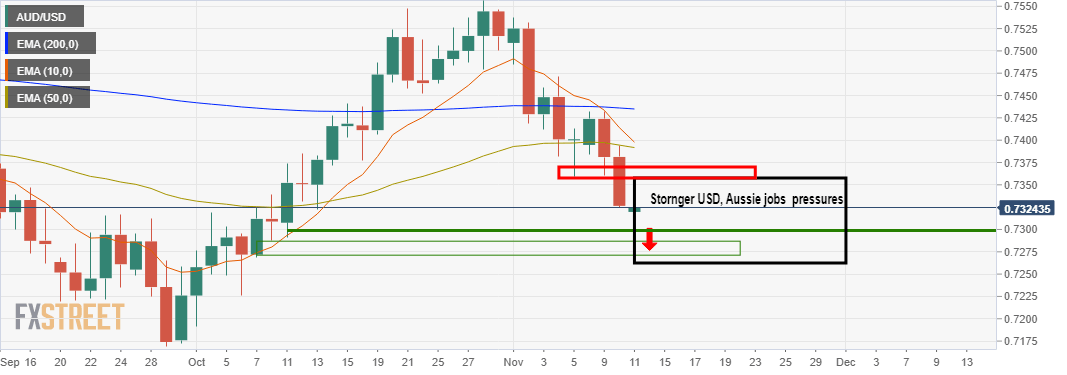

AUD/USD fell on Wednesday and extended losses in Thursday's Asian session following a surprisingly strong US Consumer Price Index report and a shockingly poor Aussie jobs event. AUD/USD has fallen from 0.7393 to a low of 0.7315 since the start of yesterday's trade.

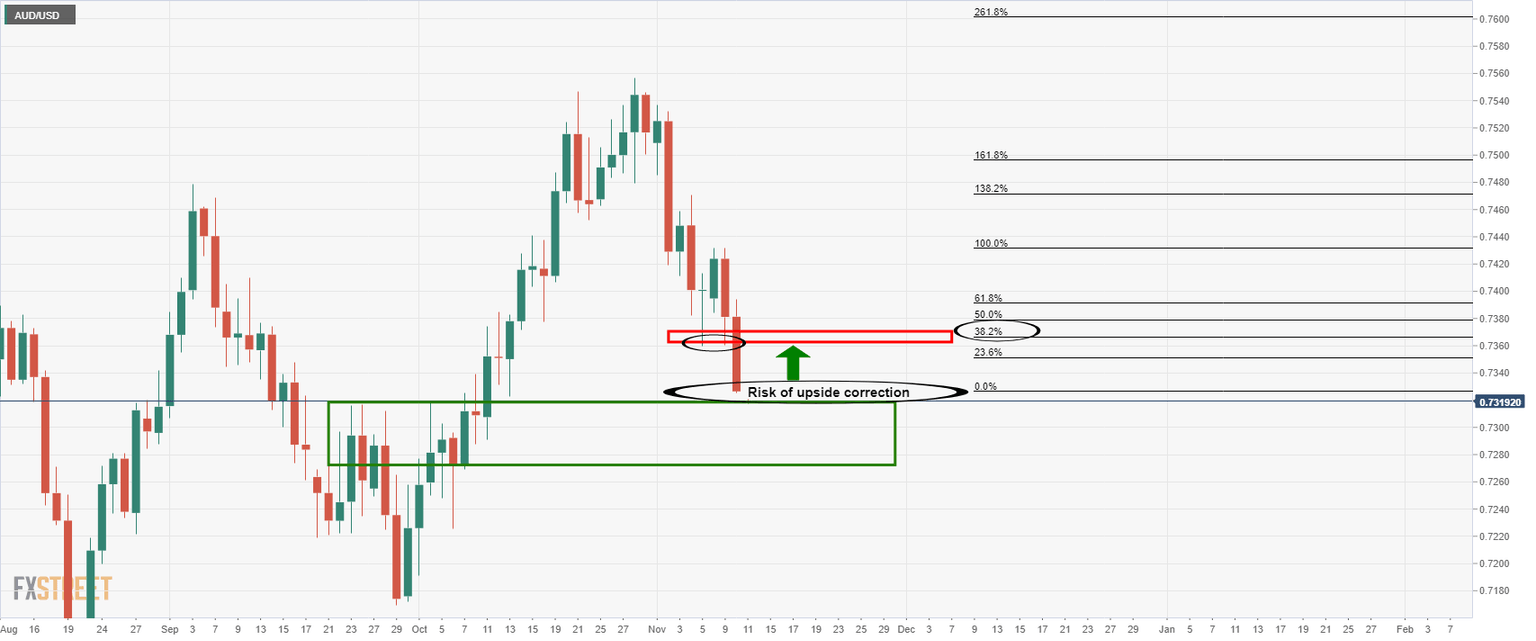

The momentum indicators are pointing toward further declines ahead which leave the 0.7300 figure vulnerable. A break of the level could expose the start of October's territories to around 0.7280 for which is illustrated in the following daily chart analysis:

AUD/USD daily charts

The price is now below the 50-EMA on the daily time frame as pressures mounted below the 200-EMA at the start of the month. However, there are also the probabilities of an upside correction first:

The imbalance left prices shooting lower as far as they have and beyond the daily ATR. An upward correction can be expected in due course. However, the momentum is with the bears at the moment.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.