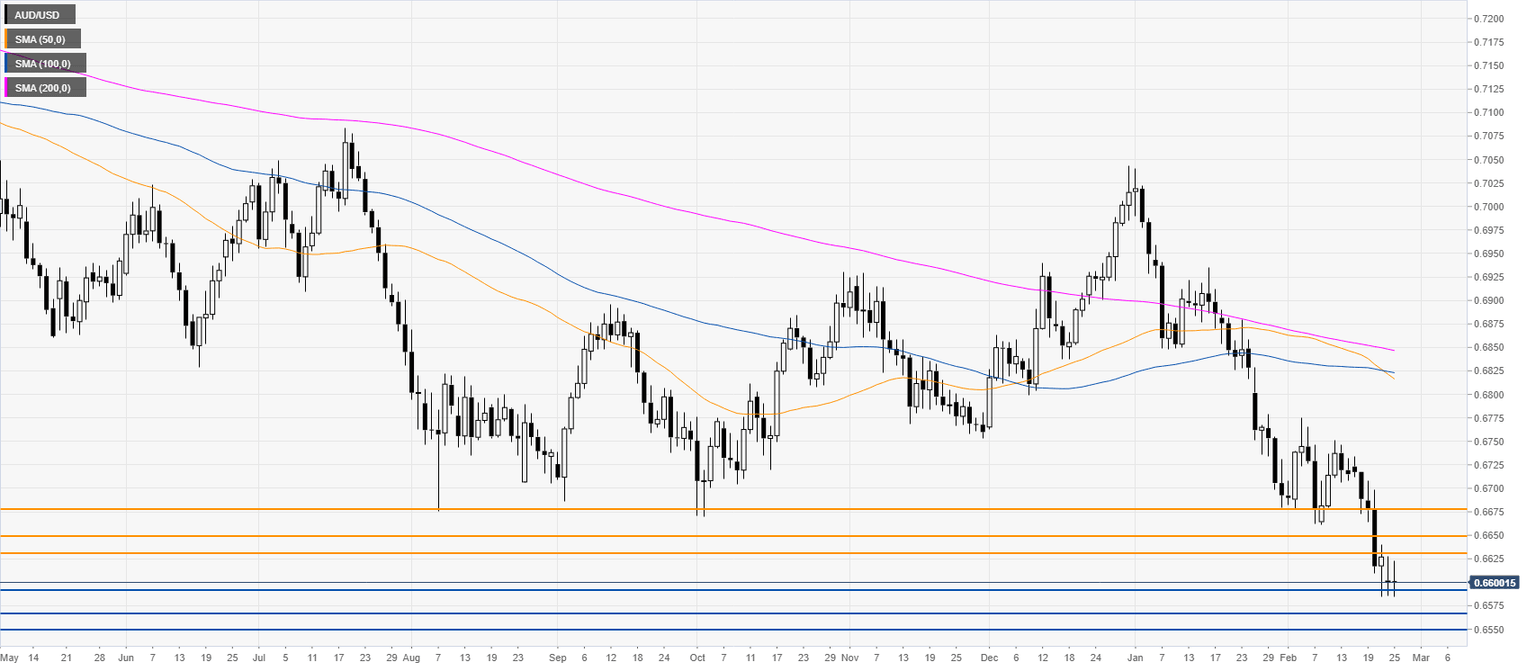

AUD/USD Price Analysis: Aussie looking for direction near one-decade lows

- AUD/USD keeps consolidating losses as USD is on the back foot.

- AUD/USD is trading sideways near one-decade low.

AUD/USD daily chart

Additional key levels

Author

Flavio Tosti

Independent Analyst