AUD/USD hits three-month low below 0.6500 ahead of RBA’s decision

- AUD/USD stabilizes at 0.6483, rebounding from three-month low post-Powell's comments on future rate cuts.

- Powell's talk of three 2024 rate cuts, excluding March, boosts USD, affecting AUD sentiment.

- Strong ISM Services PMI and rising US Treasury yields further underpin the Dollar's strength versus the Aussie.

- Attention turns to RBA's meeting, with a dovish outlook expected due to slowing inflation.

The AUD/USD plunged to a three-month low due to hawkish comments from Federal Reserve Chair Jerome Powell and expectations of a dovish rate held by the Reserve Bank of Australia (RBA). Therefore, the hands of the major exchange at 0.6483 are virtually unchanged.

Aussie Dollar stabilized as traders brace for RBA decision

The pair extended its losses on Monday as market participants digested Powell’s comments. He added that the Fed is committed to getting to its 2% goal and that he and his colleagues eyed three interest rate cuts in 2024. Powell added it’s too soon to begin easing in March, adding that the beginning of the easing cycle could begin in the first half of 2024.

Additionally, AUD/USD traders got cues from data revealed in the New York session, with the ISM Services PMI rising above estimates and the prior month’s reading, up from 50.5 to 53.4, exceeding estimates of 52.

In the meantime, the Greenback was underpinned by upbeat ISM data, and the jump in US Treasury yields. The US 10-year benchmark note rose by 13 basis points, up to 4.16%, while the US Dollar Index (DXY) closed at 104.45, up 0.47%.

Traders are eyeing the release of the Reserve Bank of Australia (RBA) monetary policy meeting. The RBA is expected to hold rates unchanged at 4.35%, based on the latest inflation data, which was softer than expected. Market participants are eyeing a dovish monetary policy statement and would look for the removal of “further tightening is needed.”

In regard to that, ANZ analysts commented, “The Q4 CPI data cemented our view that there will be no change in rates. We think the RBA will retain a tightening bias in the post-meeting statement, although it is likely to acknowledge the general slowdown in the economy since the last Board meeting and the softer CPI data. “

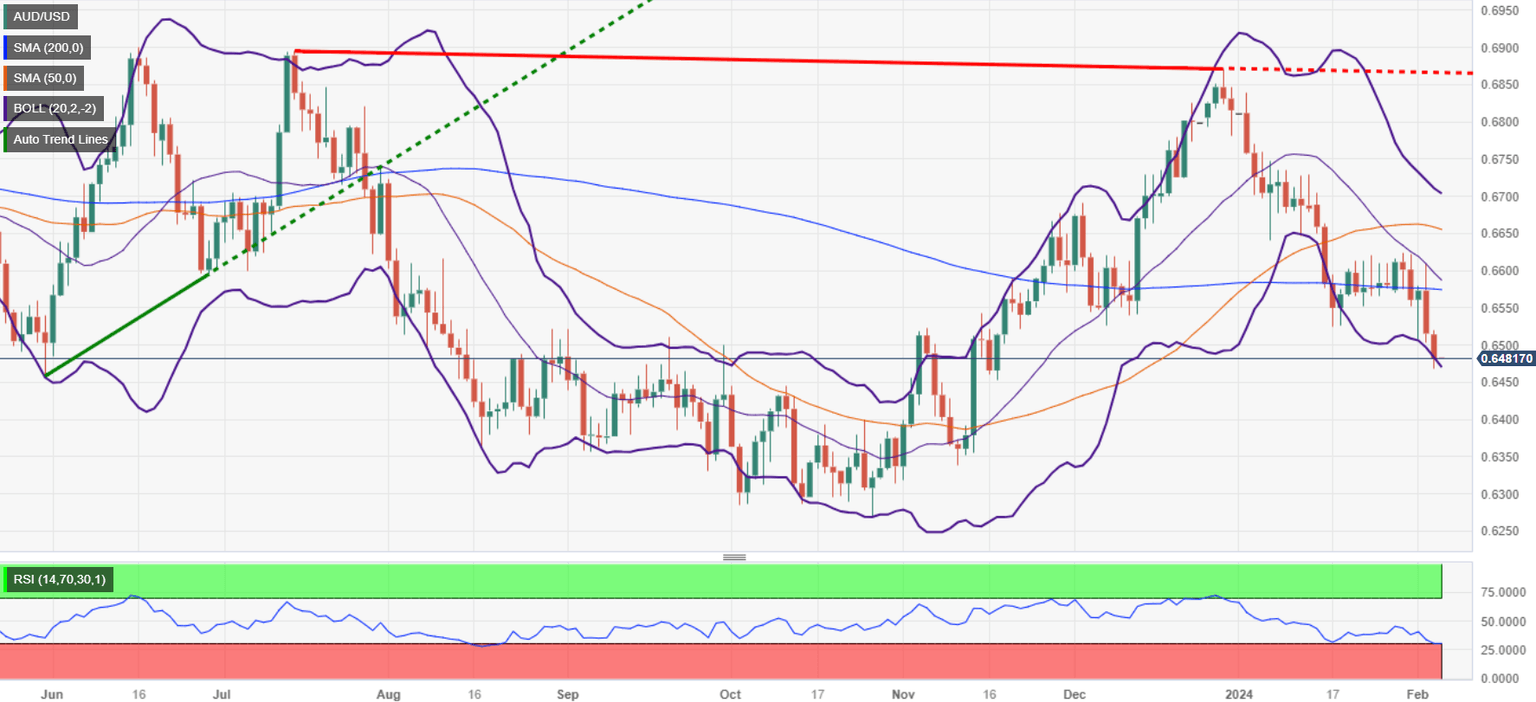

AUD/USD Price Analysis: Technical outlook

The daily chart depicts the AUD/USD is downward biased, and after breaching the 100-day moving average (DMA) at 0.6531, it opened the door to breach the 0.6500 mark. If sellers push prices below the February 5 low of 0.6468, that could open the door toward the 0.6400 figure, followed by the November 10 low of 0.6338.

Conversely, if buyers reclaim the 0.6500 figure, that could pave the way towards the 100-DMA at 0.6531, followed by the 200-DMA at 0.6572.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.