AUD/USD floating higher ahead of Aussie inflation expectations, US CPI in the barrel for Thursday

- The AUD/USD is catching gentle bids at the top of the Thursday trading session after getting knocked back in Wednesday trading.

- The Aussie fell to an intraday low of 0.6388 on Wednesday, after opening near 0.6445.

- Early Thursday sees Aussie inflation expectations, with US CPI inflation figures due later in the day.

The AUD/USD is trading into 0.6420 as markets head into Thursday, and an early Australian Consumer Inflation Expectations reading, which last printed at 4.6%.

The Aussie (AUD) fell lower against the US Dollar (USD) before staging a mild recovery, as the USD eased back following underwhelming market reaction to US PPI figures which beat expectations and the Federal Reserve's latest meeting minutes, which saw officials spreading their bets to the middle with inflation risks still on the board, but not bad enough to move on rates.

Forex Today: Dollar remains weak despite PPI and FOMC Minutes, CPI Next

Thursday's early Aussie inflation expectation read remains the last meaningful data point on the economic calendar for the AUD, and market participants will be turning their eyes ahead to US Consumer Price Index (CPI) inflation figures due later in the day.

US CPI inflation is expected to show a slight downtick in the headline annualized figure for September, forecast at 3.6% against the previous reading of 3.7%.

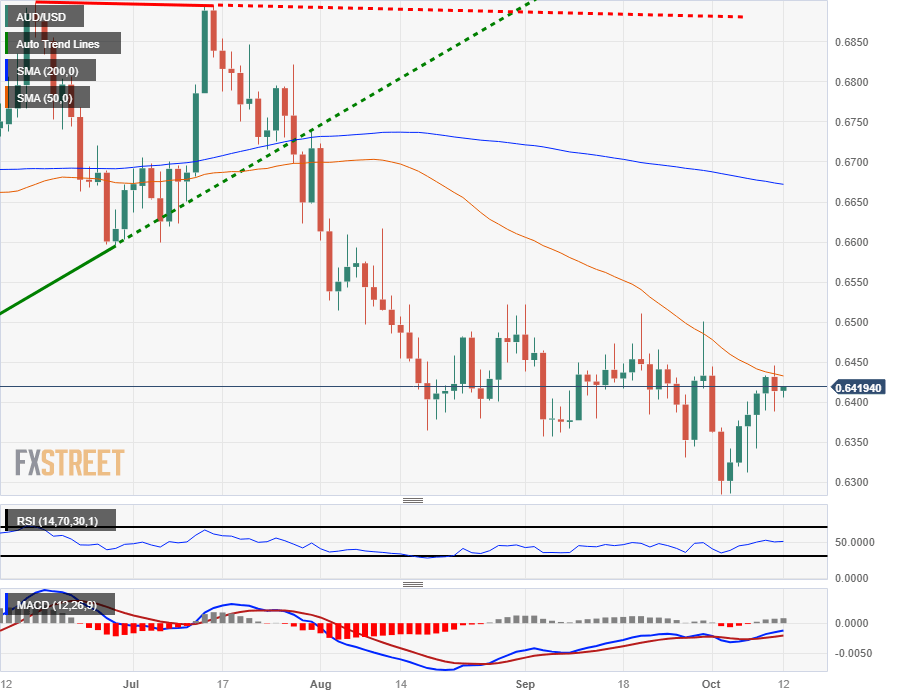

AUD/USD Technical Outlook

Wednesday saw the AUD/USD break it's upside closing streak, with the Aussie closing to the upside against the US Dollar for the previous five consecutive trading sessions, and the AUD/USD is heading into the Thursday market window trading directly into the 50-day Simple Moving Average (SMA), and upside momentum could struggle to develop a foothold.

Higher up, the 200-day SMA remains high above current bids, turning bearish into 0.6650, and the AUD/USD remains on the low end of 2023 after etching in a new low for the year last week at 0.6285.

AUD/USD Daily Chart

AUD/USD Technical Levels

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.