AUD/USD falls below 0.6430 due to dovish RBA’s and Fed officials’ hawkish commentary

- AUD/USD dives more than 1% but remains above the 0.6400 figure.

- Fed’s Governor Cook expressed that inflation is “stubbornly high” and said more interest rate increases are needed.

- US claims for unemployment exceeded forecasts but remained at lower levels.

- Australia’s Trade Balance was positive but was short of estimations.

The AUD/USD extended its losses to three consecutive days after the Reserve Bank of Australia (RBA) lifted rates by “just” 25 bps, seeing as a dovish hike by market participants and the source of a possible Fed pivot. Nevertheless, Fed officials’ hawkish posture remains, reiterated by Fed’s Cook and Kashkari Thursday’s speeches.

At the time of writing, the AUD/USD is trading at 0.6418 after hitting a daily high of 0.6540, plunging more than 100 pips, weighed by the RBA’s dovish posture and a strong US dollar.

US unemployment jobs data revealed by the US Labor Department showed signs that the labor market might be easing. Unemployment claims for the week ending on October 1 jumped by 219K, exceeding estimates and the third increase since the end of July.

Aside from this, at the time of typing, one of the newest Fed Governor Lisa Cook expressed that inflation is “stubbornly and unacceptably high,” according to her, still needing interest rate increases to ensure that it begins to fall towards the Fed goal. Cook said that she backed the three-quarter points increases at her first meetings as governor, agreeing that “front-loading” will quicken the policy impact on the economy.

Earlier, the Minnesota Fed President Neil Kashkari crossed newswires. He said that the Fed is “quite a ways away from pausing rates,” adding that the Fed has “more work to do” to tackle inflation down.

All that said, the US Dollar Index, a gauge of the buck’s performance against six currencies, edges up by 0.31%, at 112.082, a headwind for the AUD/USD.

The interest rate differential would likely favor the USD vs. the AUD. Money market futures expect the Federal funds rate (FFR) to peak around 4.5%, while the RBA Cash Rate is expected to top around 3.6%, a headwind for the AUD/USD.

Elsewhere, Australia reported its Trade Balance, which showed a surplus of $8.3 billion, shorter than estimated, and according to ANZ analysts, “the days of record trade surpluses are over.” Imports jumped by 4.5% MoM, and Exports also increased at a modest 2.6% MoM.

According to ANZ analysts, the already battered China’s real estate sector weighed on lower demand for Iron ore, but “strong coal and LNG exports counterbalanced sluggish iron ore exports.”

What to watch

An absent Australia’s economic docket would leave traders leaning on US economic data. On the US front, the calendar will feature September’s Nonfarm Payrolls report and the Unemployment Rate.

AUD/USD Price Forecast

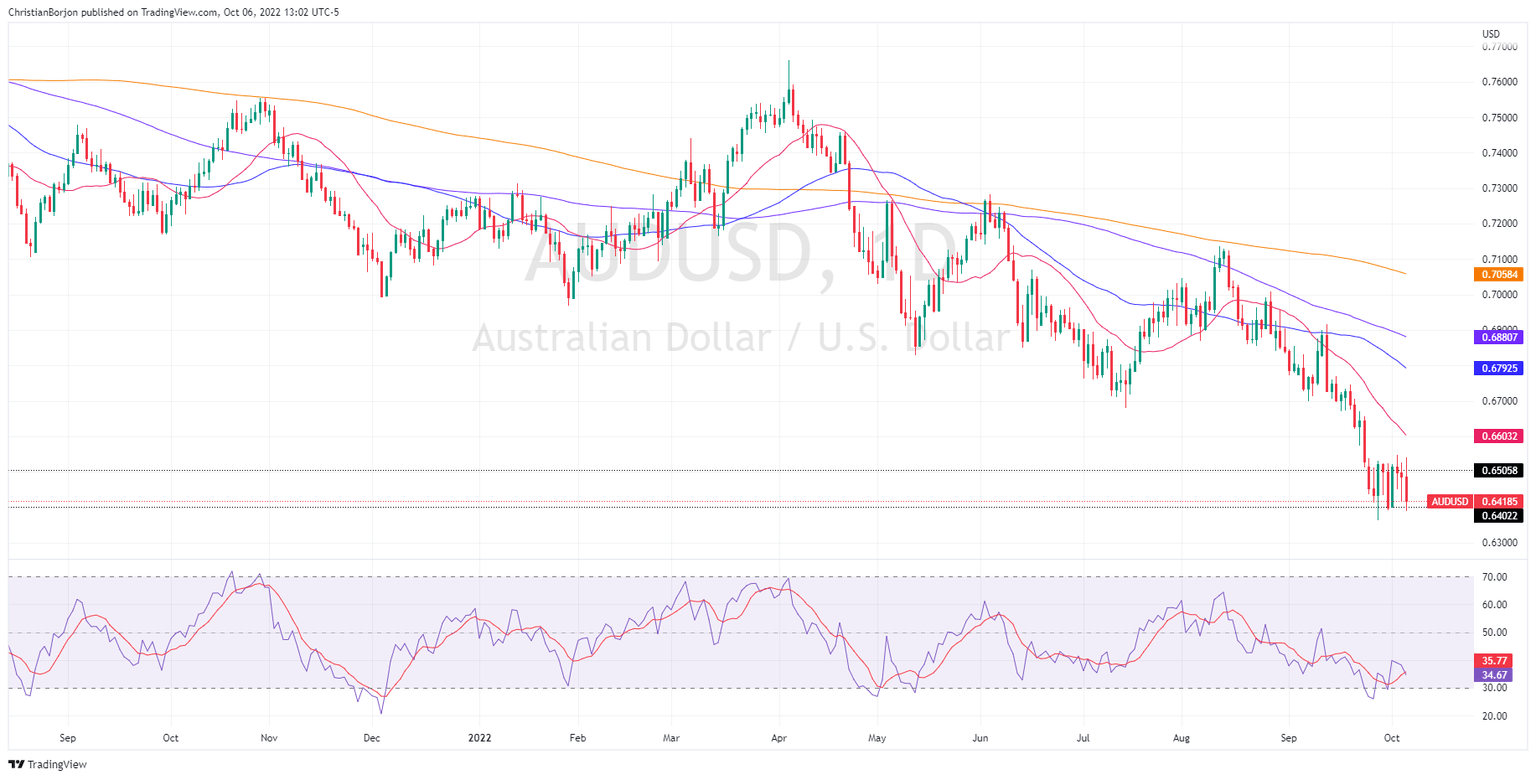

The AUD/USD consolidates for the eighth consecutive day, within the 0.6400-0.6550 range. However, the Relative Strength Index (RSI) shifted downwards in the last four trading days, meaning sellers are gathering momentum. Still, unless the exchange rate tumbles below 0.6400 and challenges the YTD low at 0.6363, the AUD/USD bias will remain subdued.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.