AUD/NZD Price Analysis: Bulls gathered ahead of RBNZ

- AUD/NZD is poised both and bullish and bearish depending on the time frame.

- The RBNZ will be the deciding factor for the day ahead.

Ahead of the Reserve Bank of New Zealand today, AUD/NZD Bears are lined up on the long-term charts for a downside continuation but the bulls have committed to the test of recent lows on the lower time frames so there is no bias either way, at least for the short term and within 100 pips or structure as the following will illustrate.

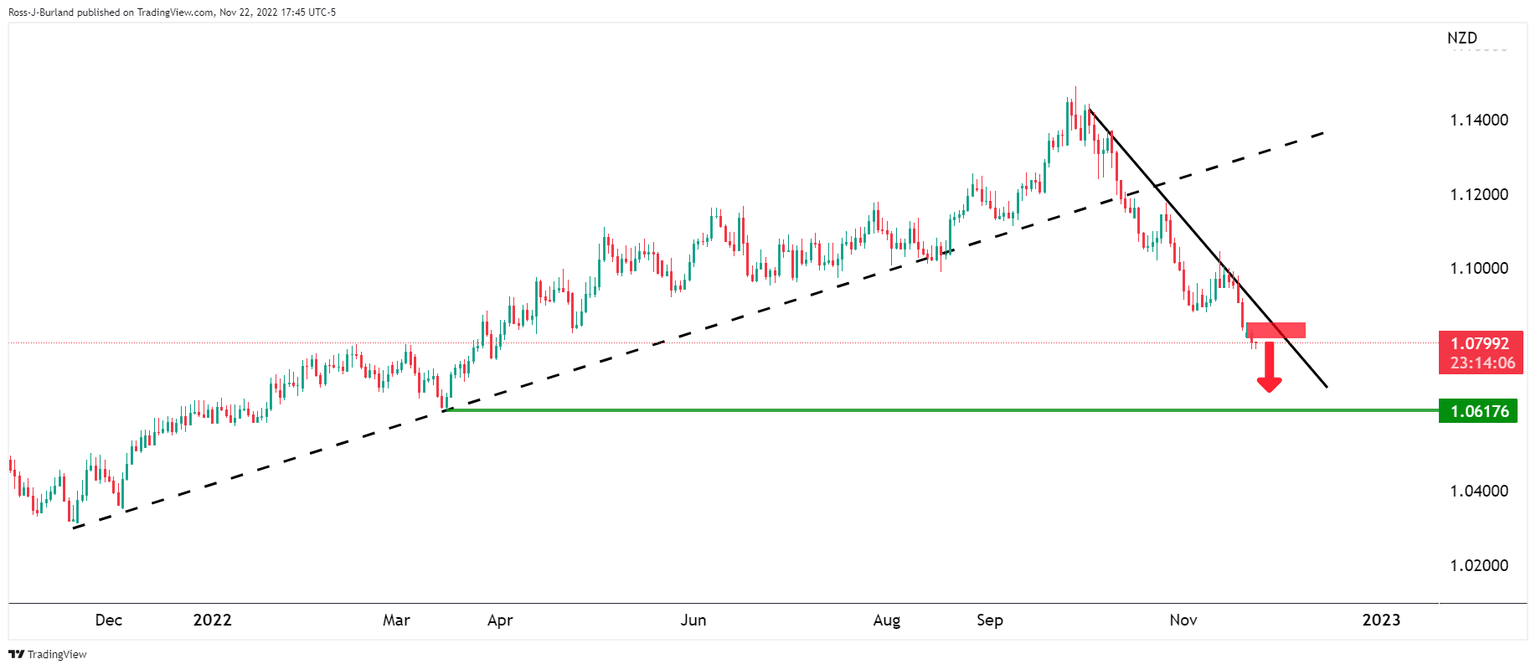

AUD/NZD daily chart

While on the front side of the trend, the bias on the longer-term time frame is lower with a run to 1.0620 on the cards.

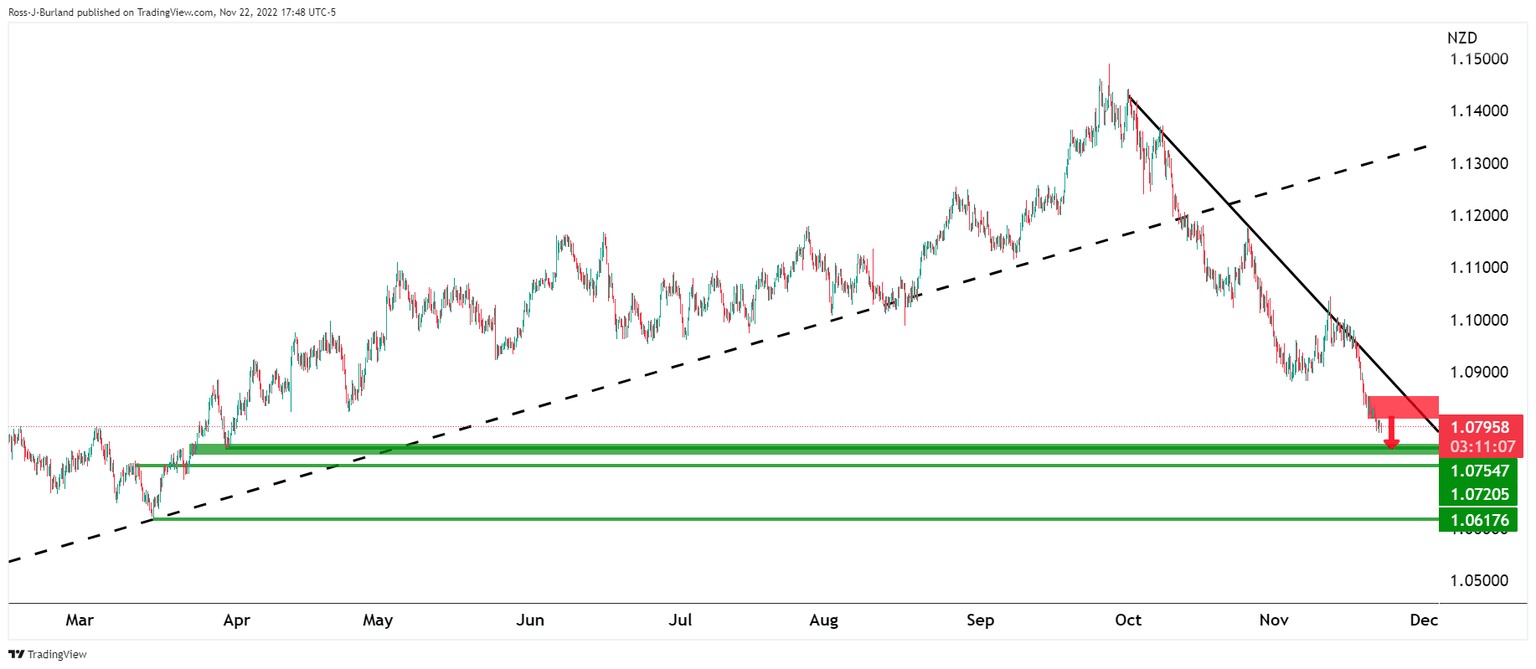

AUD/NZD H4 chart

The 4-hour time frame offers support structure on the way there with 12.0750/20 and then space to 1.0620.

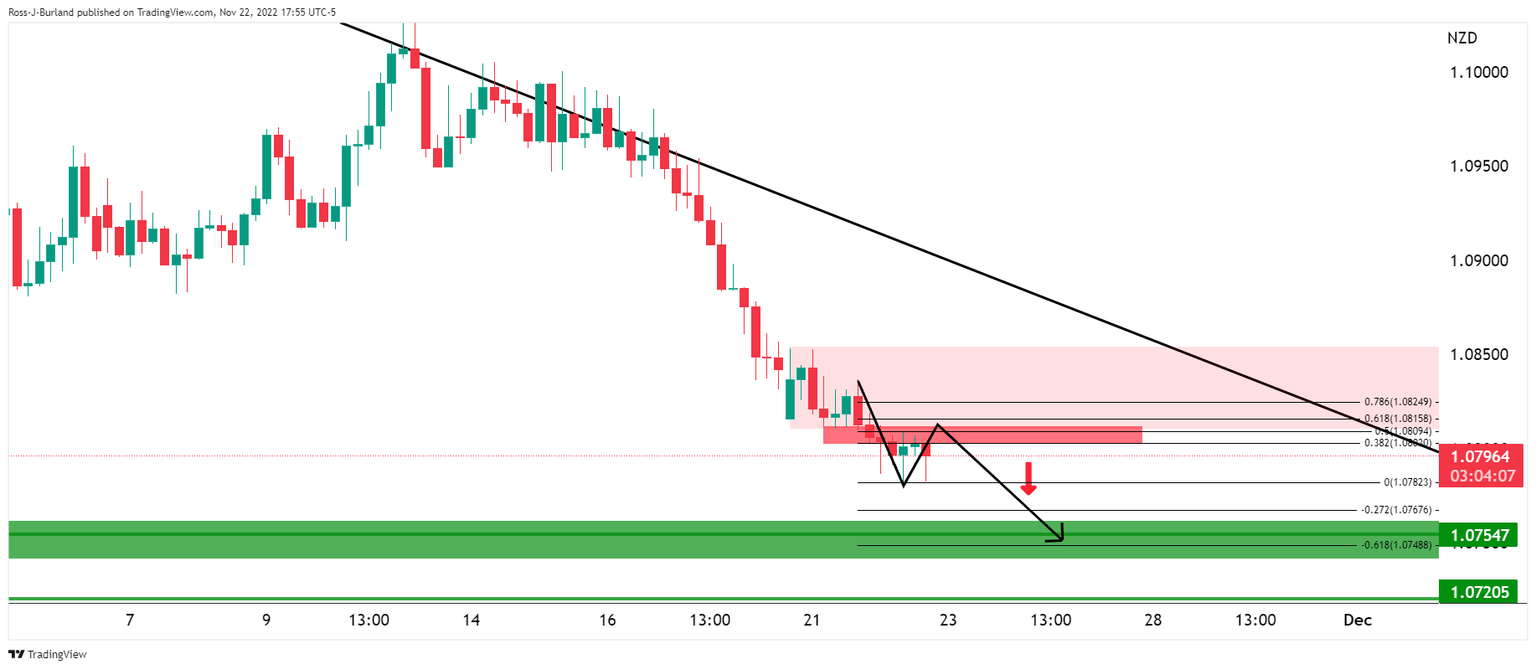

AUD/NZD H1 chart

The price has found resistance at a 50% mean reversion of the prior drop and this would be expected to lead to a downside continuation.

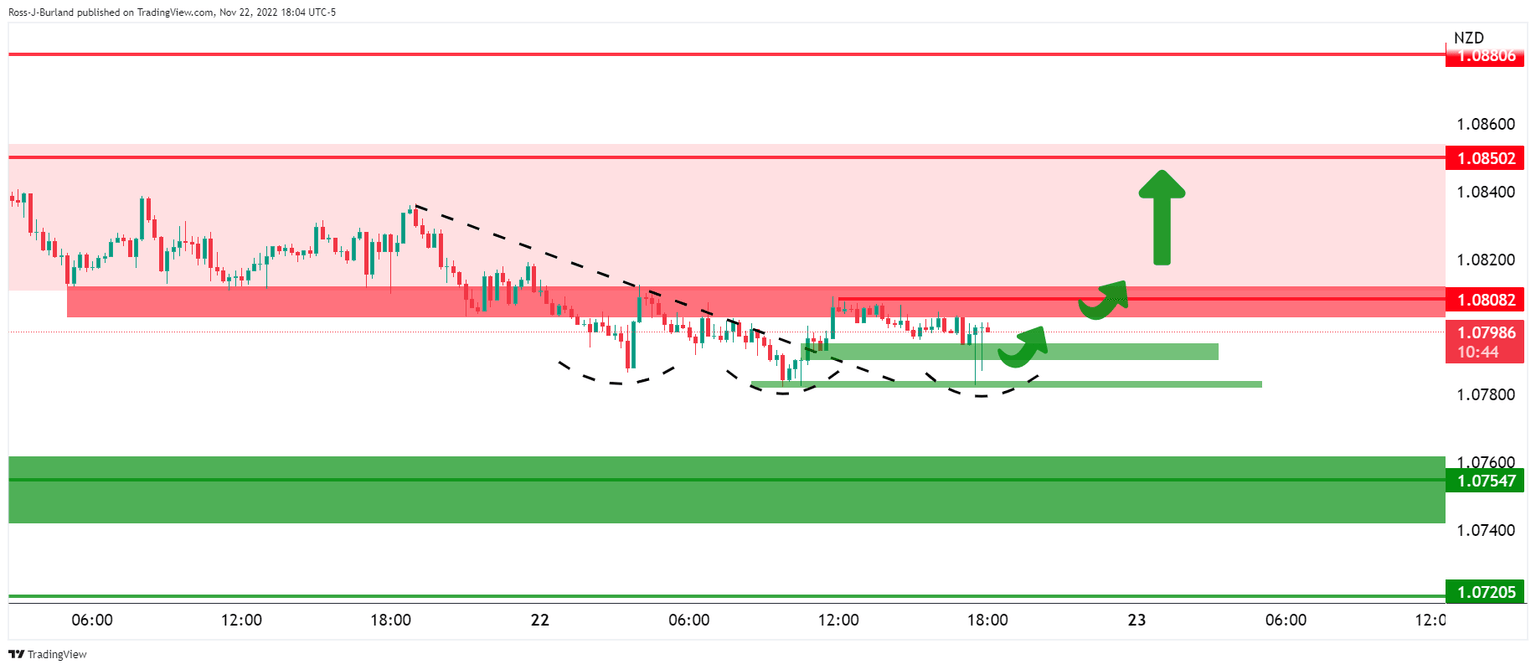

AUD/NZD M15 chart

However, the bulls have already been stepping in and we have a triple bottom on the 15-minute chart. A break of 1.0820 would likely see a continuation of the price higher that is on the back side of the micro trendline already. 1.0850 is eyed before 1.0880.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.