AUD/NZD Price Analysis: Bears have reasons to attack 1.0900

- AUD/NZD stays pressured near two-week low, fails to keep bounce off 1.0919.

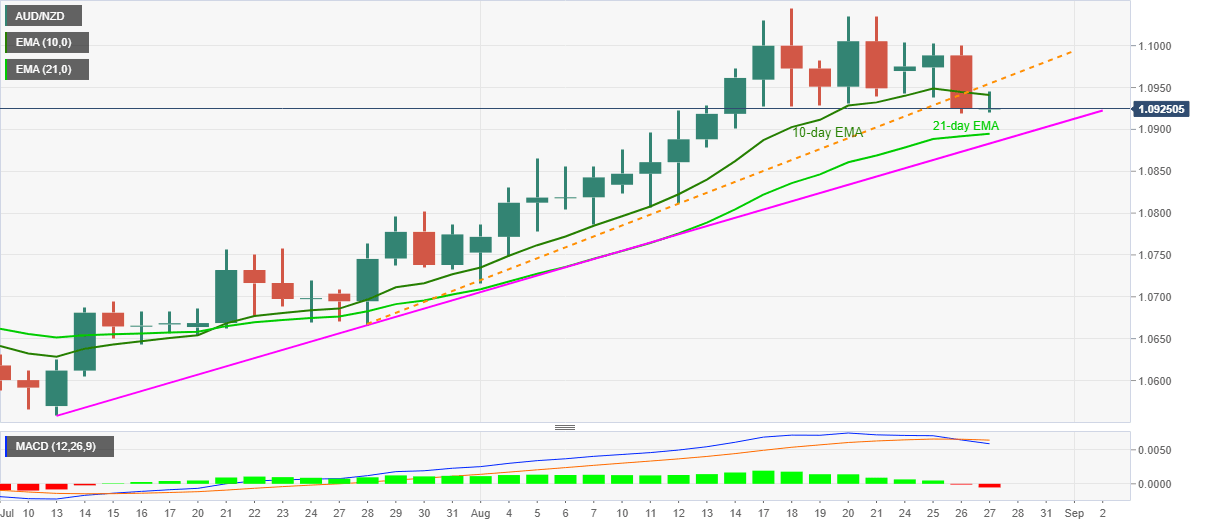

- MACD turns bearish for the first time in six weeks after the break of a one-month-old support line.

- 21-day EMA, an ascending trend line from July 13 are in the spotlight.

AUD/NZD drops to 1.0925 amid the initial Asian session trading on Thursday. The pair marked the week’s biggest losses after breaking an upward sloping trend line support, now resistance, the previous day. The bearish bias also gains support from the MACD histogram that left the bullish region after six weeks of stay.

As a result, sellers can target a 21-day EMA level of 1.0894 as nearby support ahead of the rising trend line from July near 1.0880.

In a case where the bears refrain from respecting 1.0880 support, the August 05 top surrounding 1.0865 may offer an intermediate halt before highlighting the July month’s peak close to 1.0800.

Alternatively, 10-day EMA and the support-turned-into-resistance-line, respectively around 1.0940 and 1.0955, restrict the pair’s immediate upside.

Also acting as the short-term key resistance is the 1.1000 psychological magnet that holds the gate for the bull’s run-up to challenge the monthly top near 1.1045.

AUD/NZD daily chart

Trend: Further weakness expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.