AUD/NZD price analysis: Aussie holds steady near 1.0900 despite overbought signals

- AUD/NZD trades around the 1.0900 zone with minimal movements on Thursday.

- Mixed signals from momentum indicators as overbought conditions emerge.

- Key support sits below, while resistance levels cluster around recent highs.

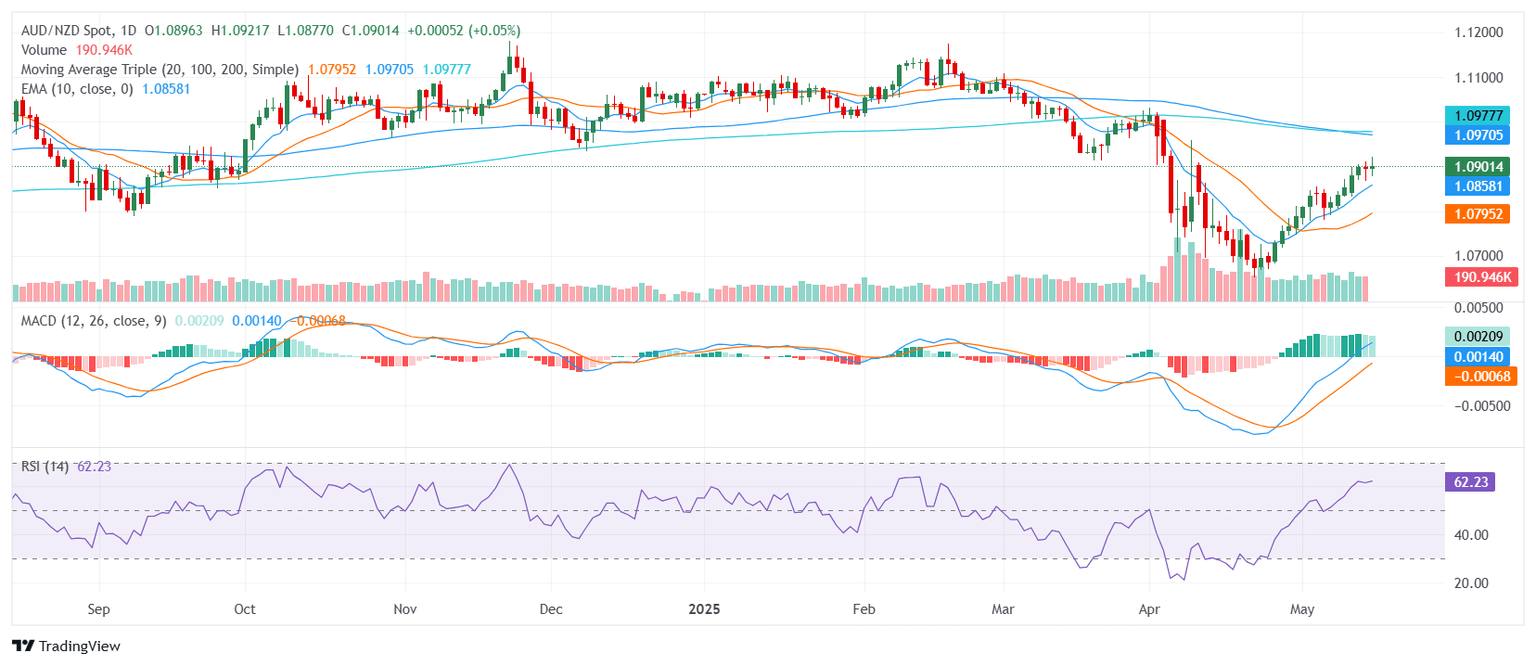

The AUD/NZD pair remained stable around the 1.0900 zone on Thursday, reflecting a cautiously bullish tone as the market heads into the Asian session. Price action remains within the middle of its daily range, suggesting that buyers are still in control, but the emergence of overbought conditions across several momentum indicators raises the risk of a short-term correction.

From a technical perspective, the pair presents a mixed outlook. The Relative Strength Index hovers in the 60s, indicating generally neutral momentum without immediate overbought pressure, though nearing a potentially overextended zone. The Moving Average Convergence Divergence supports the broader uptrend with a clear buy signal, aligning with the short-term moving averages like the 10-day Exponential and Simple Moving Averages, which also favor further gains.

However, the Williams Percent Range (14) and Stochastic %K (14, 3, 3) both trade in overbought territory, suggesting a possible near-term pullback if recent gains cannot be sustained. The Ultimate Oscillator, trading in the 60s, adds to the cautious tone, highlighting the risk of a corrective move despite the broader bullish backdrop.

In terms of support and resistance, the short-term structure remains constructive, with key support levels identified near 1.0870 and 1.0859. Immediate resistance sits around 1.0916, 1.0924, and 1.0946. A clear break above these resistance levels could confirm a broader bullish continuation, while a failure to hold current levels might trigger a deeper correction toward the lower end of the recent range.

Daily Chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.