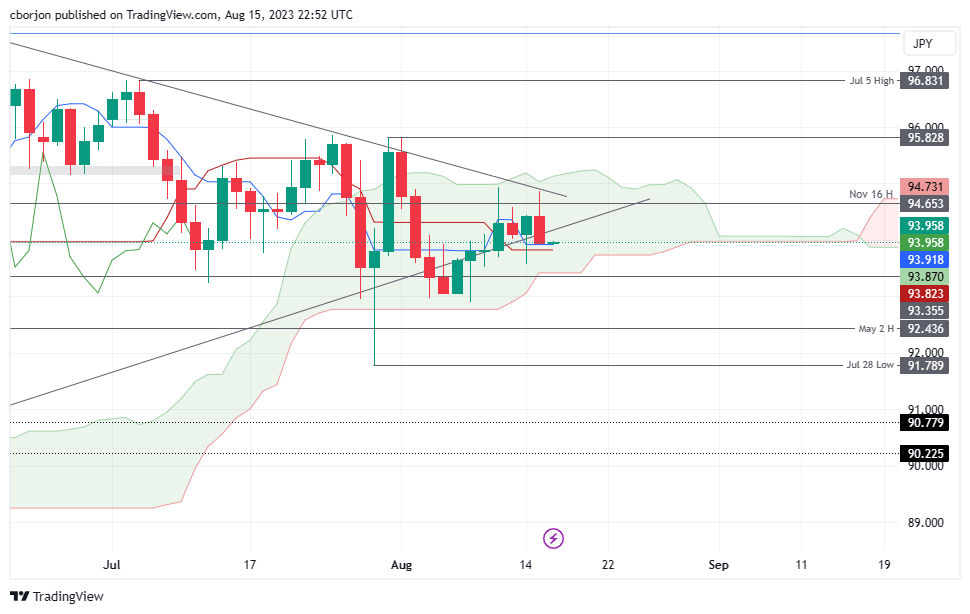

AUD/JPY Price Analysis: Slumps below 94.00 after reaching weekly highs nearby 95.00

- AUD/JPY faces resistance from Tenkan and Kijun-Sen lines, currently trading just above at 93.93.

- Downside potential targets include the bottom of the Ichimoku Cloud at 93.45 and the 93.00 psychological level.

- On the upside, reclaiming 94.00 could see challenges at the August 15 high (94.86) and the Kumo top near 95.00/05.

The AUD/JPY retraces from weekly highs reached during Tuesday’s session at around 94.86, prolonging its losses after cracking a five-month-old upslope support trendline that intersects with the 94.00 mark. At the time of writing, the AUD/JPY is trading at 93.93, down by a minimal 0.01%.

AUD/JPY Price Analysis: Technical outlook

The daily chart portrays the AUD/JPY pair as subdued, capped on the downside by the Tenkan and Kijun-Sen lines at 93.92 and 93.82. If AUD/JPY slides past that area, the next support will emerge at the bottom of the Ichimoky Cloud (Kumo) at 93.45 before challenging 93.00.

Conversely, if AUD/JPY buyers reclaim the 94.00 figure, the first resistance would be the August 15 high of 94.86 ahead of testing the top of the Kumo at around 95.00/05. Once cleared, the next resistance would emerge at 95.83, the July 31 daily high.

AUD/JPY Price Action - Daily chart

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.