AUD/JPY Price Analysis: Gains momentum as bullish-engulfing pattern emerges

- AUD/JPY gains 0.31% and forms a bullish-engulfing pattern, indicating potential for further upside.

- A daily close above 95.00 could open the door for buyers to target 96.92 and the YTD low of 97.67.

- If AUD/JPY struggles at 95.00, it could expose Monday's low of 94.32 and potentially shift to a neutral-downward trend.

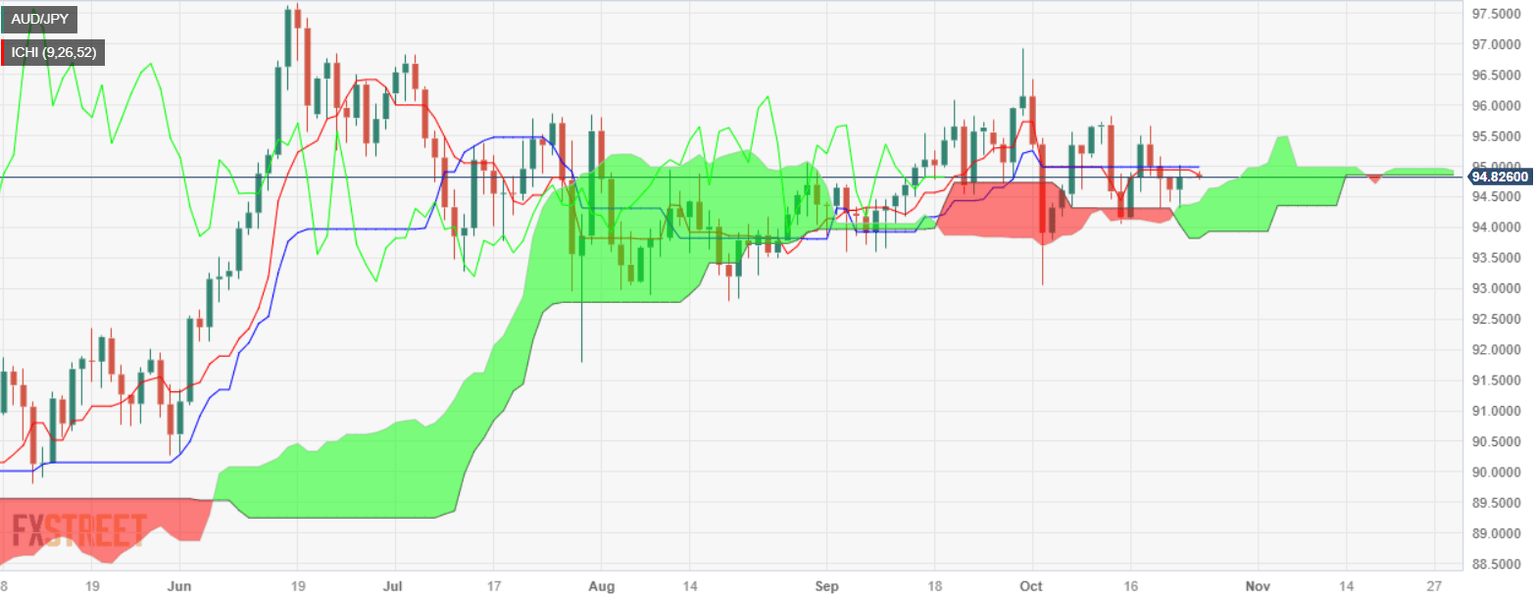

AUD/JPY snapped three days of losses on Monday, gaining 0.31%, while forming a bullish-engulfing two-candle chart pattern, which suggests that further upside is warranted. The cross-pair exchanges hands at 94.82 as the Asian session begins, almost unchanged.

The daily chart portrays the AUD/JPY remains in consolidation but at the brisk of achieving a daily close above 95.00, which could open the door for further upside. If buyers conquer that level, the next ceiling level would be the September 29 high at 96.92 before challenging the year-to-date (YTD) low of 97.67.

On the other hand, if AUD/JPY struggles at 95.00, that could expose Monday’s low of the day at 94.32, which, once cleared, the cross would slump inside the Ichimoku Cloud (Kumo). The next stop would be the bottom of the Kumo at 93.80/84, and once surpassed, the pair will shift to neutral-downwards.

AUD/JPY Price Action – Daily chart

AUD/JPY Technical Levels

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.