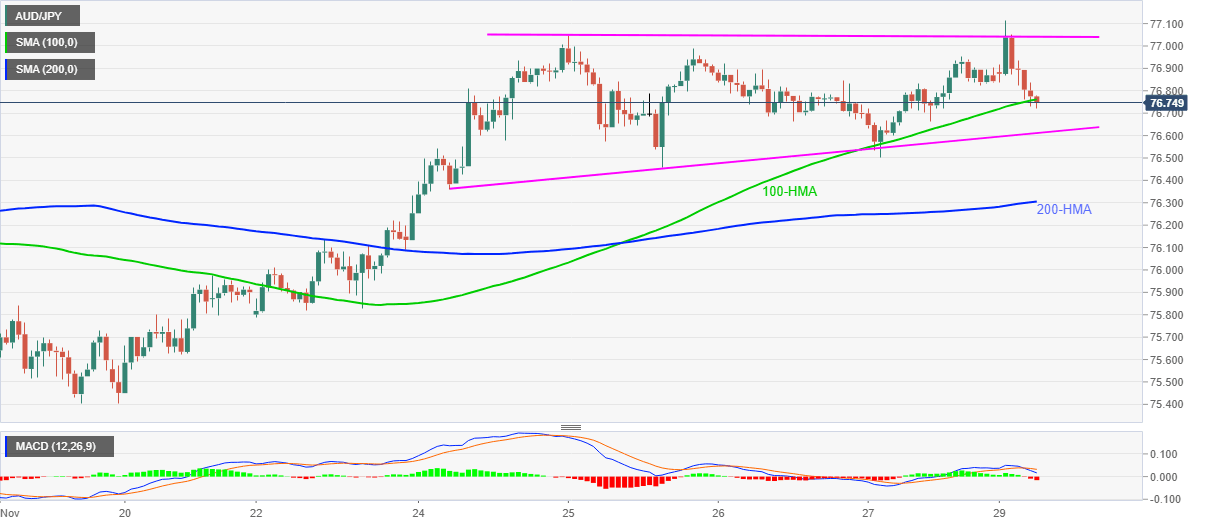

AUD/JPY Price Analysis: Drops from fresh 11-week top to revisit sub-77.00 area

- AUD/JPY refreshes intraday low while breaking 100-HMA.

- Marks repeated reversal from 77.00, one-week-old ascending triangle becomes the key to watch amid bearish MACD.

AUD/JPY drops to 76.74, down 0.12% intraday, during the early Monday. The quote rose to the highest since the mid-September during early Asia before taking a U-turn from 77.11.

In doing so, the AUD/JPY bulls mark another resistance to accept the ride beyond the 77.00, considering the last Wednesday’s pullback from 77.04.

The latest declines get validation from a downside break of 100-HMA and bearish MACD to suggest further weakness.

However, the support line of the short-term ascending triangle established since last Tuesday, at 76.60 now, holds the gate for the extended south-run targeting 200-HMA level of 76.30.

Meanwhile, a sustained break above 77.00 will have to refresh the multi-day high of 77.11 while targeting the September 11 top near 77.75.

AUD/JPY hourly chart

Trend: Pullback expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.