AUD/JPY Price Analysis: Buyers take control as sellers lose steam

- AUD/JPY edged higher ahead of the Asian session, stabilizing near the 94.00 zone after recent losses.

- Tuesday’s price action suggested that sellers hit a strong support area, paving the way for a potential consolidation.

- Key resistance aligns near 95.00, while support remains at the recent low around 93.60.

AUD/JPY showed signs of recovery on Wednesday, inching higher after a prolonged bearish run. The pair was last seen trading around the 94.50 region ahead of the Asian session, attempting to regain ground following a steep decline. Sellers dominated earlier sessions, but Tuesday’s price action indicated exhaustion as they failed to drive prices lower. This shift has given buyers an opportunity to step in, potentially setting up a consolidation phase.

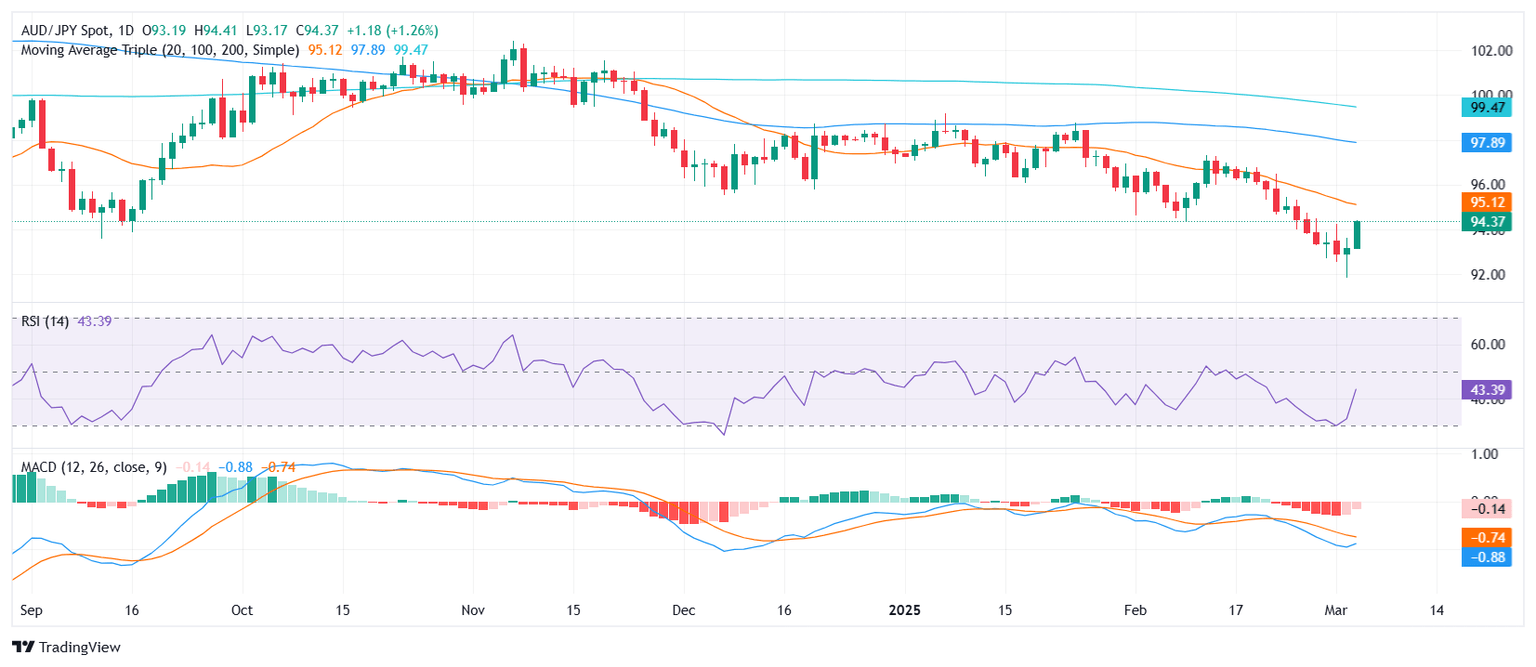

Technical indicators reflect this transition. The Relative Strength Index (RSI) is rebounding sharply from negative territory, suggesting that selling momentum is easing. Meanwhile, the Moving Average Convergence Divergence (MACD) is still printing decreasing red bars, indicating that downside pressure remains but is gradually fading. If bullish momentum builds, a test of the 94.50-95.00 resistance could follow.

From a technical perspective, immediate resistance is seen near 95.00, aligning with a previous reaction zone. A breakout above this level could push the pair toward the 95.00 handle. On the downside, initial support is located around 93.60, with a move below this threshold potentially reigniting bearish pressure. However, given the signs of stabilization, the near-term outlook appears to favor sideways trading as the market digests recent losses.

AUD/JPY daily chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.