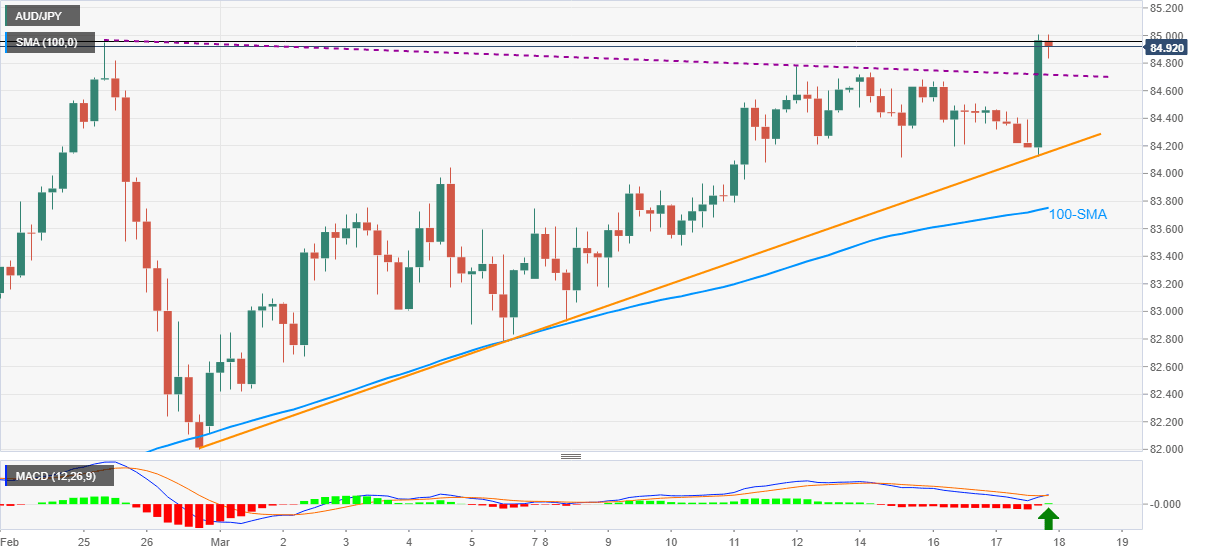

AUD/JPY Price Analysis: Bulls can keep reins beyond 84.70

- AUD/JPY keeps three-week-old trend line breakout despite pullback from multi-month high.

- MACD turns bullish, adds strength to the pair’s run-up beyond 100-SMA, short-term support line.

AUD/JPY stays on the front-foot around 84.90, despite the latest pullback from 85.01, amid the initial Asian session on Thursday. In doing so, the pair stays above the near-term resistance line, now support, as the MACD turns bullish for the first time since early Monday.

The quote crossed a downward sloping trend line before a few hours to refresh the multi-month high but couldn’t stay beyond 85.00 for long. However, the latest consolidation is yet to break the previous resistance line and hence justifies the MACD signals to favor bulls.

Against this backdrop, AUD/JPY buyers may keep calm between 84.70 and 85.00 but the bears are less likely to enter until witnessing a clear break below 100-SMA.

That said, an upward sloping trend line from February 26, currently around 84.15, adds to the downside filters below 84.70 and ahead of 100-SMA level near 83.75.

On the contrary, a clear run-up beyond the 85.00 threshold will extend the quote’s north-run towards the mid-February 2018 top near 85.60.

Overall, AUD/JPY bulls are catching a breather but are not out of the game.

AUD/JPY four-hour chart

Trend: Bullish

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.