AUD/JPY Price Analysis: Bears take control as pair extends losing streak

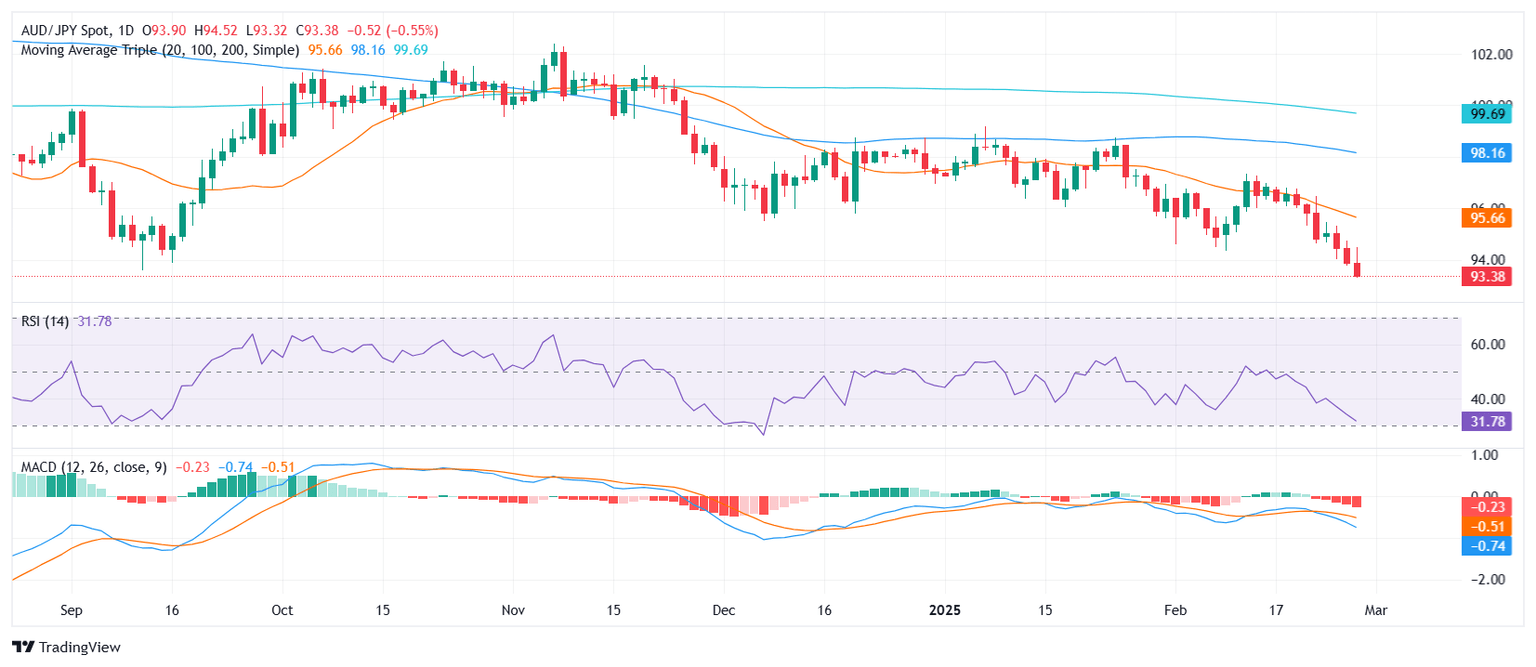

- AUD/JPY posts a three-day losing streak, trading near its lowest levels since mid-September.

- RSI declines toward oversold territory, signaling persistent downside pressure.

- MACD histogram prints rising red bars, reflecting strengthening bearish momentum.

AUD/JPY extended its downward trajectory on Thursday, marking a third consecutive day of losses and trading around its lowest levels since mid-September. The pair remains under pressure, with sellers firmly in control after breaching key support levels. The broader technical structure suggests that bearish forces could continue to dominate in the near term.

Technical indicators reinforce the prevailing downtrend. The Relative Strength Index (RSI) is steadily declining and is now hovering near oversold territory, indicating that downside momentum remains intact. Meanwhile, the Moving Average Convergence Divergence (MACD) histogram shows rising red bars, further highlighting increasing bearish sentiment.

Looking ahead, key support is seen around 93.30, a level that previously acted as a floor in September. A break below this could open the door toward 93.00. On the upside, initial resistance stands at 95.50, aligning with the 20-day Simple Moving Average (SMA), followed by a more significant barrier at 96.00. A recovery above these levels would be needed to shift the bearish outlook.

AUD/JPY daily chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.