AUD/JPY Price Analysis: Advances towards 81.00 as bulls await Aussie GDP

- AUD/JPY remains on the front foot around two-week top.

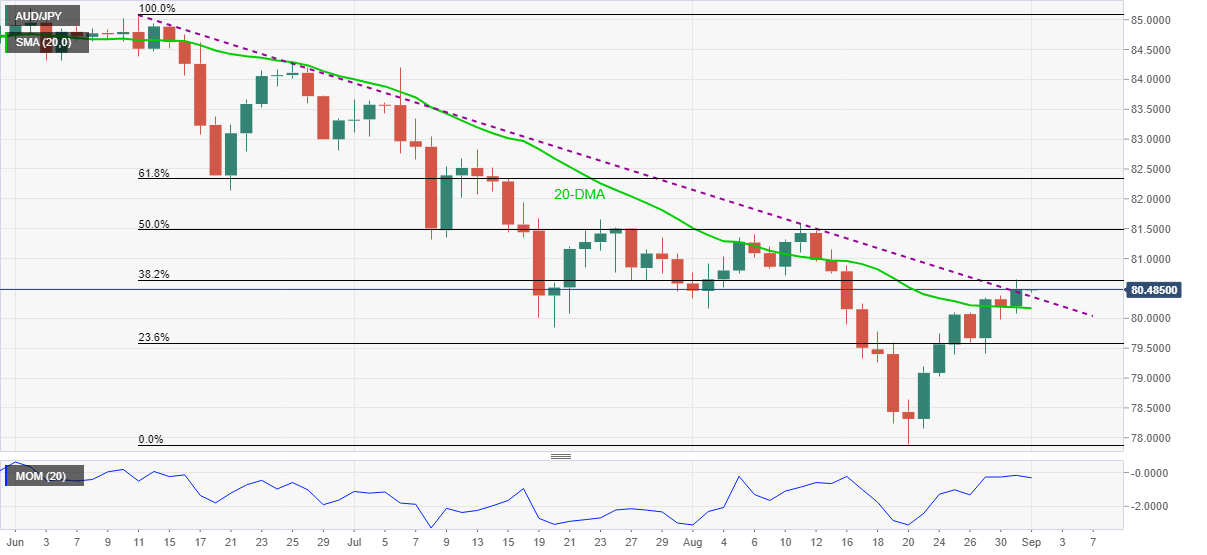

- Sustained trading above 20-DMA, 12-week-old falling trend line keeps buyers hopeful.

AUD/JPY stays firmer around 80.50 during Wednesday’s Asian session. The cross-currency pair jumped to the highest since mid-August the previous day while crossing a downward sloping resistance line, now support, from June 11.

In addition to the trend line breakout, the pair’s successful trading above 20-DMA and upbeat Momentum line also favor AUD/JPY buyers.

That said, the latest breakout aims for 50% Fibonacci retracement of June–August downside, around 81.50.

However, tops marked during late July and August, around 81.60–65, challenge the AUD/JPY bulls afterward.

Meanwhile, a downside break of the previous resistance line near 80.35 could retest 20-DMA level near 80.15 whereas the 80.00 psychological magnet can add to the immediate downside filters.

Should AUD/JPY remains bearish past 80.00, the last month’s low, also the yearly bottom surrounding 77.90, will gain the market’s attention.

Also read: AUD/USD: Steady at two-week top around 0.7300, Australia Q2 GDP eyed

AUD/JPY: Daily chart

Trend: Further upside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.