ARK Innovation ETF: Is ARKK signaling that stocks have bottomed out?

- ARKK ETF was up over 1% on Wednesday as it continues to recover.

- ARKK stock is up nearly 10% over the past week.

- As one of the riskier growth ETFs, ARKK may a signal of the bottom.

ARK Invest and Cathie Wood have been a favorite target of bears in the first half of 2022 with the former high-flying fund manager and ETF both falling from grace as 2022 progressed into bear market territory. Now though a curious outperformance has begun, not just in ARKK but across the tech and high-growth sectors. Does this point to a stock market bottom, or is this just a pause before another leg lower?

ARKK stock news

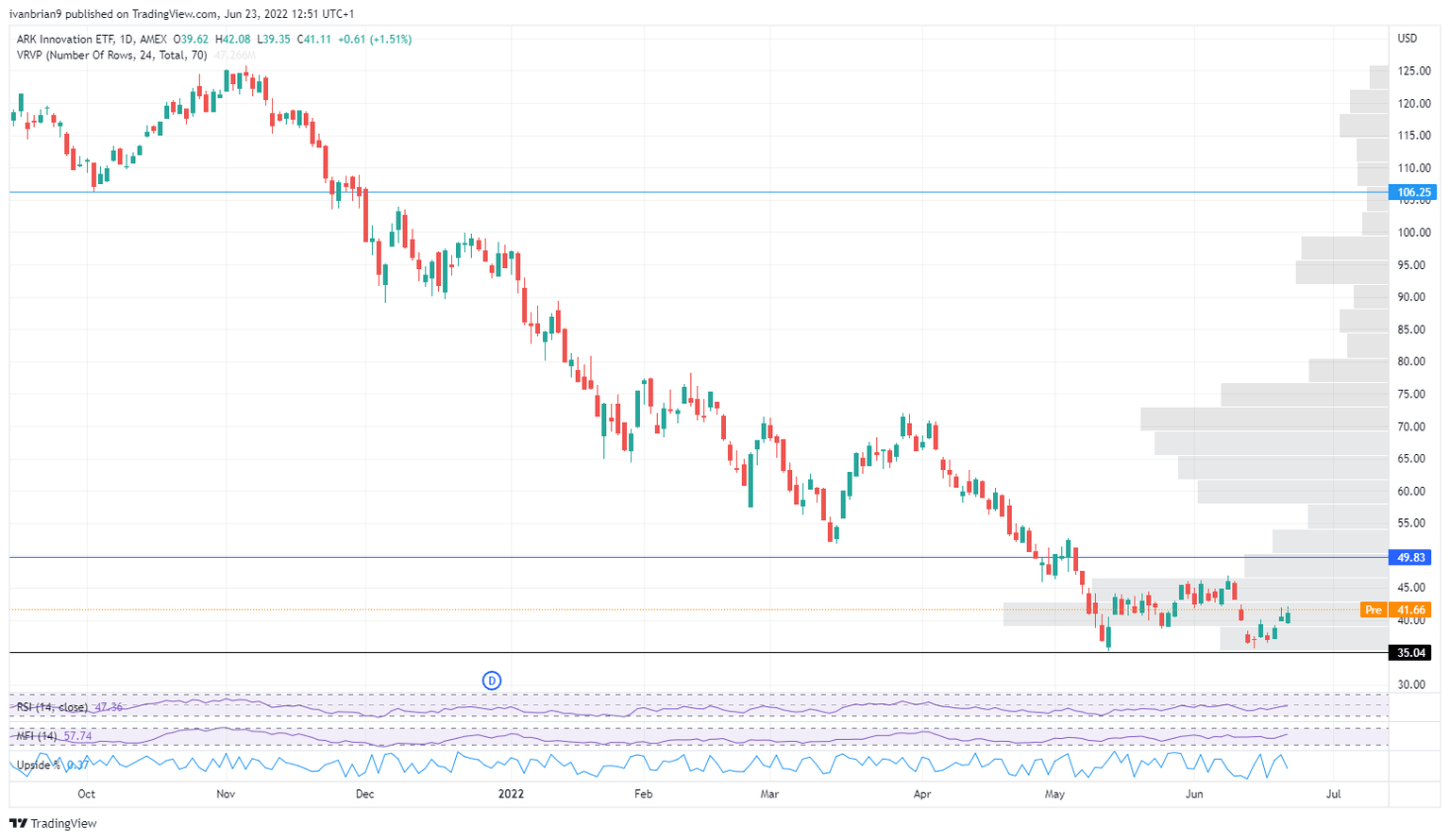

ARKK is down 66% from June 2021, 57% for 2022, and 38% over the past three months. Lately though, we have begun to see a possible bottom in the growth and tech space. Let us take a look at some formerly beaten-down names and sectors to illustrate.

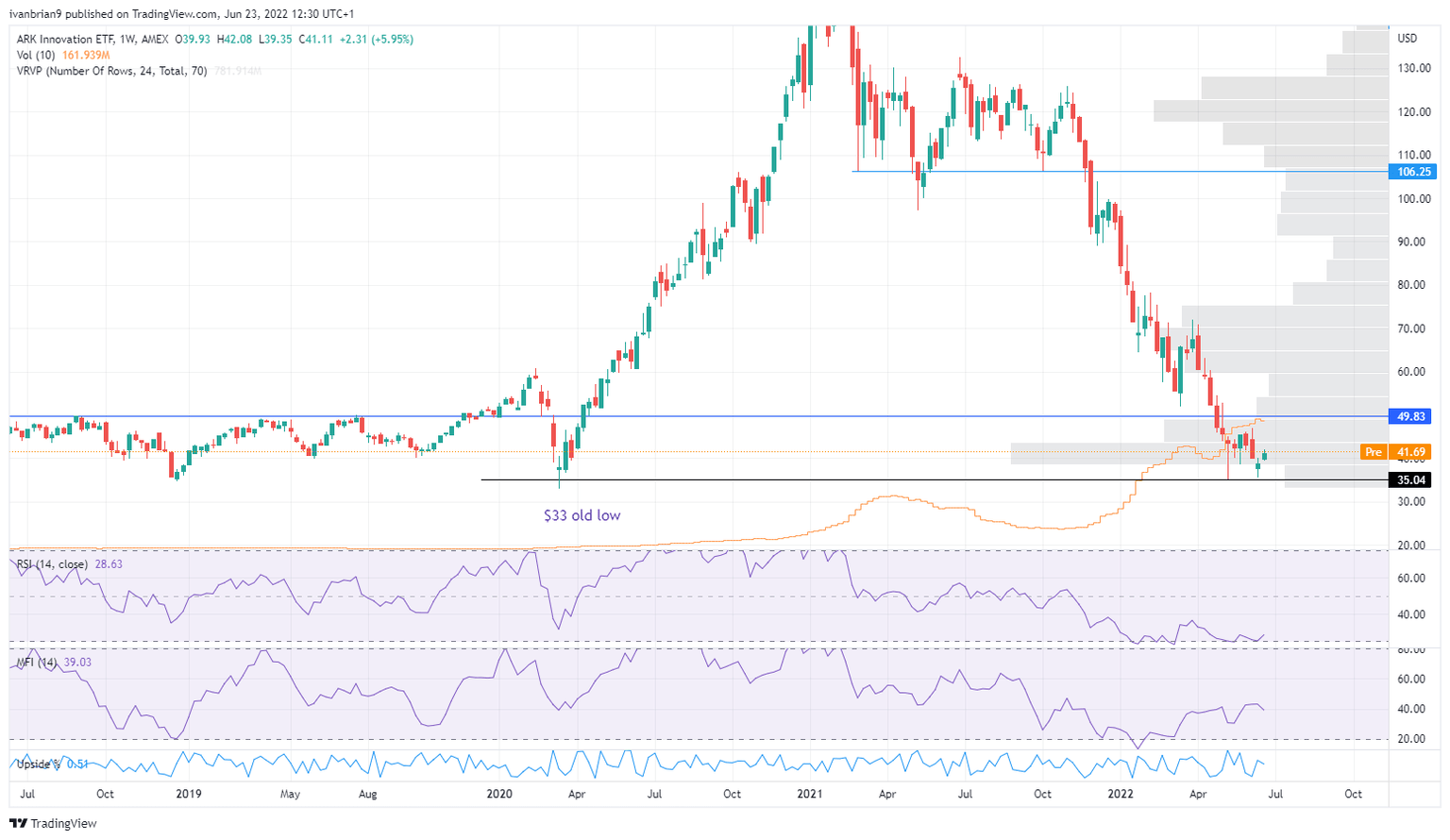

ARKK weekly chart

ARKK has stopped short of the $33 low from March 2020 or the pandemic low.

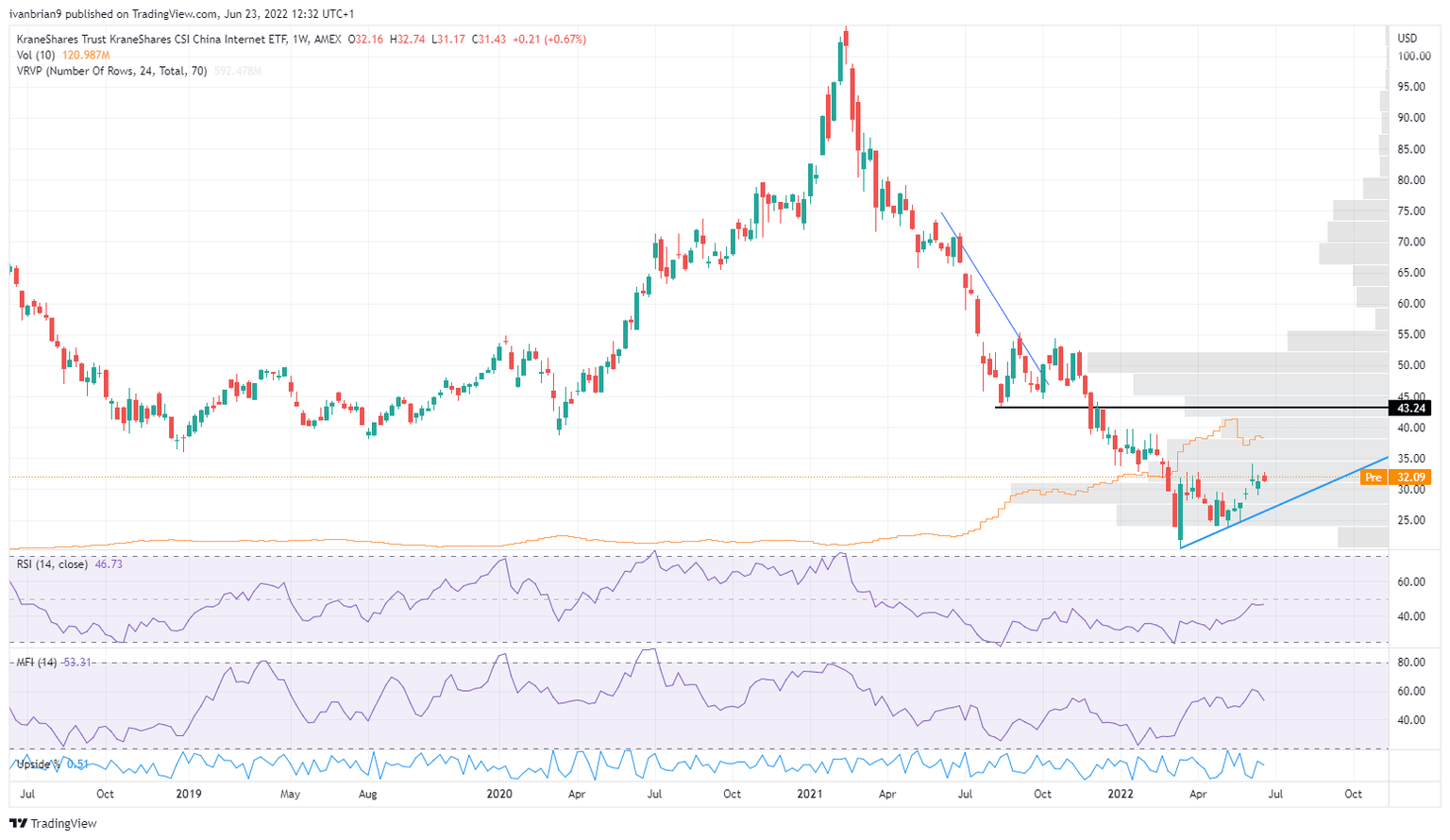

Another high-risk, high-growth sector also looks to have bottomed out. See below the chart of KWEB ETF. This is the China Internet ETF and includes such names as Alibaba, JD.com, Baidu, etc.

KWEB ETF chart, daily

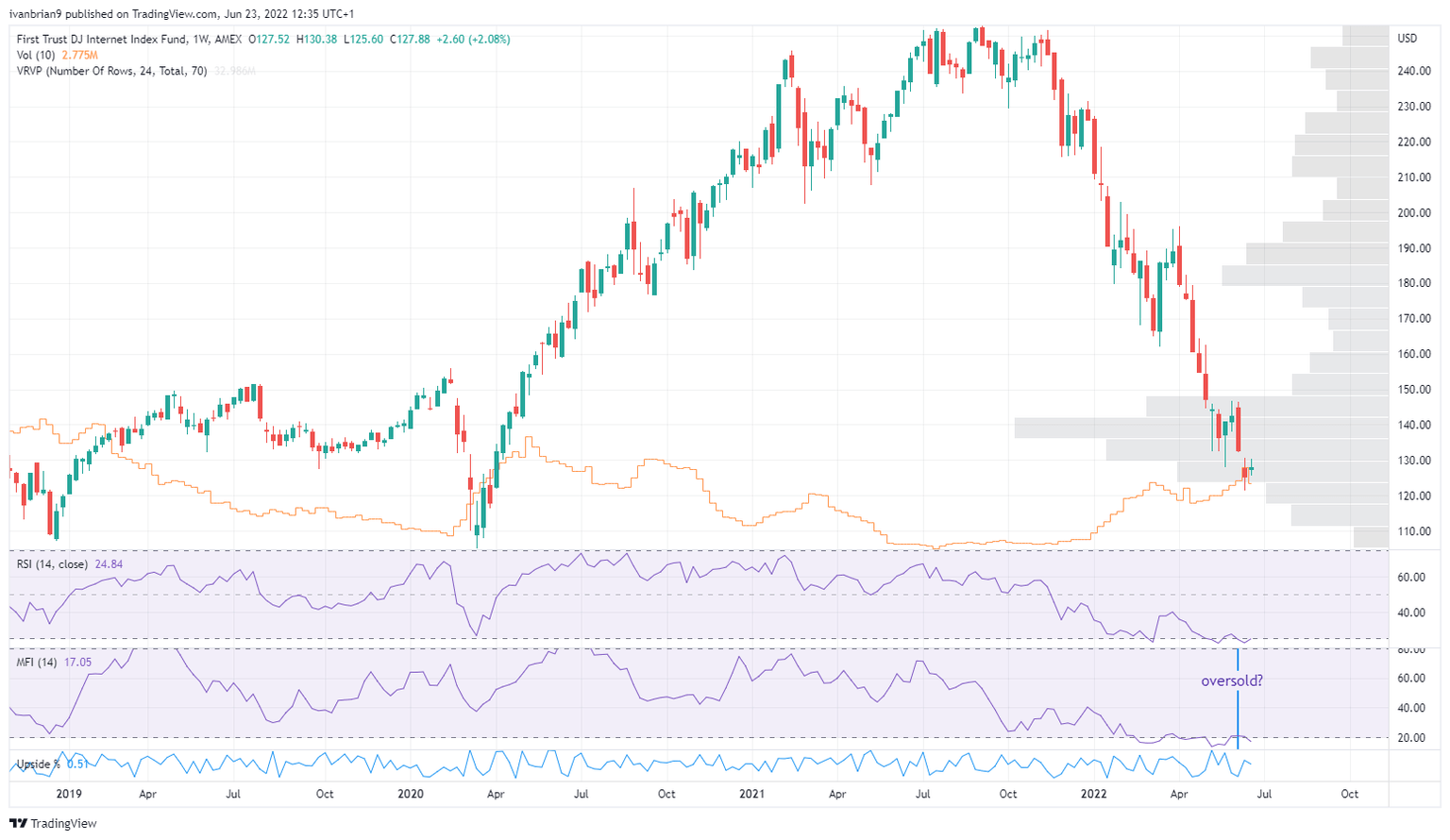

Things look slightly less positive for the DJ Internet Fund or FDN ETF, but it still has so far held the pandemic lows and looks oversold on both the Relative Strength Index (RSI) and Money Flow Index (MFI) indicators. This one holds the likes of Netflix, Paypal, Airbnb, Twitter, Amazon, Meta, Google, etc.

FDN ETF chart, weekly

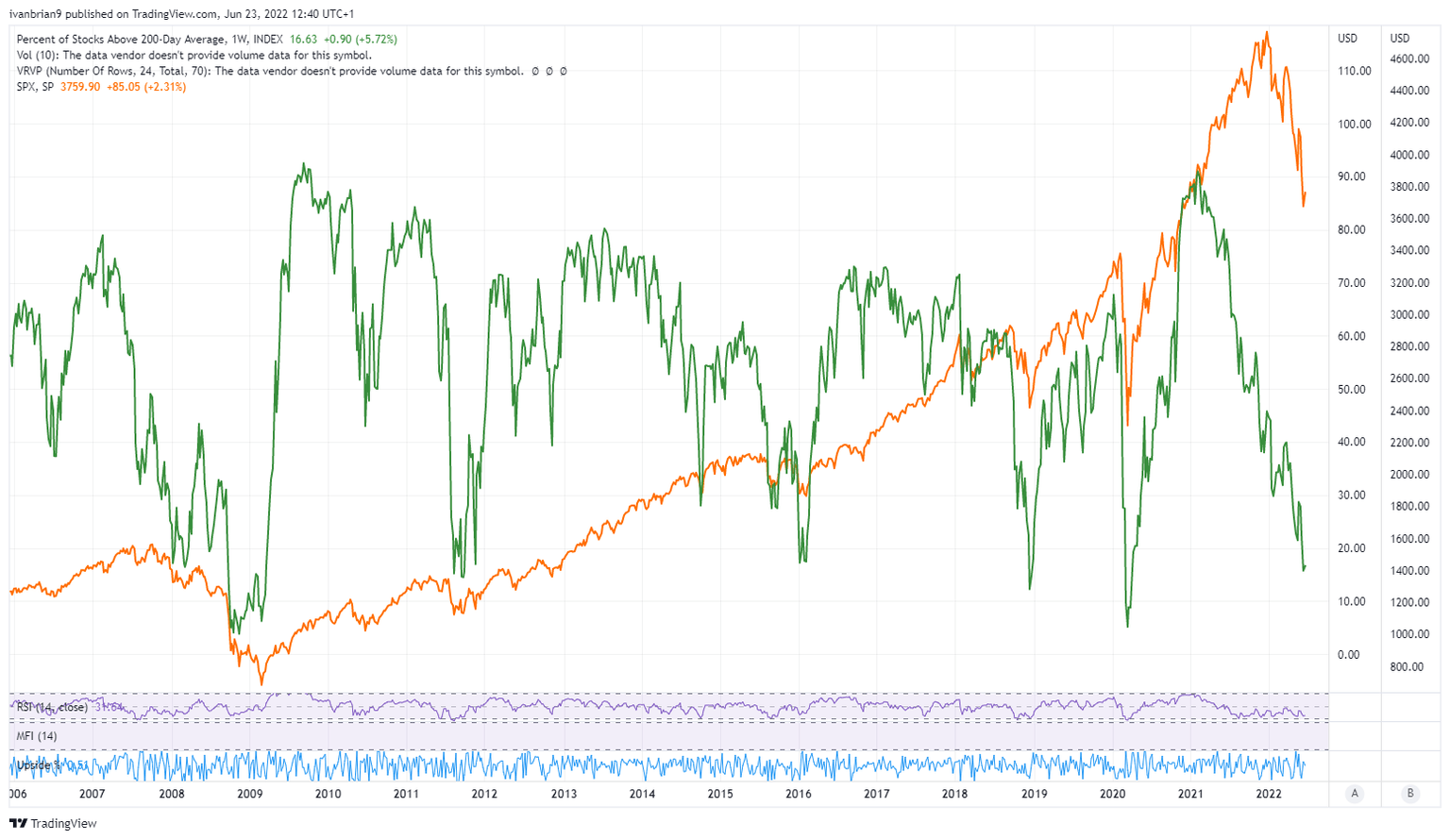

The percentage of stocks trading above their 200-day moving average has continued to fall in this bear market. The chart below shows the number of stocks above their 200-day moving average (green line) to be at 15% of the overall number of stocks on the NYSE. Previous moves under 15% are associated with bottoms in the S&P 500 (orange line).

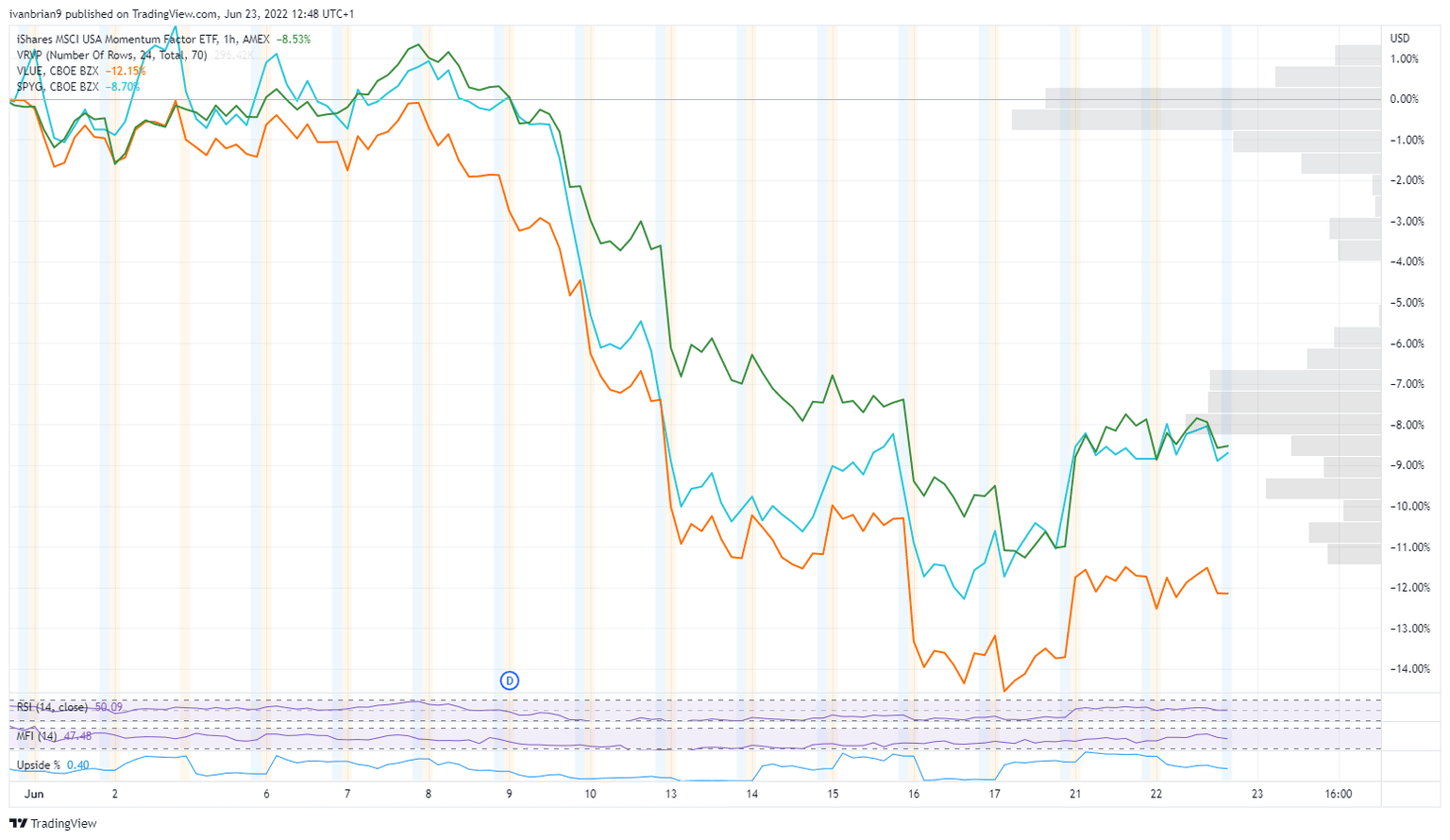

For June, growth and momentum stocks have outperformed value. Chart below shows Value ETF (VLUE) in orange versus Momentum (MTUM) in green and Growth (SPYG) in blue.

ARKK Stock forecast

Have we bottomed out? That is a big ask. My feeling is that this is merely some position adjusting ahead of the end of the first half of the year and option and flow needs. The next earnings season should finally see Wall Street analysts lower their EPS forecasts, which could see a bottom form sometime in late summer or fall. $35 remains key short-term support in ARKK, and then the $33 pandemic low is huge.

ARKK daily chart

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.