Are stocks close to a short-term bottom?

Stock prices went lower again – Is a short-term bottom in?

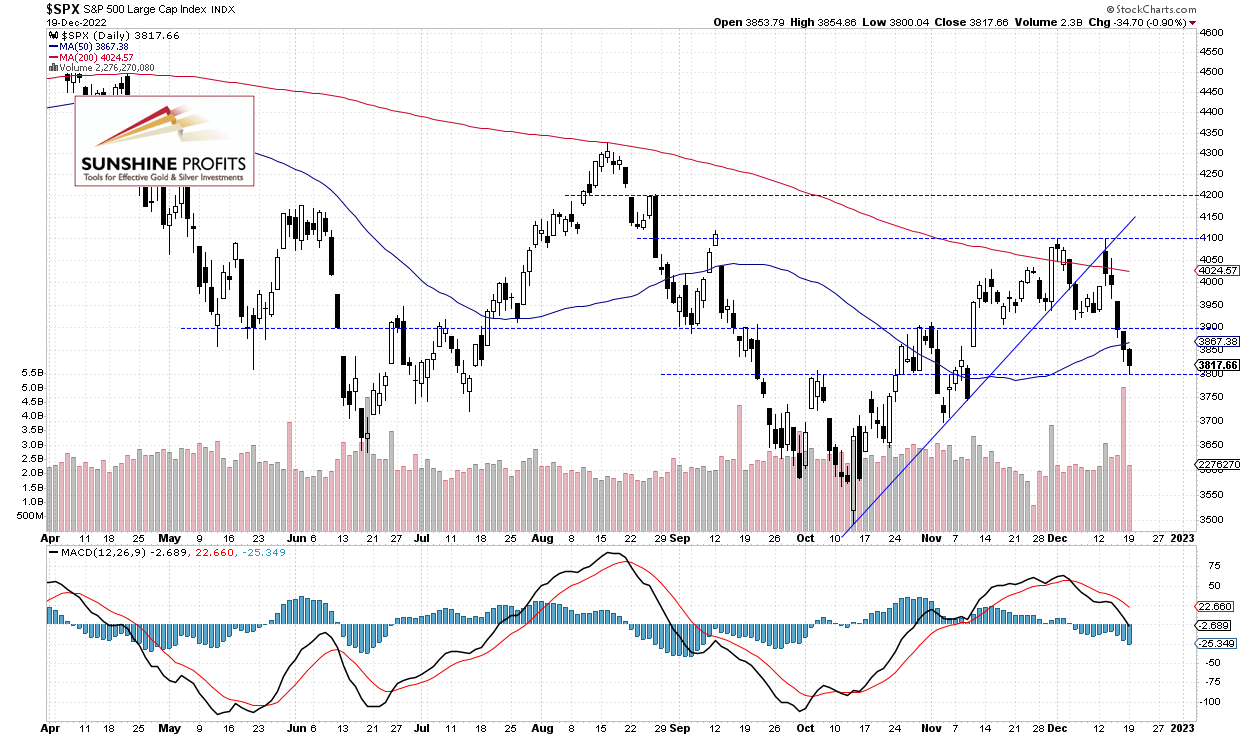

The S&P 500 index lost 0.90% on Monday, as it further extended its last week’s decline following Wednesday’s FOMC interest rate hike. On Friday the index lost 1.1% and on Thursday it sold off by 2.5%. Yesterday the broad stock market index reached its new local low of 3,800.04.

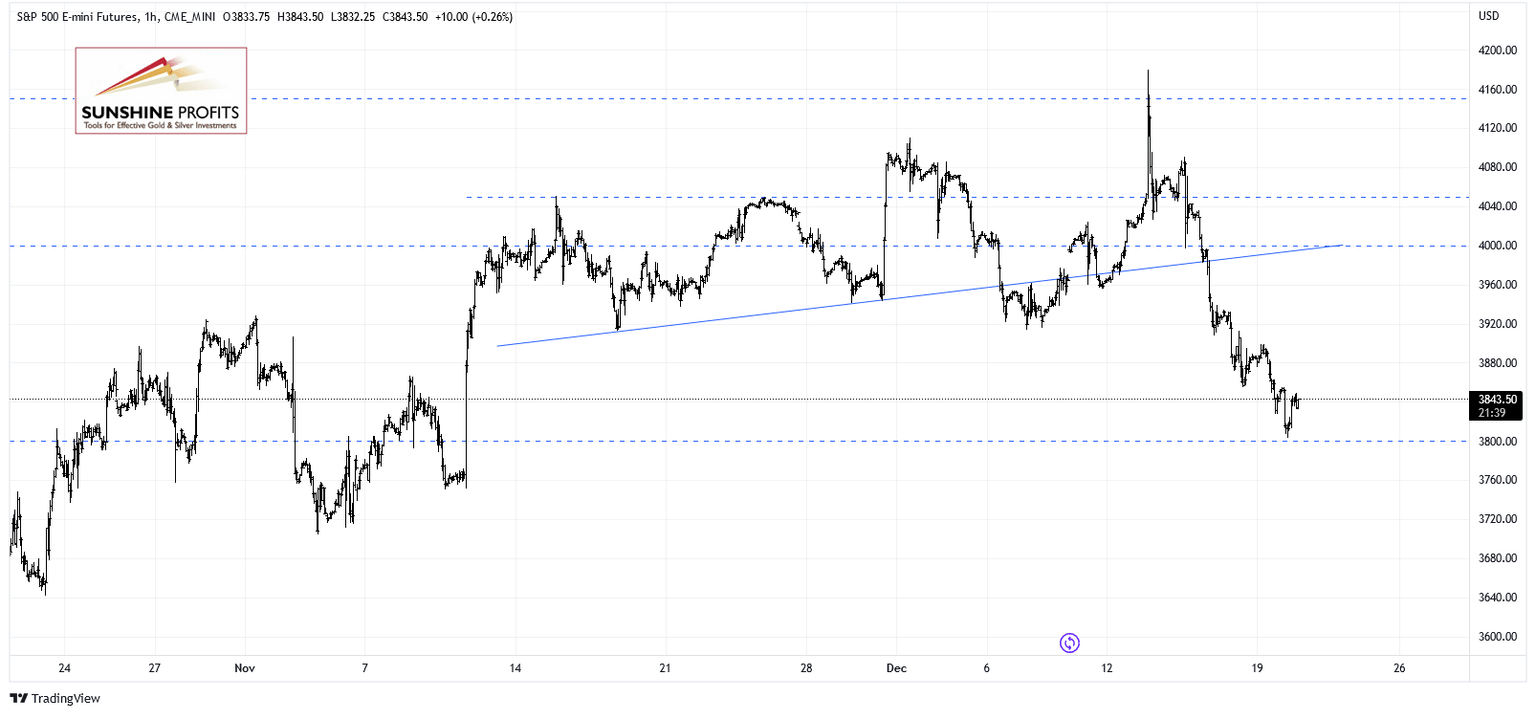

Today the S&P 500 will likely open 0.2% lower after an overnight Bank of Japan’s monetary policy release. The markets were very volatile, but the European stock indexes bounced from their local lows.

Recently the S&P 500 index broke below its two-month-long upward trend line and moved sharply lower after getting back to that line last week, as we can see on the daily chart:

Futures contract trades closer to 3,800

Let’s take a look at the hourly chart of the S&P 500 futures contract. Today it reached new local low of around 3,804. The resistance level remains at 3,900-3,950. There have been no confirmed positive signals so far. However, there are some clear short-term oversold conditions that may lead to a bounce or an upward reversal at some point.

Conclusion

The S&P 500 index is expected to open slightly lower this morning and it may see an attempt at retracing some of the recent sell-off. For now, it looks like a temporary bottom before an upward correction.

Here’s the breakdown:

-

The S&P 500 index went to the 3,800 level yesterday

-

Today it will likely go sideways or bounce despite an initial bearish reaction to the important Bank of Japan release.

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!

Author

Paul Rejczak

Sunshine Profits

Paul Rejczak is a stock market strategist who has been known for the quality of his technical and fundamental analysis since the late nineties.