Apple (AAPL) Stock Price and News: Apple Inc finally bounces after earnings results, targets $137

- AAPL shares close just in positive territory on Friday.

- The tech giant gets some bounce from the reaction to a weak jobs report.

- Aaple still lower after stellar earnings release.

AAPL shares closed Friday at $130.21 a gain of 0.36%. AAPL shares have not had the reaction many would expect to a truly stellar earnings release. Apple made most Wall Street analysts look like rookie horse pickers when it smashed analyst estimates on April 28. Earnings per share reported $1.40 versus the average analyst forecast of $0.99. A forty per cent beat.

AAPL shares were trading at $131 at the time of reporting earnings, popped up to $137 before gradually sliding back to $126.70. Even with Friday's gain, AAPL shares are still trading below where they released earnings.

Oh yeah, not content with smashing earnings expectations, Apple announced an increase in its dividend and an increase in its buyback program. Still not good enough for the market, though.

AAPL stock forecast

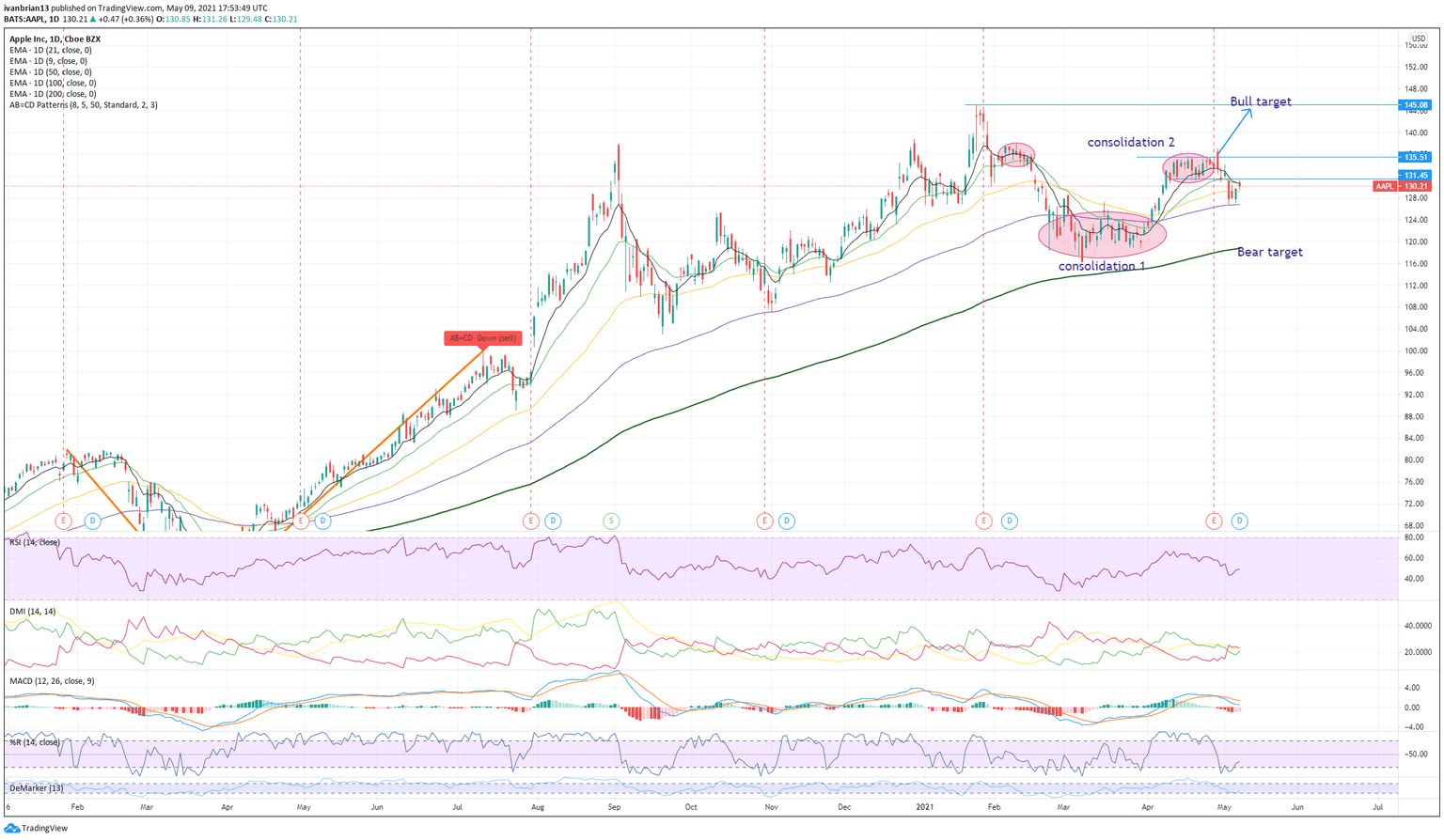

The AAPL chart shows clearly the sell-off after earnings. Better to travel than arrive, buy the rumour-sell the fact all spring to mind here but the size of the beat and the subsequent dividend increase and buyback increase still came as a surprise and were not priced in.

Finally, on Friday, AAPL shares caught some bids as the jobs report saw a broad tech rally. Apple has now retraced back to test the short-term moving average resistance at $130.75. Apple bounced beautifully from the 100-day moving average earlier in the week. So, bulls have some hope here.

The first step is to breach the 9-day moving average at $130.75 and then test the lower end of the consolidation range shown on the chart. This level is $131.45. Continued appreciation should see the Moving Average Convergence Divergence (MACD) give a buy crossover but this needs to be watched for further confirmation. The top of the range is $135.51 and the spike high post the earnings release is $137.07. This should be the short term target if AAPL breaks the 9-day moving average.

If momentum fails to take the 9-day moving average then the bounce from the 100-day moving average will be the first target support. At the time of writing, this is at $126.86. A break of that will see AAPL target the old consolidation area of $120-$125. Given the volume and time spent in this range, it will be a strong area of support. The 200-day moving average at $117 would support below this level.

At the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

This article is for information purposes only. The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice. It is important to perform your own research before making any investment and take independent advice from a registered investment advisor.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to accuracy, completeness, or the suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. The author will not be held responsible for information that is found at the end of links posted on this page.

Errors and omissions excepted.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.