American Airlines (AAL) Stock News and Forecast: No staff, no flights, no bulls

- American Airlines has to cancel flights over the weekend due to staff shortages.

- AAL also says bad weather is behind some of the cancellations.

- Companies are struggling to fill job vacancies post-pandemic.

American Airlines (AAL) underlined the problems facing many companies in the new post-pandemic world. Workers are in demand and now hold the power over employers who are being forced to offer greater incentives to lure staff back to traditional schedules and fixed offices. The pandemic has opened workers' eyes to the benefits of flexible working practices, and employers are struggling to catch up.

American Airlines (AAL) stock news

American underlined this problem over the weekend as it was forced to cancel thousands of flights. Now some of these cancellations were down to pure bad weather as the US heads into the winter season, but staff shortages are a growing problem for the airline. Since Friday it is estimated that American Airlines (AAL) has cancelled 2,001 flights. The airline has cited bad weather and staff shortages for the cancellations.

The bad weather has exacerbated an already tight crew schedule due to staff shortages. Airline crews are subject to mandatory limits on hours worked due to health and safety when in control of an aircraft. If a crew is scheduled to work two flights, but the first one is delayed, this can then put them over the mandatory hours worked. This means they cannot work on the second flight. In a tight labour environment, the availability of stand-in crews is shrinking.

American Airlines said in a letter to staff on Saturday that 1,800 staff are returning to work on Monday, while AAL has hired 600 new flight attendants, according to Reuters. Other airlines have had similar issues with Southwest (LUV) cancelling flights in early October.

American and other airlines have been struggling to rehire workers as demand has quickly picked up in the post-Coronavirus world, and results have confirmed this. American Airlines (AAL) released Q3 earnings 10 days ago, which came in better than expected. Earnings per share (EPS) was $-0.99 versus -$1.04 expected. Revenue also beat estimates at $8.97 billion versus $8.94 billion. Cargo yields also doubled as shipping shortages see companies turn to other means of transportation.

American Airlines (AAL) stock forecast

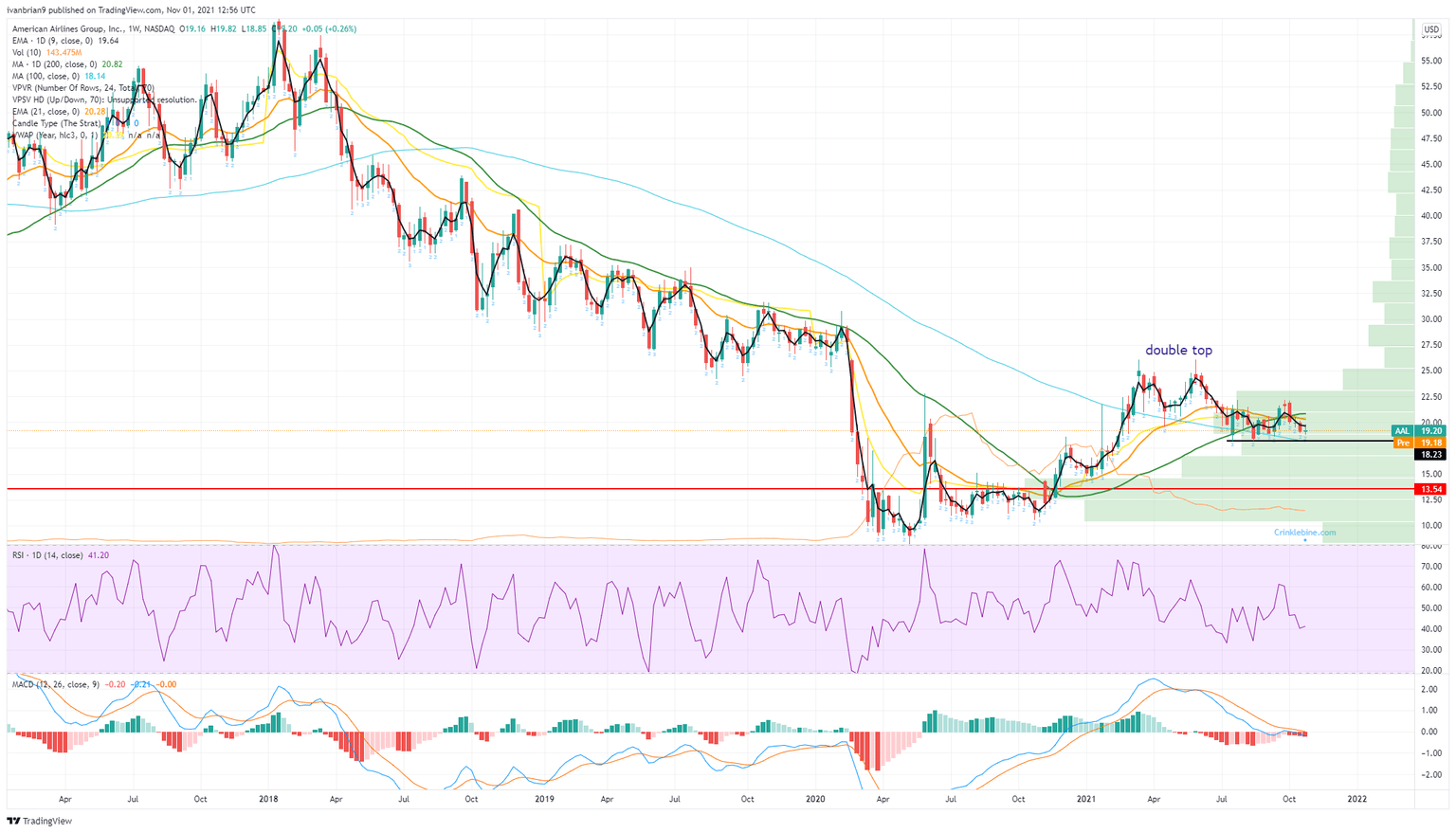

A worrying double top in the weekly chart has played out well and led AAL stock to where we are now with a potential flattening of the share price looking to break out. $18.23 is support, and a break lower should see AAL stock retreat to strong support at $12. Strong volume profile bars here should provide some comfort to bulls. The more worrying aspect is the AAL stock price was in decline for some time before the pandemic hit and this post-pandemic rally has failed to recapture where the stock was trading before March 2020. Worrying to say the least. American Airlines stock is also now back below the 200-day moving average. $12 seems the obvious target in our view.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.