AMC Stock Price and News: AMC Shares struggle to maintain gains as inflation overwhelms all

- AMC shares struggled to maintain gains on Thursday and Friday.

- AMC shares up 11% in Monday's pre-market trading session.

- AMC has been the subject of retail interest and re-opening trade.

Shares in AMC are currently trading at $8.89 during Monday's pre-market session, a gain of 11% from Friday.

AMC describes itself as "the largest movie exhibition company in the United States, the largest in Europe and the largest throughout the world with approximately 960 theatres and 10,700 screens across the globe". "AMC operates among the most productive theatres in the United States' top markets, having the #1 or #2 market share positions in 21 of the 25 largest metropolitan areas of the United States. AMC is also #1 or #2 in market share in 9 of the 15 countries it serves in North America, Europe, and the Middle East."

AMC Stock Price

AMC has been a volatile stock as its trades with the ebb and flow of social media trends. AMC was caught up in January's Gamestop social media rally and AMC was one of the most-mentioned stocks on /wallstreetbets and other social media forums.

AMC shares slid from $8 to $2 as the global pandemic took hold in February/March 2020 as cinemas were shuttered across the globe. AMC was also heavily shorted, not to the extent of Gamestop, but still high versus norms. It was this which caught the attention of the Reddit traders.

On January 25 AMC announced "it has successfully raised or signed commitment letters to receive $917 million of new equity and debt capital. This increased liquidity should allow the company to make it through this dark coronavirus-impacted winter. Of this $917 million in much-welcomed monies, AMC has raised $506 million of equity, from the issuance of 164.7 million new common shares, along with the previously announced securing of $100 million of additional first-lien debt and the concurrent issuance of 22 million new common shares to convert $100 million of second-lien debt into equity."

On January 25 Adam Aron, AMC CEO and President, said, “Today, the sun is shining on AMC. After securing more than $1 billion of cash between April and November of 2020, through equity and debt raises along with a modest amount of asset sales, we are proud to announce today that over the past six weeks AMC has raised an additional $917 million capital infusion to bolster and solidify our liquidity and financial position. This means that any talk of an imminent bankruptcy for AMC is completely off the table.”

AMC Stock Forecast

So where to from here. Well, last week's report that New York was to reopen movie theatres on a reduced capacity basis certainly gave incentive to AMC investors. However, the good news was overshadowed by general market weakness as inflation fears hurt all equities.

What is clear though is that the economy will reopen and there is significant pent-up demand amongst consumers for leisure activities. A summer blockbuster season may be achievable if the US plans for vaccination progress are met.

What is less clear is if inflation concerns will overweigh equity appreciation.

Quarterly results are due to be released shortly, no date confirmed. What investors will be looking to are outlook statements and cost control and cash burn. AMC has raised sufficient capital to see itself through the pandemic.

AMC Technical analysis

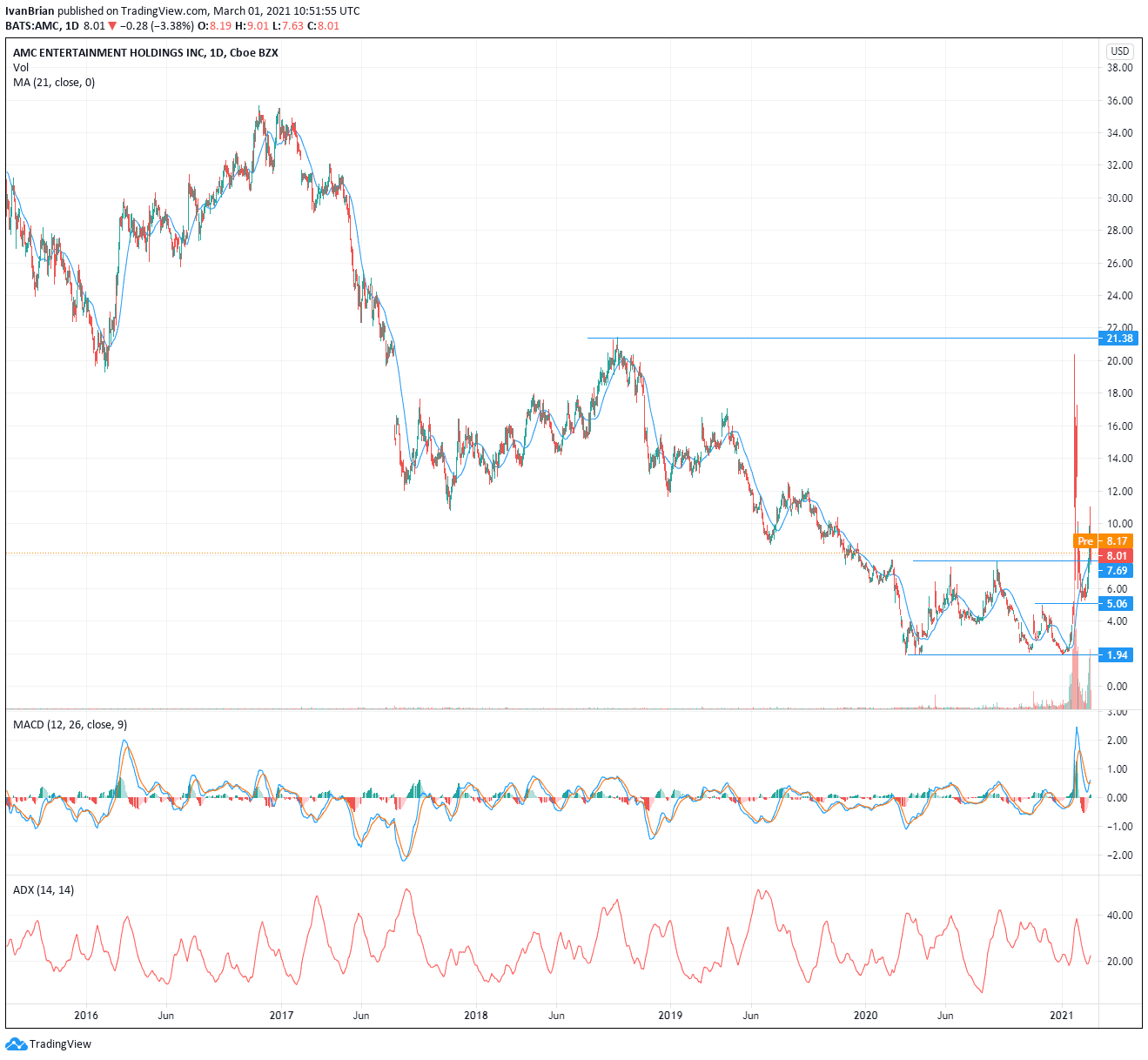

AMC has again broken out of the range from earlier in 2020. The longer-term view shows just how far AMC has fallen. Resistance at $21.38 was nearly reached during the Reddit rally in January.

The author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

This article is for information purposes only. The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice. It is important to perform your own research before making any investment and take independent advice from a registered investment advisor.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to accuracy, completeness, or the suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. The author will not be held responsible for information that is found at the end of links posted on this page.

Errors and omissions excepted.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.