AMC Stock Price and News: AMC Shares still a Sell at Citi $2 target

- AMC shares drop on Tuesday as Citi keeps a $2 target on AMC.

- AMC holder Wanda Group reducing its stake in AMC.

- AMC to open all cinemas in California by Friday.

Update March 16: Citi maintained its sell rating on AMC shares after Q4 results saying the shares are overvalued. Also, Wanda group, AMC's largest shareholder has reduced its stake from 23.8% to under 10% according to AMC filings with the SEC on March 12.

Update March 15: Shares in AMC continue to receive investor support as AMC announced it plans to open most of its California theatres by March 19. Shares in AMC are trading $13.92 up 25% on Monday.

AMC Entertainemnt Holdings Inc shares were strong on Monday as the equity market rallied from last week's weakness. Shares across the board were boosted by the demise of the 10 year as the focus finally shifted away from inflation, for now anyway!

Stay up to speed with hot stocks' news!

AMC shares were one of the stronger performers in a sea of green for equity markets and rallied to $9.18 for a near 15% gain on the day.

AMC Stock News

AMC made a regulatory filing on Feb 23 with the SEC approving bonuses for top executives and eligible employees. AMC said

"On February 23, 2021, the Compensation Committee of the Board of Directors (the “Committee”) of AMC Entertainment Holdings, Inc. (the “Company”), in consultation with the Company’s independent compensation consultant, approved supplemental special incentive cash bonuses (the “Bonuses”) in lieu of any payments under its 2020 Annual Incentive Plan (“AIP”). The Bonuses are in addition to the initial special incentive bonuses awarded in October 2020, as disclosed in the Company’s Quarterly Report on Form 10-Q filed with the SEC on November 4, 2020. The Bonuses were approved in order to recognize the extraordinary efforts of employees to maintain the Company’s business and preserve stockholder value during the COVID-19 pandemic, encourage continued engagement and retention, and incentivize our management and employees during the continuing and unprecedented difficult business conditions.

The Bonuses will be paid to eligible Company employees, including its NEOs, corporate associates, and theatre management from a total authorized pool of approximately $8.3 million. The Bonuses approved for the Company’s NEOs are provided below:

NEO Bonus Amount

Adam Aron $3,750,000

Sean Goodman $507,500

John McDonald $194,550

Elizabeth Frank $180,650

Stephen Colanero $173,875

AMC also announced it will hold its 2021 AGM on May 4, 2021.

AMC just announced on Tuesday, March 2 that it will release Q4 2020 results after the market closes on Wednesday, March 10. Data from Refinitiv shows a loss of $3.61 per share is expected. AMC is expected to post a fall in revenue from $1.45 billion to $155.2 million for Q4 2020.

Q4 results will obviously show the full effects of the covid-19 pandemic and it is more forward-looking statements that investors are likely to focus on. Recent news on the reopening of New York cinemas will be closely watched for attendance extrapolation into future revenue predictions. Commentary on reopening timelines, cash burn, etc will all be closely watched.

AMC is in a strong cash position having raised cash during the crisis to fund future operations. In some respects, the spike in AMC shares on the back of strong retail interest may have helped the company to survive as it enabled AMC to raise capital.

On January 25 AMC "announced today that since December 14, 2020, it has successfully raised or signed commitment letters to receive $917 million of new equity and debt capital. This increased liquidity should allow the company to make it through this dark coronavirus-impacted winter". Adam Aron, AMC CEO and President, said, “Today, the sun is shining on AMC. After securing more than $1 billion of cash between April and November of 2020, through equity and debt raises along with a modest amount of asset sales, we are proud to announce today that over the past six weeks AMC has raised an additional $917 million capital infusion to bolster and solidify our liquidity and financial position. This means that any talk of an imminent bankruptcy for AMC is completely off the table.”

AMC share price for today Tuesday during the pre-market is $9.18 at the time of writing.

AMC Stock forecast

Clearly, the improved economic picture benefits AMC but more so the vaccination drive underway across the globe.

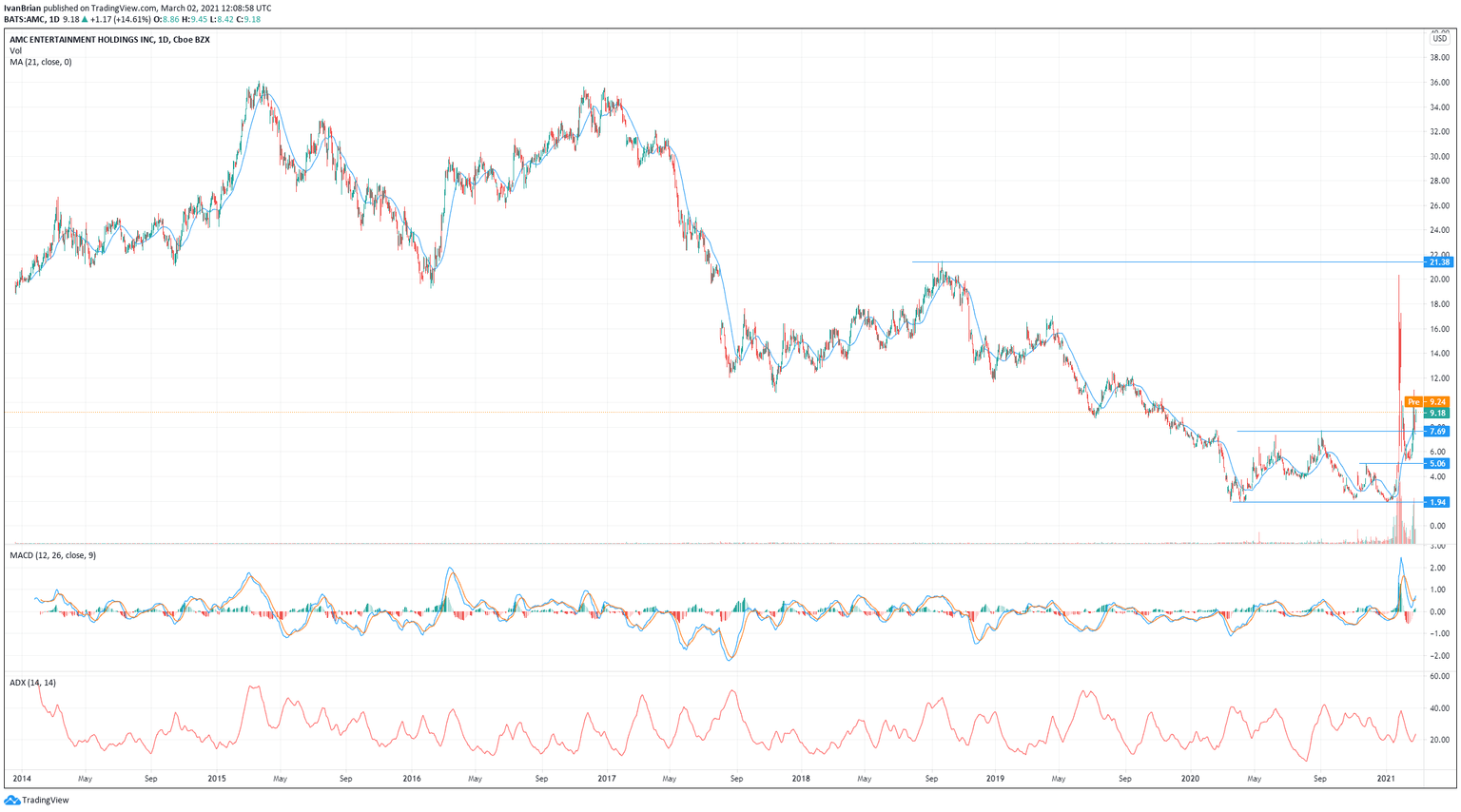

The big picture chart shows just how far AMC shares dropped from a "normal" economic environment. $21.38 was nearly reached during the Reddit fueled ride. Short-term channel support at $7.69 needs to be held to maintain the bullish momentum.

The author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

This article is for information purposes only. The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice. It is important to perform your own research before making any investment and take independent advice from a registered investment advisor.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to accuracy, completeness, or the suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. The author will not be held responsible for information that is found at the end of links posted on this page.

Errors and omissions excepted.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.