AMC stock news: AMC Entertainment rises but takes a back seat to Bed Bath and Beyond

- NYSE:AMC gained 2.48% during Tuesday’s trading session.

- Bed Bath and Beyond steals the spotlight on Wall Street once again.

- Other meme stocks including AMC are starting to see more chatter.

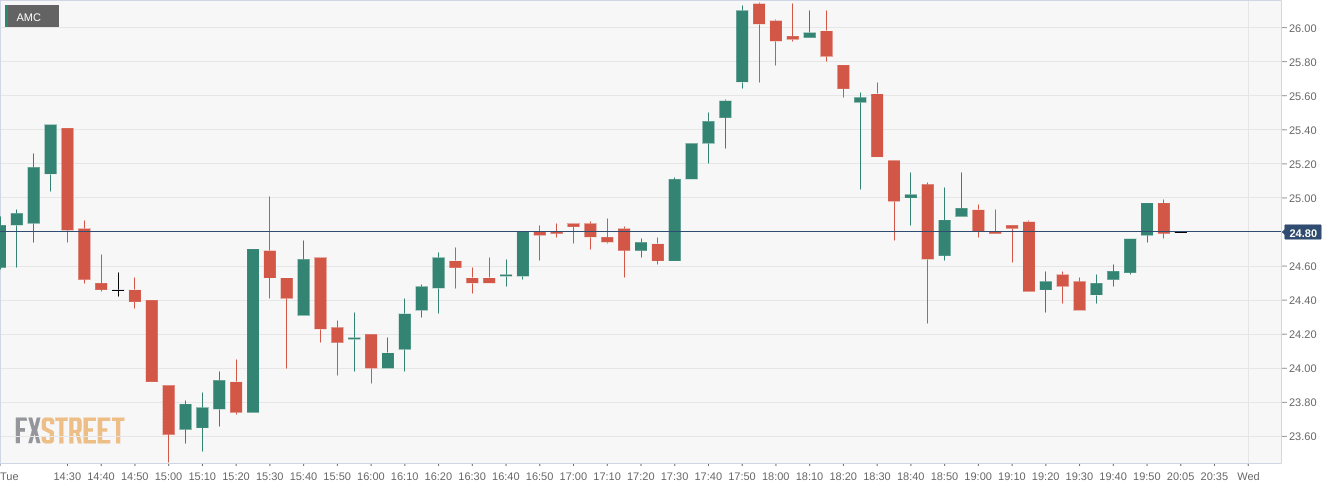

NYSE:AMC bounced back as the meme stock mania once again took hold of Wall Street during Tuesday’s session. Shares of AMC rose by 2.48% and closed the trading day at a price of $24.81. Stocks were mixed on Tuesday amidst another Reddit-induced short squeeze that dominated financial headlines. Retail earnings came in better than expected from companies like WalMart (NYSE:WMT) and Home Depot (NYSE:HD), and both blue-chip companies provided optimistic guidance for the rest of 2022. Overall, the Dow Jones gained 239 basis points, the S&P 500 rose by 0.19%, and the NASDAQ inched lower with a 0.19% loss.

Stay up to speed with hot stocks' news!

Once again on Tuesday, all of the news was about struggling home furnishing retailer Bed Bath and Beyond (NASDAQ:BBBY). The meme stock of the moment continued to squeeze higher and was up by more than 70% at one point during intraday trading. The rally lost some of its steam by the closing bell and shares closed the day up by only 29%. Reddit investors piled into BBBY after a report showed that GameStop (NYSE:GME) Chairman Ryan Cohen had purchased out-of-the-money call options for BBBY. The strike price of these options are between $60 and $80, with an expiration of January 2023.

AMC stock forecast

Other meme stocks were picking up some steam on Tuesday including both AMC and GameStop. The two original meme stocks had been somewhat left on the sidelines, but discussion on Twitter and Reddit boards have increased significantly. FuboTV (NYSE:FUBO) closed the day higher by 45%, as short squeezers took no prisoners during Tuesday’s session.

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet