AMC Share Price: Stock tumbles as CEO shifts to be the new Chairman of the Board

- NYSE:AMC fell by 5.36% as the meme stock leader continued to struggle following Tuesday’s pop.

- AMC CEO Adam Aron is now officially the Chairman of the Board.

- Other meme stocks fell alongside AMC, even as the broader markets rallied.

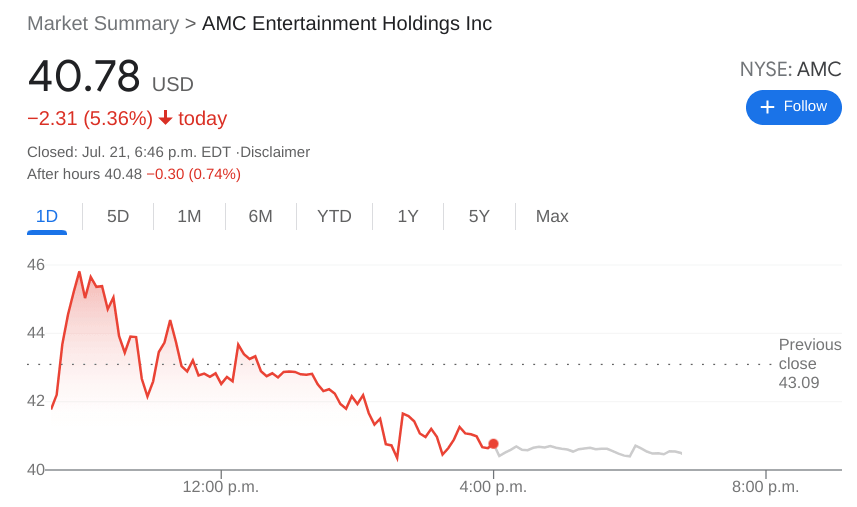

NYSE:AMC failed yet again to gain traction following its 25% jump during Tuesday’s session. On Wednesday, shares of AMC fell by 5.36% and closed the day at $40.78. The decline in price came following an early morning spike, but the stock could not hold up throughout the session and declined into the closing bell. One positive note for investors is that AMC did find support at its 50-day moving average price. AMC investors are trying to shrug off the rising cases of the COVID-19 delta variant, which may threaten to close down theaters once again, just as they have finally reopened.

Stay up to speed with hot stocks' news!

Popular CEO Adam Aron received a new title on Wednesday, as he was named the new Chairman of the Board. The title change was the reason behind the early morning jump, although perhaps the news wasn’t as bullish as first believed which would account for declines later in the session. Chairman of the Board is the same title that Ryan Cohen holds at GameStop (NYSE:GME), although AMC Apes should not expect the type of transformation for AMC that Cohen is attempting with GameStop.

AMC stock forecast

Speaking of GameStop, shares of the video game retailer also fell by 2.81% on Wednesday, and lost support at its 21-day moving average, which is a sign that more pain could be ahead for those with diamond hands. GameStop has fallen steadily since its annual shareholder meeting back in June, and if you zoom out, the stock has declined over 60% since its all-time high prices in January.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet