Amazon Stock Price and News: Can AMZN save the market?

- Amazon announced strong earnings after the close on Thursday.

- AMZN stock surged as a huge beat on EPS announced.

- AMZN shares are currently up over 12% in Friday's premarket.

Amazon (AMZN) is riding to the equity market rescue this morning after Facebook parent Meta Platforms (FB) left investors teetering over the edge on Wednesday. Amazon announced a big beat on EPS and a small miss on revenue. Investors cheered the news and set Amazon shares surging higher in the aftermarket on Thursday night. This has renewed bullish sentiment. Currently, US futures are also up with the NASDAQ pointing to a 1% higher open for the tech index. We had identified in our preview that the pessimism from Facebook had tilted the risk-reward to the upside for Amazon earnings and so it proved.

Amazon Stock News

Earnings per share (EPS) beat big, coming in at $5.80 versus estimates for $3.67. Revenue though did miss slightly, coming in at $137.41 billion versus $137.6 billion. In our preview note yesterday, we pointed out the strong cloud revenue numbers from IBM and Microsoft. Amazon's cloud unit, Amazon Web Services, duly delivered a strong performance with sales of $17.78 billion, an increase of over $1.5 billion from the last quarter.

The initial EPS number was a huge $27.75, which included the massive gain from the Rivian IPO. The performance of Amazon Web Services bodes well for future earnings as this is the highest contributor to earnings. Yes, the regular business drives most of the revenue, but AWS is the most profitable. Amazon also announced an Amazon Prime price increase. The company did allude to rising costs as have most companies this earnings cycle.

Amazon Stock Forecast

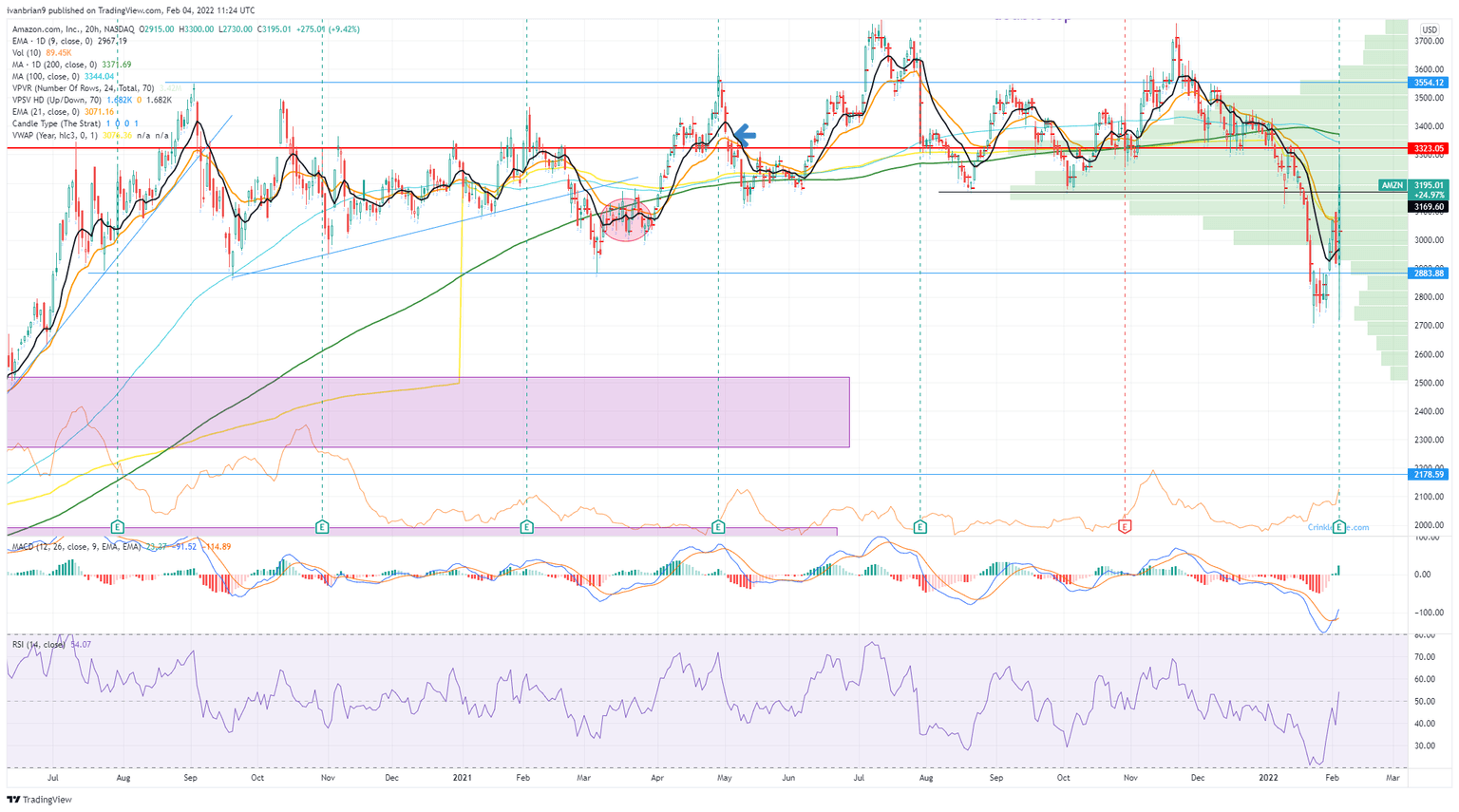

The 200-day moving average is the first target in sight at $3,371. Once above there, record highs are likely. First, Amazon needs to stabilize above the $3,170 double bottom. The Moving Average Convergence Divergence (MACD) has crossed into a bullish area, and the Relative Strength Index (RSI) is finally showing signs of life by getting above 50. Support is at $2,670.

AMZN chart, 20 hourly

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.