Active bullish chart patterns to bolster AAPL?

APPL prints largest one-day gain in months

Major US equity indices rallied across the board yesterday; the S&P 500 added nearly +1.0% (and formed a half-hearted daily morning star pattern [it does not precede a meaningful decline, hence half-hearted]). Large tech names led the way in recent movement, and, unsurprisingly, the price of Apple (AAPL), due to its large weight in the S&P, gapped higher and delivered its largest one-day gain in months.

Technically speaking

Now, technically, this is a market poised to extend recovery gains.

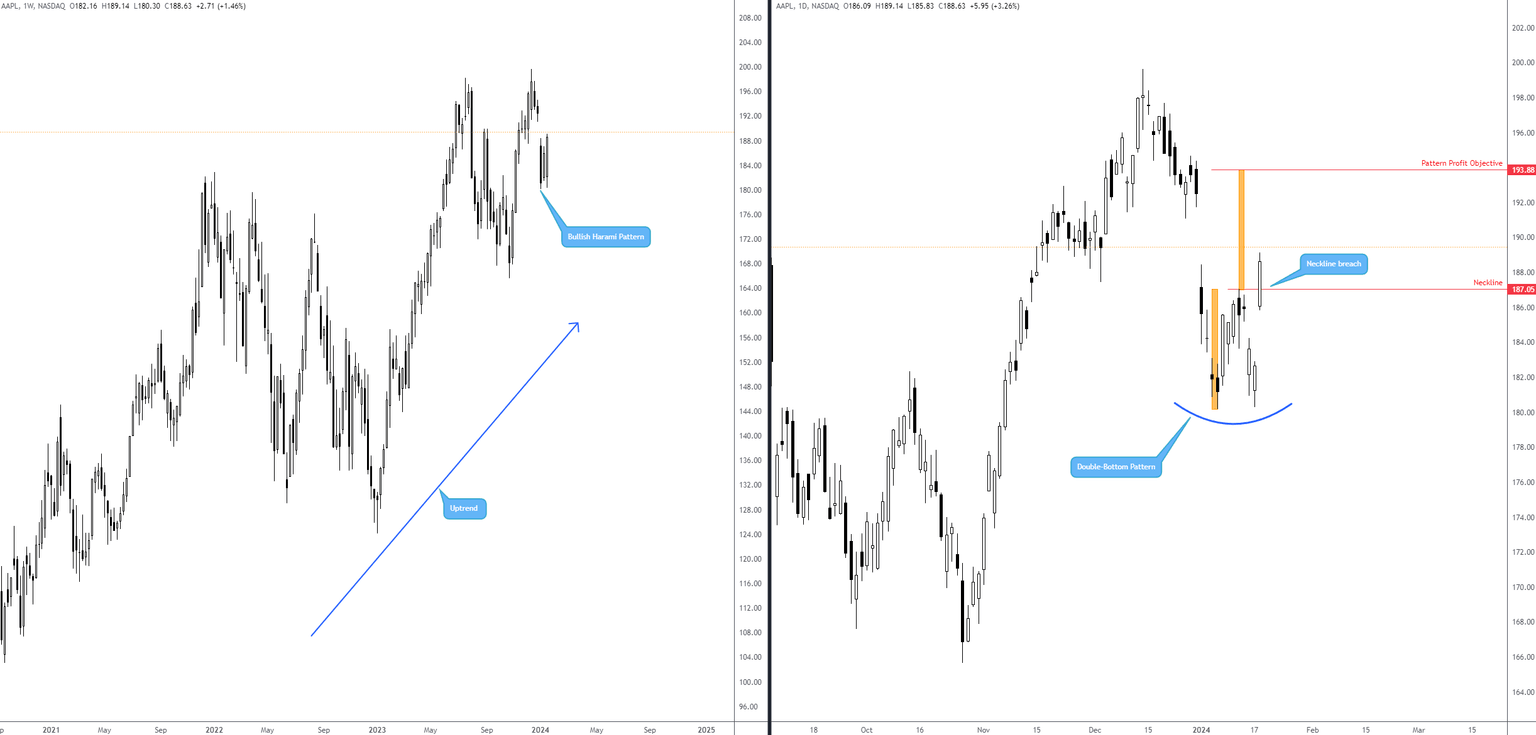

Kicking off from the weekly timeframe, the first and most obvious technical observation is the clear-cut uptrend that the stock is in. Couple this with the last week’s bullish Harami candlestick formation formed at the base of a correction from the all-time high of $199.62, and buyers appear to be in the driving seat. Note that traders who based a long off the aforementioned candlestick pattern are likely filled (usually, traders tend to set buy-stop orders north of the initial candle’s upper shadow).

Adding credibility to the weekly structure is the daily timeframe’s recently completed double-bottom pattern at $180.18. You will acknowledge that yesterday’s upside gap penetrated the pattern’s neckline at $187.05 and revealed the pattern’s profit objective at $193.88.

Taking the above into consideration, assuming AAPL remains north of the daily pattern’s neckline, this is a market that could attract further outperformance to fill the downside gap produced at the beginning of the year and touch gloves with the pattern’s profit objective at $193.88.

Author

Aaron Hill

FP Markets

After completing his Bachelor’s degree in English and Creative Writing in the UK, and subsequently spending a handful of years teaching English as a foreign language teacher around Asia, Aaron was introduced to financial trading,